5 tools for smooth multi-entity accounting in 2026

Fresh insights from 2,650 finance decision-makers across Europe

Managing finances across multiple entities doesn’t have to be a nightmare of spreadsheets, mismatched data and late nights reconciling reports. With the right mix of tools, finance teams can unify operations, cut down manual work and gain the clarity they need to steer the business forward confidently.

Multi-entity accounting software brings all your financial data under one roof – from spend and payroll to treasury, reporting and forecasting. Whether you’re expanding into new markets or managing multiple subsidiaries, these tools make it easier to stay compliant, stay in control and scale with confidence.

We’ll cover what multi-entity accounting software is and introduce you to five solutions that make managing multi-entity accounting in 2026 easy as pie.

Key takeaways:

- Multi-entity accounting software brings it all together. It centralises financial data from multiple subsidiaries, regions or business units into one system, making it easier to manage intercompany transactions, reporting and compliance without endless spreadsheets.

- With multi-entity accounting software, manual reconciliations and approvals are a thing of the past. Automating workflows across entities keeps books accurate, audits smooth and teams focused on strategy – not admin.

- The best multi-entity accounting setups connect spend management, payroll, treasury, accounting and FP&A tools, giving finance teams one clear financial picture without the silos.

- Your software should grow with your business. Look for tools that make it easy to add entities, currencies and users without compromising control or visibility.

What is multi-entity accounting software?

As businesses grow, so do their structures. New subsidiaries, branches or regional entities often come with separate accounts, currencies and compliance requirements – and before you know it, keeping the books balanced across them all becomes a serious challenge.

The good news is that you don’t have to do it manually: this is where multi-entity accounting software comes in handy.

Multi-entity accounting solutions bring financial data from multiple entities under one roof, giving finance teams a single source of truth for everything from expenses to reporting.

Instead of juggling spreadsheets or logging into multiple systems, teams can automate intercompany transactions, manage multi-currency operations and generate consolidated reports in a few clicks. The result? Less admin, fewer errors and a clearer view of performance across the entire organisation.

Multi-entity accounting doesn’t rely on one platform alone: it’s supported by an ecosystem of tools that help businesses manage complexity from every angle.

From spend management platforms and accounting and consolidation software to multi-entity payroll and HR platforms, treasury and cash management systems and FP&A solutions, these technologies work together to simplify operations and strengthen financial control at scale.

5 software solutions to make multi-entity accounting easy as pie

Still juggling spreadsheets, switching between systems and struggling to keep financial data consistent across multiple entities? It might be time to swap confusion for clarity with smarter multi-entity accounting software.

We’ve compiled a list of tools that make managing finances across subsidiaries, regions and business units faster, more accurate and far more transparent.

In the table below, you’ll find a quick overview of the solutions covered:

|

Software |

Category |

G2 rating |

Pricing |

|

Pleo |

Spend management platforms |

4.7/5 |

Starting at £9.5 per month for up to 3 users |

|

Sage Intacct |

Accounting and consolidation software |

4.3/5 |

N/A – all pricing is quote-based |

|

Deel |

Multi-entity payroll and HR platforms |

4.8/5 |

Starting at $5.00 per month for 1 user |

|

Kyriba |

Treasury and cash management systems |

4.5/5 |

N/A – all pricing is quote-based |

|

Pigment |

Financial planning & analysis platforms |

4.6/5 |

N/A – all pricing is quote-based |

Spend management platforms

Want complete control over company spending across multiple entities? Spend management platforms are the solution you’re looking for. These tools automate approvals, track expenses in real time and offer detailed visibility, reducing errors, streamlining workflows and helping your business spend smarter.

