5 tools to simplify cash flow management in 2026

Fresh insights from 2,650 finance decision-makers across Europe

Keeping your business cash flow healthy is about more than just numbers on a spreadsheet: it’s about control, visibility and confidence. When you know exactly where your money is going and when it’s coming in, you can plan ahead, make smarter decisions and stay one step ahead of every challenge.

But managing cash flow manually is a time-consuming, error-prone task. That’s why more businesses are turning to cash flow management software: the tools that simplify the process, giving finance teams real-time insights into spending, income and liquidity.

Whether you’re a growing startup or a global enterprise, the right tools can transform how you manage money day to day.

We’ll cover what cash flow management software is and spotlight five tools that make keeping track of the money moving in and out of your business easy as pie.

Key takeaways:

- Manual cash flow tracking is outdated. Modern tools automate data collection and analysis, freeing finance teams from spreadsheets.

- Real-time visibility is essential. The best platforms let you monitor spend, invoices and cash positions as they happen.

- Connecting spend, accounting, invoicing and forecasting tools ensures a complete financial picture. Integration drives efficiency – and that’s essential.

- When choosing your cash flow management tools, look for solutions that fit your workflow. The best tool is one that integrates seamlessly, automates routine tasks and adapts as your business grows.

What is cash flow management software?

Cash flow management software is a category of digital tools that help businesses keep track of how money moves in and out of the company – from everyday expenses to customer payments and everything in between.

In the past, cash flow management was a manual process often handled through spreadsheets, receipts and late nights trying to make the numbers line up. It worked – mostly – but didn’t give finance teams the real-time visibility or control they needed to make confident decisions.

Today, cash flow management software does the heavy lifting. From spend management platforms and accounting software to invoicing and billing tools, cash flow forecasting software and treasury and liquidity management systems, these solutions bring all your financial data together in one place.

The result? A clear, up-to-date view of where your cash is going, what’s coming in and how to plan ahead. Whether it’s managing spending, forecasting cash flow or optimising liquidity, the right tools make staying on top of your finances simpler – and smarter.

5 cash flow management solutions to get your finances on track in 2026

Still tracking cash flow manually, piecing together spreadsheets and trying struggling to keep up with expenses, invoices and payments? It might be time to swap stress for clarity with smarter cash flow management software. We’ve put together a list of tools that make managing your company’s money faster, more accurate and far more transparent.

In the table below, you’ll find a quick overview of the solutions covered:

|

Software |

Category |

G2 rating |

Pricing |

|

Pleo |

Spend management platforms |

4.7/5 |

Starting at £9.5 per month for up to 3 users |

|

Xero |

Accounting software |

4.4/5 |

Starting at £16 per month |

|

Zoho Invoice |

Invoicing and billing tools |

4.7/5 |

Free for small businesses |

|

Float |

Cash flow forecasting software |

4.4/5 |

Starting at £19 per month |

|

Kyriba |

Treasury and liquidity management systems |

4.5/5 |

N/A – all pricing is quote-based |

Spend management platforms

Spend management platforms help businesses gain real-time visibility and control over company spending. These tools automate expense tracking, approvals and reporting, allowing finance teams to see exactly where money is going – without chasing receipts or reconciling spreadsheets. By centralising spend data, spend management platforms make it easier to spot trends, enforce budgets and make smarter decisions that protect cash flow.

1. Pleo

With more than 1,480 five star reviews, Pleo is Europe’s most loved and trusted spend management platform.

Managing company cash flow has never been easier. With Pleo, every business expense – whether it’s a subscription, vendor payment or team purchase – is tracked in real time, giving finance leaders a complete view of cash outflows across the business.

Capture, monitor and control spending instantly, enforce budgets and approve purchases on the spot – not weeks later. Teams gain faster, more accurate visibility into where money is going, helping prevent overspend, optimise allocations and maintain control over company cash.

Turn spend data into actionable insights with automated workflows, seamless categorisation and analytics that reveal the bigger financial picture. Spend less time reconciling costs and chasing approvals and more time making strategic, data-driven decisions that keep cash flow healthy and the business running smoothly.

Pros and key functionalities:

- Real-time spend and invoice tracking: Monitor and reconcile all business expenses and supplier invoices instantly – no more untracked costs or surprises that disrupt cash flow.

- Flexible spend control: Give teams physical and virtual cards with configurable limits, merchant restrictions and policy enforcement to manage outflows and stay within budget.

- Seamless expense and invoice capture: Say goodbye to manual entry. Snap, attach and categorise receipts instantly via the mobile app. Every expense is accounted for.

- Smart automation and approvals: Automate workflows, enforce policies and approve expenses and invoices on the spot. Get faster, more accurate reconciliation and keep cash flow under control.

