9 tools to streamline your e-invoicing in 2026

Fresh insights from 2,650 finance decision-makers across Europe

E-invoicing software helps you create, send, receive and process invoices electronically. It doesn’t just save time and reduce admin: it also helps companies stay compliant with evolving tax regulations.

In 2026, the e-invoicing ecosystem goes far beyond just invoice creation. From accounting platforms to tax compliance networks, a wide range of tools now support or enhance the entire invoicing process.

In this article, we’ll explore e-invoicing tools and different types of tools that help businesses streamline their invoicing workflows in 2026.

Key takeaways:

- E-invoicing tools streamline invoicing, helping you save time, reduce errors, cut down on admin and improve payment speed and financial visibility.

- Today’s e-invoicing ecosystem is bigger than ever, covering everything from accounting software and AP automation to procurement platforms and tax compliance networks.

- Platforms like Pleo offer integrated solutions, combining e-invoicing with expense management and automated workflows to give your finance team full control over company spend – all in one place.

- When choosing your e-invoicing tools, look for features like ease of use, strong integrations and good value for money to find a solution that fits your business needs and future growth.

What is e-invoicing software?

E-invoicing software is a digital tool that enables businesses to create, send, receive and process invoices electronically.

Before e-invoicing, businesses relied on paper or PDF email attachments for their invoicing. Now, e-invoicing software allows invoices to be exchanged in a structured digital format, helping businesses save time, process payments faster and boost everything from financial management to regulatory compliance.

In 2026, there are countless e-invoicing tools on the market that support or enhance the process from different angles, covering everything from accounting and accounts payable to procurement and compliance and tax reporting.

If you haven’t explored what today’s e-invoicing solutions and the growing ecosystem of complementary tools around them have to offer, now’s the perfect time to get into it!

E-invoicing and expense management

E-invoicing solutions help businesses send, receive and manage invoices digitally, cutting out paperwork and manual data entry. Expense management tools track, approve and report business spending – from employee expenses to supplier invoices.

Modern platforms combine both, giving finance teams a smarter, faster way to control company spend.