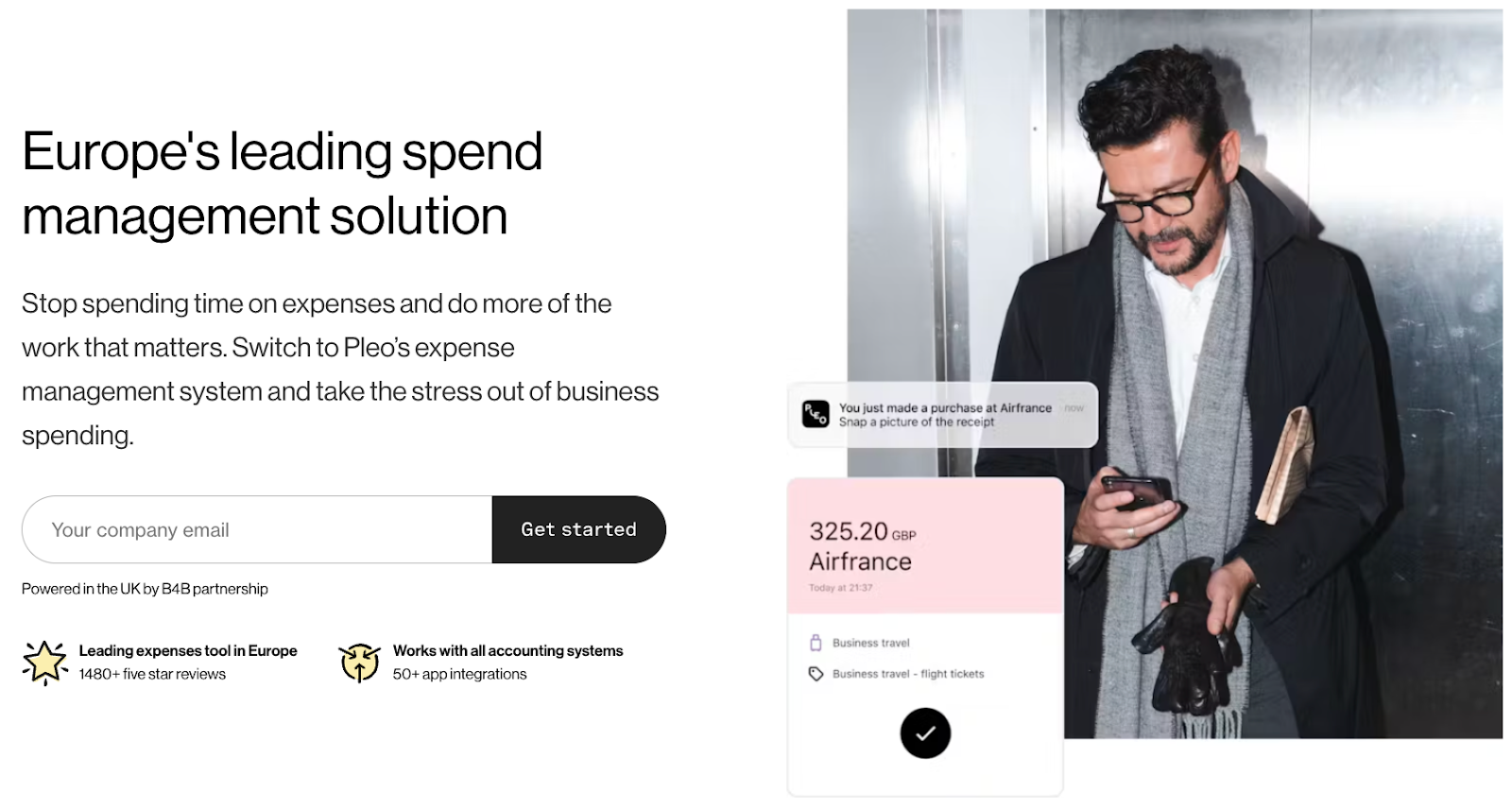

1. Pleo

With more than 1,480 five star reviews, Pleo is Europe’s most loved and trusted spend management platform.

Managing company cash flow across multiple entities has never been easier. With Pleo, every business expense – whether it’s a subscription, vendor payment or team purchase – is tracked in real time across all subsidiaries, giving finance leaders a complete view of cash outflows throughout the organisation.

Capture, monitor and control spending instantly, enforce entity-specific budgets and approve purchases on the spot – not weeks later. Teams gain faster, more accurate visibility into where money is going, helping prevent overspend, optimise allocations and maintain control over company cash across all entities.

Turn multi-entity spend data into actionable insights with automated workflows, seamless categorisation and analytics that reveal the bigger financial picture. Spend less time reconciling intercompany costs and chasing approvals, and more time making strategic, data-driven decisions that keep cash flow healthy – and your business running smoothly.

Pros and key functionalities:

- Real-time spend and invoice tracking: Monitor and reconcile expenses and supplier invoices across all entities instantly. No more untracked costs or unexpected outflows disrupting cash flow at any level of the organisation.