Reasons to choose Pleo:

- Fast implementation and onboarding

- Strong customer support and user-friendly interface

- Scalable solution that grows with your business

Pricing: Pleo offers monthly or yearly billing, with prices starting at £9.5 per month for up to 3 users.

What do our users say about Pleo?

“Since our company is based in Europe, Pleo truly understands and provides services that align with European regulations. It integrates seamlessly with our accounting system, making our work much easier. Pleo also offers all the features we need to manage our company expenses efficiently. We used to rely on multiple expense apps, but now we’ve replaced them all with Pleo – it’s compact, convenient, and powerful. ”

- Financial Accountant Ghitha S., G2

Accounting software

Accounting software sits at the heart of financial management, recording every transaction to give a clear picture of business performance. These solutions simplify bookkeeping, automate reconciliations and generate financial reports that support cash flow planning. When connected with other tools, accounting software becomes the backbone of a connected finance stack, helping ensure every penny going in and out is accounted for.

2. Xero

Xero specialises in giving small and medium-sized businesses a clear picture of their finances, making accounting simple and stress-free. From tracking expenses to reconciling bank accounts, it brings everything into one place so you can see exactly where your money is going.

With Xero, managing cash flow becomes less about crunching numbers and more about making confident, informed decisions.

Pros and key functionalities:

- All-in-one accounting: Keep track of expenses, invoices and bank transactions in one place. Say goodbye to scattered spreadsheets and enjoy a clear view of your cash flow.

- Automated reconciliations: Let Xero match transactions automatically, reducing errors and saving hours of manual work.

- Real-time financial insights: Get up-to-date reports on profit, cash position and spending trends so you can make informed decisions quickly.

Reasons to choose Xero:

- Intuitive and easy to use

- Streamlined invoice management

- Clear financial reporting

Source: G2

Pricing: Xero starts at £16 per month.

Invoicing and billing tools

Getting paid on time is key to healthy cash flow – and that’s where invoicing and billing tools come in. These platforms make it easier to send professional invoices, track payments and follow up automatically on overdue bills. By speeding up the collection process and improving accuracy, invoicing and billing tools help businesses maintain a steady flow of income and reduce administrative hassle.

3. Zoho Invoice

Want to get paid faster without the headaches? Zoho Invoice is where it’s at. Create and send professional invoices in minutes, track payments and automate follow-ups – all from one easy-to-use platform.

Zoho Invoice is designed to save time, reduce errors, and give you a clear view of incoming cash so you can keep your business running smoothly.

Pros and key functionalities:

- Fast, professional invoicing: Create and send invoices in minutes, with templates that look polished and professional.

- Automated payment reminders: Reduce late payments by automatically nudging clients, keeping your cash inflow steady.

- Detailed tracking and reporting: Monitor invoice status, payments and client activity to know exactly where your money is and what’s coming.

Reasons to choose Zoho Invoice:

- Fast and effortless invoicing

- Clean and straightforward platform

- Simple and easy to use

Source: G2

Pricing: Zoho Invoice is free for small businesses.

Cash flow forecasting software

Cash flow forecasting software helps businesses look ahead and plan with confidence. These tools pull data from accounting and banking systems to predict future cash positions based on income, expenses and upcoming commitments. With clear, data-driven forecasts, finance teams can make informed decisions about spending, saving and investing – before cash flow issues arise.