1. Pleo

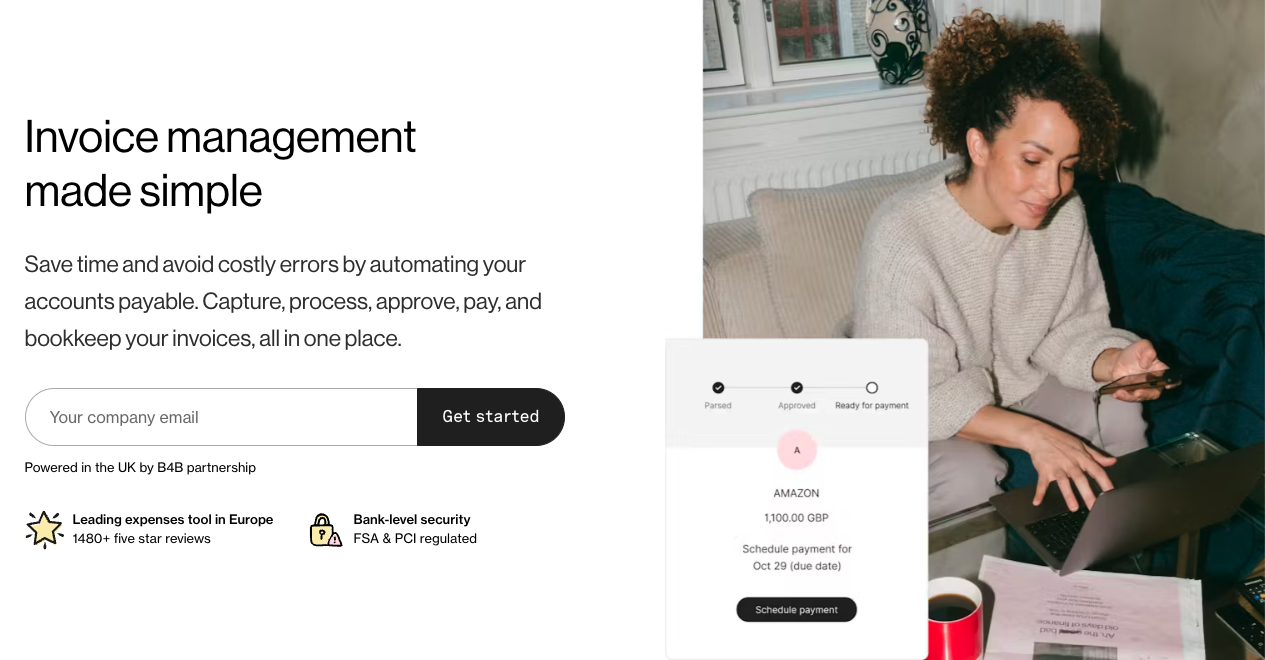

With more than 1,480 five star reviews, Pleo is Europe’s most loved and trusted spend management platform, combining expense management with an end-to-end e-invoicing solution.

With more than 1,480 five star reviews, Pleo is Europe’s most loved and trusted spend management platform, combining expense management with an end-to-end e-invoicing solution.

Capture, process, approve, pay and bookkeep your invoices – with Pleo’s e-invoicing, you can do it all in one place. Save time on tedious tasks, automate approval processes and track invoices in real time.

No more chasing invoices, no more complicated approval processes, no more messy spreadsheets. Simplify e-invoicing for everyone – finance teams, bookkeepers and employees alike.

Pleo pros:

- Ease of use

- Seamless integrations

- Easy upload

- Expense management

- Simplicity

Source: G2

Don’t just take our word for it. Check out this this review from one of our happy users:

“Pleo is an easy system to learn that makes the day to day of our organisation more fluid.”

Accounting software

Accounting software helps businesses manage their financial records – from bookkeeping to tax reporting. Many platforms also support e-invoicing by helping create, send and track invoices whilst integrating with e-invoicing tools to automate payments, approvals and reconciliations. Together, they keep finances accurate, compliant and up to date.

2. Xero

Xero is a cloud-based accounting platform designed for small to medium-sized businesses. It’s known for its clean, user-friendly interface and strong ecosystem of integrations.

Alongside managing financial records, bank reconciliations and reporting, Xero offers built-in e-invoicing features. It also integrates smoothly with dedicated e-invoicing and expense management tools like Pleo, allowing you to automate invoice capture, approvals and payment workflows whilst keeping accounting records in sync.

Xero pros:

- Ease of use

- Easy integrations

- Reporting

- Time-saving

Source: G2

3. QuickBooks

QuickBooks (particularly QuickBooks Online) is another popular cloud-based accounting solution tailored to small businesses and growing companies.

The solution offers a wide range of features for invoicing, payroll and financial reporting. It also integrates with dedicated e-invoicing and expense management tools like Pleo to automate approvals, match payments and keep accounts up to date.

QuickBooks pros:

- Ease of use

- Invoice management

- Accounting management

- Intuitive

- Easy access

Source: G2

Accounts payable automation

Accounts payable (AP) automation software is all about streamlining the entire invoice-to-payment process by digitising invoice capture, approval workflows and payments.

Instead of handling invoices manually, AP automation tools reduce errors, speed up approvals and improve visibility into outstanding liabilities. They often integrate with accounting platforms and e-invoicing tools to create a smooth, end-to-end payables process.

4. Tipalti

Tipalti is a great option for businesses that need to handle payments at scale, especially if you’re dealing with suppliers or partners around the world.

The solution is built to handle international payments smoothly and takes care of the entire payment process for you. It works with all kinds of payment methods – including ACH, wire transfers and PayPal.

Tipalti pros:

- Ease of use

- Customer support

- Payment processing

- Efficiency

- Time-saving

Source: G2

5. Stampli

Stampli is an accounts payable automation platform that simplifies invoice processing and approvals. It uses AI to capture invoice data, streamline workflows and resolve payment issues quickly.

The solution integrates with accounting and ERP systems, making it easy to connect e-invoicing tools and improve visibility over payables, approvals and cash flow.