- Flexible spend control: Give teams physical and virtual cards with configurable limits, merchant restrictions and policy enforcement for each entity. Keep outflows controlled – and budgets intact.

- Seamless expense and invoice capture: Say goodbye to manual entry. Snap, attach and categorise receipts instantly via the mobile app. Every expense is accounted for across every subsidiary.

- Smart automation and approvals: Automate workflows, enforce policies and approve expenses and invoices on the spot. Speed up reconciliation, maintain compliance and keep multi-entity cash flow under control.

Reasons to choose Pleo:

- Fast implementation and onboarding

- Strong customer support and user-friendly interface

- Scalable solution that grows with your business

Pricing: Pleo offers monthly or yearly billing, with prices starting at £9.5 per month for up to 3 users.

What do our users say about Pleo?

“Since our company is based in Europe, Pleo truly understands and provides services that align with European regulations. It integrates seamlessly with our accounting system, making our work much easier. Pleo also offers all the features we need to manage our company expenses efficiently. We used to rely on multiple expense apps, but now we’ve replaced them all with Pleo – it’s compact, convenient, and powerful. ”

- Financial Accountant Ghitha S., G2

Accounting and consolidation software

Designed to handle the complexity of multiple entities, accounting and consolidation software simplifies bookkeeping, intercompany transactions and consolidated reporting. These platforms ensure accuracy, save time and make compliance and auditing far less painful.

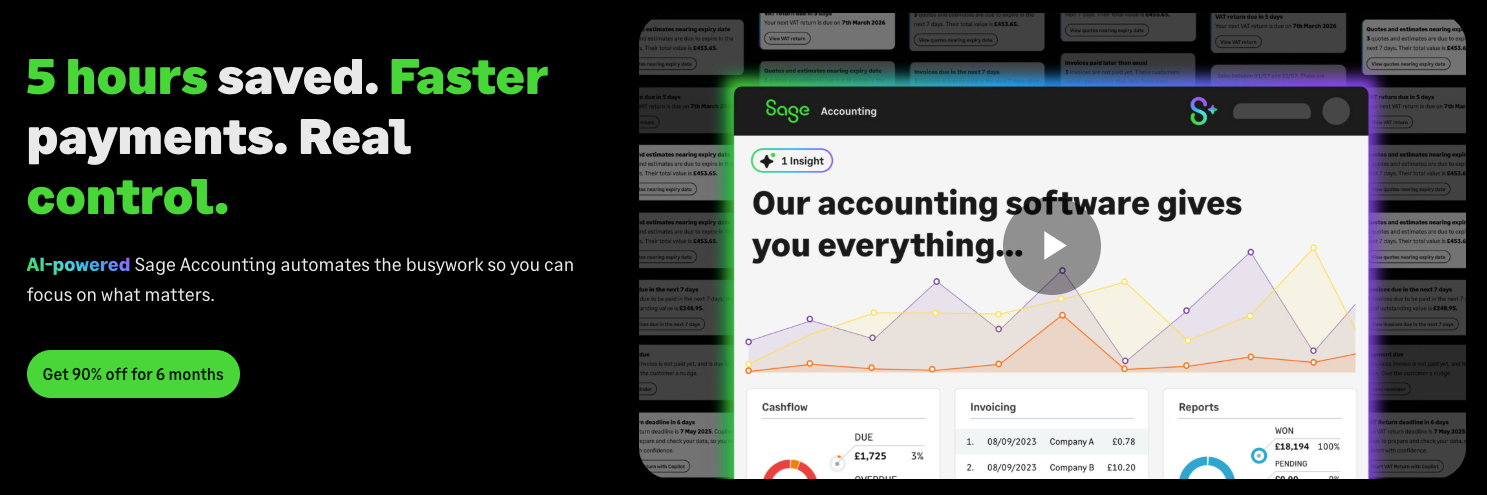

2. Sage Intacct

Managing finances across multiple entities can get messy – but Sage Intacct makes it much easier. It automates intercompany transactions, keeps your books accurate and produces consolidated reports so finance teams can see the full picture at a glance.

With Sage Intacct’s multi-entity capabilities, you can track performance across subsidiaries, streamline compliance and reduce the manual work that usually comes with managing complex organisations.

Pros and key functionalities:

- Multi-entity financial management: Track and consolidate accounts across multiple subsidiaries, automating intercompany transactions for faster, more accurate reporting.