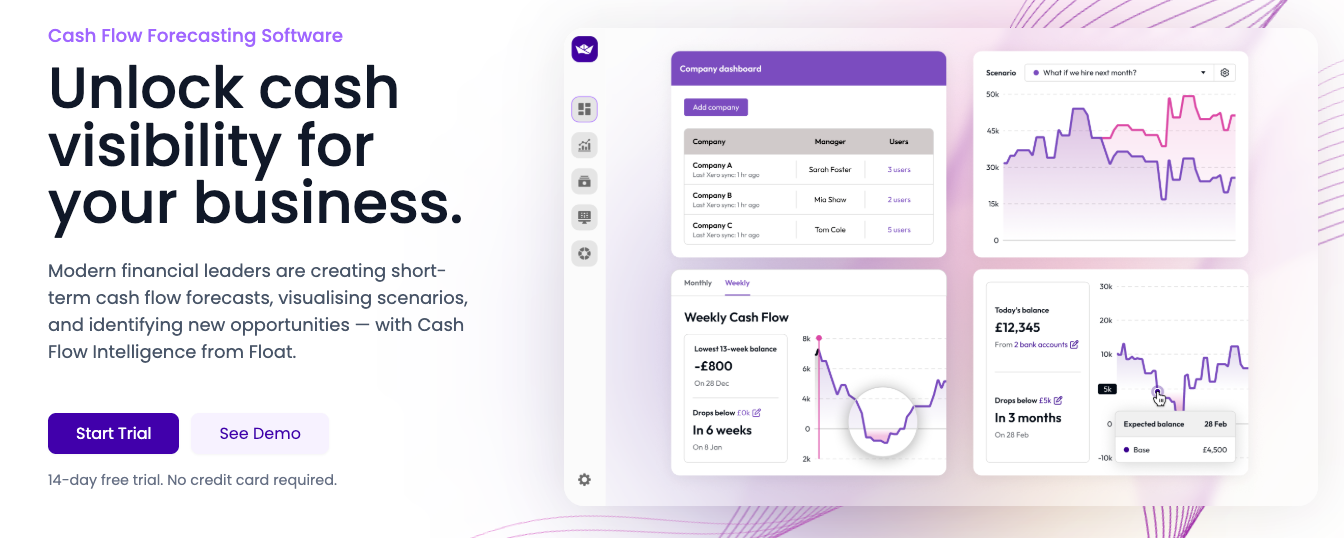

4. Float

Float takes the guesswork out of cash flow forecasting. By connecting to your accounting and bank systems, it gives you a real-time view of where cash is today and where it’s heading tomorrow.

With Float, you can plan ahead, spot potential gaps and make smarter decisions to keep your business financially healthy – without the stress of spreadsheets.

Pros and key functionalities:

- Real-time cash flow forecasting: See where your cash is today and where it’s going tomorrow, so you can plan with confidence.

- Scenario planning made easy: Test different ‘what if’ scenarios to understand how decisions affect your cash position.

- Seamless integration: Connect with accounting systems like Xero or QuickBooks to keep all data up to date without manual entry.

Reasons to choose Float:

- Easy and intuitive to navigate

- Seamless accounting integrations

- Flexible scenario planning

Source: G2

Pricing: Float starts at £19 per month (billed annually].

Treasury and liquidity management systems

For larger organisations, treasury and liquidity management systems provide a more advanced layer of control. These platforms centralise global cash positions, automate bank connectivity and optimise liquidity across multiple entities or currencies. They help treasury teams ensure that cash is always in the right place at the right time, improving efficiency, reducing risk and supporting strategic decision-making.

5. Kyriba

Kyriba brings enterprise-level treasury and liquidity management to life, giving finance teams the tools to manage cash, payments and risk with confidence.

The solution centralises global cash positions, automates bank connections and helps treasury teams make smarter decisions faster. With Kyriba, staying on top of liquidity isn’t just easier – it’s strategic.

Pros and key functionalities:

- Centralised cash visibility: Monitor cash positions across accounts, currencies and subsidiaries in real time.

- Automated treasury operations: Streamline payments, reconciliations and liquidity management, reducing errors and freeing up your team.

- Risk and compliance control: Manage FX, interest rate and counterparty risk while staying compliant with internal policies and regulations.

Reasons to choose Kyriba:

- Centralised cash and accounts

- Intuitive and easy to use

- Smarter financial decision-making

Source: G2

Pricing: N/A – all pricing is quote-based.

What to look for in a cash flow management solution

Choosing the right tool can make managing your business’s cash flow far simpler and more effective. Not every solution will be the right fit for your business – but certain features are always worth prioritising.

Here are some key features to look for in a cash flow management tool:

- User-friendly interface: You want a tool that’s easy to pick up. Look for solutions your teams can adopt quickly and learn to use with minimal training.

- Invoice capture and management: For accurate reconciliation, it’s a good idea to choose a tool that lets you snap, attach and categorise invoices instantly.

- Flexible spending controls: Being able to set budgets, enforce policies and approve purchases on the spot are all game-changers for cash flow management.

- Automated workflows and approvals: Choose a solution that’ll help you reduce manual work and speed up reconciliations – automation makes all the difference.

- Seamless categorisation and analytics: Look for tools that let you turn spending data into actionable insights for smarter decision-making.

- Good value for money: Choose a tool that gives you the value you need for a price that won’t break your budget – and one that scales with your business.

Cash flow management isn’t just about tracking income and expenses: it’s about giving your business visibility, control and insight into every financial movement.

With the right tools, finance teams can manage spending confidently, optimise cash allocation and make strategic decisions that support growth. Instead of reacting to cash flow challenges, they can plan ahead, stay agile and keep the business moving forward with clarity and control.

Final thoughts

Cash flow is the heartbeat of any business – and managing it effectively can be the difference between stability and strain. The good news? You don’t have to do it alone. With today’s digital tools, finance teams can see the full picture in real time, make confident decisions and adapt quickly when conditions change.

From spend management platforms like Pleo to forecasting, accounting and treasury systems, there’s a solution for every stage of growth. The key is finding the right mix of simplicity, automation and insight to keep your cash flow healthy – and your business moving forward.