Stampli pros:

- Ease of use

- Customer support

- Invoicing

- Time-saving

- Helpful

Source: G2

Supplier portals and procurement platforms

Supplier portals and procurement platforms are here to help businesses manage purchasing processes and supplier relationships. They allow vendors to submit invoices electronically, track payments and manage purchase orders – all in one place.

By connecting with e-invoicing and AP tools, these platforms streamline approvals, improve spend visibility and keep procurement and finance teams aligned.

6. ProcurementExpress

ProcurementExpress is a user-friendly procurement and purchase order management platform designed for small to mid-sized businesses. It helps teams manage purchase requests, approvals and budgets in real time.

By integrating with e-invoicing and AP tools, ProcurementExpress streamlines the purchasing process, reduces maverick spend and improves control over company expenses.

ProcurementExpress pros:

- Ease of use

- Simplification

- Customer service

- Time-saving

Source: G2

7. Coupa

Coupa is a cloud-based spend management and procurement platform that helps businesses control costs, manage suppliers and streamline purchasing. Its supplier portal lets you submit invoices electronically, track payment statuses and manage purchase orders.

The platform integrates with e-invoicing tools and ERP systems to simplify invoice approvals, enforce policy compliance and improve financial visibility.

Coupa pros:

- Ease of use

- Features

- Intuitive

- Efficiency

- User interface

Source: G2

E-invoicing compliance and tax reporting

E-invoicing and tax reporting tools simplify cross-border invoicing and help businesses stay compliant with local and international invoicing regulations. They validate, deliver and archive invoices in line with tax authority requirements, ensuring every document is reported correctly and on time.

8. Pagero

Pagero is a global e-invoicing and tax compliance network that ensures businesses’ invoices meet local regulations and reporting requirements. It connects with accounting, ERP and e-invoicing platforms to automate the validation, delivery and archiving of digital invoices.

The solution is especially valuable for companies operating across multiple countries or industries with strict tax reporting rules.

Pagero pros:

- Efficient

- User interface

- Reliable

- Automation

Source: G2

9. Sovos

Sovos is a global tax compliance and e-invoicing platform that helps businesses meet complex regulatory requirements across multiple countries. It automates e-invoice validation, delivery and tax reporting, ensuring every invoice complies with local mandates.

The tool integrates with accounting, ERP and invoicing systems to simplify tax reporting and reduce compliance risks for businesses operating internationally.

Sovos pros:

- Ease of use

- Automation

- Compliance simplification

- Tax automation

- Easy access

Source: G2

What to look for in an e-invoicing solution

There are many e-invoicing software solutions on the market – but not all solutions are the right fit for your business.

Here are some key elements to consider when choosing your e-invoicing software:

- End-to-end invoice management: From capturing and approving invoices to scheduling payments and syncing with your accounting system, having everything in one place keeps workflows smooth and efficient.

- Integrated expense management: Complete oversight saves you a lot of hassle. Look for a platform that combines e-invoicing with employee expense tracking and card payments to stay on top of it all.

- Business needs: Are you looking for basic invoicing, or do you need additional features like expense tracking or recurring billing? Determine your specific business needs before you make your choice.

- Ease of use: A user-friendly interface saves you time. Look for software that’s easy to use and accessible across different devices and platforms.

- Accounting integrations: Your new tools should work well with what you’re already using. Look for solutions that integrate with your existing tools – e.g. Xero or QuickBooks – for a seamless workflow.

- Good value for money: Make sure you get what you’re paying for. Compare the solution’s pricing model with the value and features offered, and evaluate what you’re getting against the cost.

Final thoughts

In 2026, e-invoicing software is no longer just a back-office tool: it’s a core part of financial operations.

From expense management platforms like Pleo to accounting software, AP automation, procurement platforms and compliance solutions, there’s a growing network of tools designed to make invoicing faster, smarter and more connected.

When choosing your solution, make sure it fits your business needs, integrates smoothly with your existing systems and offers the right balance of features and value for money. With the right tools in place, you won’t just simplify your invoicing: you’ll improve cash flow, boost compliance and free up time for the work that really matters.