- Real-time visibility and reporting: Access up-to-date financial data across all entities for smarter decision-making and easier compliance.

- Streamlined compliance and audit readiness: Simplify multi-entity audits and ensure adherence to accounting standards with built-in controls and automated workflows.

Reasons to choose Sage Intacct:

- Strong multi-book accounting features

- User-friendly tool and intuitive interface

- Efficient reporting capabilities

Source: G2

Pricing: N/A – all pricing is quote-based.

Multi-entity payroll and HR platforms

Managing payroll and HR across different regions or subsidiaries can be a logistical headache. Luckily, multi-entity payroll and HR platforms make it much simpler. These systems automate payments, benefits and compliance, keeping employees happy and organisations legally compliant – no matter where they operate.

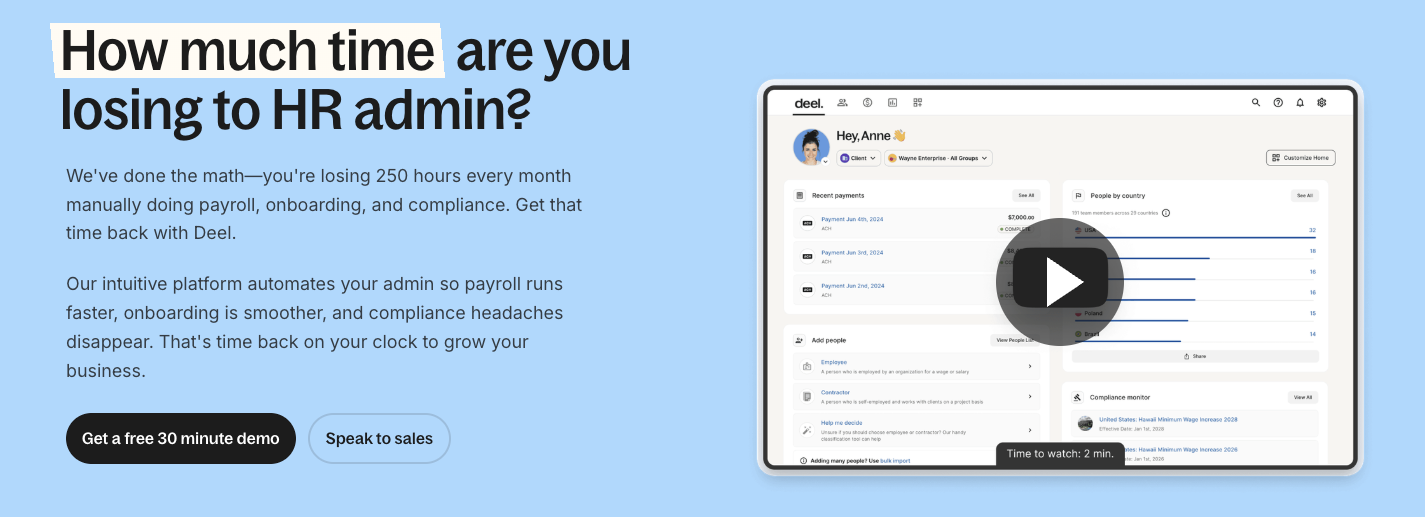

3. Deel

Handling payroll and HR across different regions doesn’t have to be a headache. Deel automates payments, manages benefits and ensures compliance with local regulations – all from a single platform.

Whether you’re paying employees or contractors across multiple countries, Deel centralises workforce management, reduces administrative stress and gives finance and HR teams the confidence that everything is accurate and compliant.

Pros and key functionalities:

- Global payroll automation: Pay employees and contractors across multiple regions instantly, ensuring accurate and timely compensation.

- Local compliance management: Stay compliant with regional payroll, tax and employment regulations without the usual administrative burden.

- Centralised workforce oversight: Manage payroll, benefits and HR tasks across subsidiaries from a single platform for greater efficiency and control.

Reasons to choose Deel:

- Simple and easy to use

- Effortless payroll automation

- Responsive and helpful support team

Source: G2

Pricing: Deel starts at $5.00 per month for 1 user.

Treasury and cash management systems

Treasury tools provide a clear, central view of cash and liquidity across all entities. They optimise intercompany transfers, improve cash flow management and help finance teams make smarter decisions about funding and investments.

4. Kyriba

Keeping track of cash and liquidity across multiple entities can be tricky – but Kyriba puts you in control. It provides a real-time view of cash positions, helps optimise intercompany transfers and supports better decision-making around funding and investments.

By centralising treasury management, Kyriba also helps reduce risk, improve efficiency and gives finance leaders the insights they need to manage liquidity across the entire organisation.

Pros and key functionalities:

- Centralised treasury visibility: Monitor cash positions, liquidity and intercompany balances across all entities in real time.

- Optimised cash flow management: Automate intercompany transfers and cash allocations to reduce inefficiencies and improve working capital.

- Risk and compliance controls: Mitigate financial risk and maintain regulatory compliance with integrated controls and reporting features.

Reasons to choose Kyriba:

- User-friendly interface

- Efficient cash and liquidity centralisation

- Seamless integration with other financial systems

Source: G2

Pricing: N/A – all pricing is quote-based.

Financial planning and analysis (FP&A) platforms

Financial planning and analysis (FP&A) platforms go beyond reporting to enable dynamic planning and forecasting across multiple entities. They support scenario analysis, strategic alignment and data-driven decision-making, helping businesses respond to change with confidence – just what you need to keep track of things as your company grows.

5. Pigment

Planning, budgeting and forecasting across several entities can quickly become overwhelming – but with Pigment, it’s no sweat. The platform allows finance teams to run scenario analyses, consolidate data from multiple entities and align financial planning with overall business strategy.

With a clear, real-time view of organisational performance, Pigment makes it easier to anticipate challenges, seize opportunities and make smarter, data-driven decisions across the business.

Pros and key functionalities:

- Cross-entity planning and forecasting: Build budgets and forecasts that consolidate data from multiple subsidiaries for a complete view of performance.

- Scenario analysis and modelling: Run ‘what-if’ scenarios to test outcomes and make proactive, data-driven decisions.

- Strategic alignment and reporting: Connect financial planning with business strategy, giving finance teams a holistic view of organisational performance.

Reasons to choose Pigment:

- Cutting edge forecasting features

- Efficient and collaborative tool

- Helpful customer support team

Source: G2

Pricing: N/A – all pricing is quote-based.

What to look for in a multi-entity accounting solution

Managing finances across multiple entities adds layers of complexity – from tracking expenses in different currencies to consolidating reports and maintaining compliance. The right tools can simplify all of this, bringing clarity, control and automation to even the most complex structures.

It goes without saying that not every platform will be the perfect fit for your organisation, but there are a few key features worth prioritising when choosing a multi-entity accounting solution:

- Real-time visibility and control: Look for a platform that lets you track spending, invoices and cash flow across all entities instantly. Real-time insights help finance teams stay proactive, not reactive.

- Flexible spend management: Choose a solution that lets you set budgets, control spending limits and enforce policies across entities. With the right controls in place, you can prevent overspend and keep cash flowing where it’s needed most.

- Automated workflows and approvals: Manual processes slow everything down. Automation ensures expenses, invoices and approvals move seamlessly through the system, saving time and reducing errors.

- Seamless expense and invoice capture: For accurate reconciliation, opt for a platform that simplifies how teams record and categorise expenses. The ability to snap, attach and match receipts instantly keeps every transaction accounted for.

- Cross-entity consolidation and reporting: Multi-entity operations demand consolidated reporting that doesn’t require endless spreadsheets. Look for tools that integrate data from all entities into one clear financial picture.

- Analytics that drive smarter decisions: Beyond tracking transactions, great tools help you turn data into insights. Choose software that gives you analytics to identify trends, optimise budgets and guide strategy across entities.

- Ease of use and scalability: A good system should be intuitive enough for teams to adopt quickly and flexible enough to grow with your business as you add new entities or markets.

Multi-entity accounting isn’t just about keeping the books in order: it’s about creating transparency, efficiency and insight across your organisation. With the right solution, finance teams can manage complexity confidently, make faster decisions and keep every entity aligned under one clear financial view.

Final thoughts

Multi-entity accounting doesn’t have to be complicated. By combining automation, real-time insights and smart integrations, finance teams can simplify even the most complex structures and unlock a single, unified view of company performance.

With the right tools working together, your finance function can move faster, make smarter decisions and keep every entity in perfect financial sync – no spreadsheets required.