8 tools for seamless invoice routing in 2025

Fresh insights from 2,650 finance decision-makers across Europe

Invoice approvals shouldn’t feel like a wild goose chase. Yet for many finance teams, chasing signatures, digging through emails and juggling spreadsheets is the reality – especially when invoices are piling up across multiple teams, entities or regions.

That’s where invoice routing software comes in. By automating approvals, keeping processes visible and ensuring invoices reach the right person at the right time, these tools make finance workflows faster, smarter and far less stressful.

In this article, we’ll explore what invoice routing software is and introduce you to five solutions to make invoice routing plain sailing in 2025.

Key takeaways:

- Invoice routing software automatically captures invoices, sends them to the right approvers and tracks their status in real time, turning a slow, manual process into a fast, transparent workflow.

- Visibility keeps finance in control. Real-time dashboards, notifications and audit trails make it easy to see where invoices are, who approved them and what’s next.

- Every organisation is different. The best solutions let you build approval paths based on teams, amounts, departments or cost centres.

- Invoice routing works best when connected to your accounting, ERP and payment systems. Seamless data flow ensures accurate books, timely payments and confident decision-making.

What is invoice routing software?

Invoice routing software is what keeps your approval process running smoothly – no more chasing signatures or guessing where an invoice has gone.

Not too long ago, invoice approvals were a bit of a nightmare. Paper invoices landed on desks, scanned copies got buried in inboxes, and finance teams spent hours chasing managers for sign-offs. It was slow, messy and full of opportunities for mistakes. Invoice routing software changes all that.

Invoice routing software automatically sends invoices to the right people for approval, keeps everything on record and moves the process along without a single email thread or sticky note reminder. The result? Faster approvals, fewer errors and better visibility across the entire spend cycle.

These days, invoice routing sits at the heart of a broader ecosystem of tools that make finance teams’ lives easier.

Accounts payable (AP) automation software captures and routes invoices automatically, whilst workflow management platforms define who approves what and when. ERP systems often include invoice modules that connect routing directly with your accounting and procurement processes, and collaboration tools keep everyone aligned when approvals need a quick nudge.

And then there are spend management platforms, which bring all these elements together. They combine invoice routing with real-time spend tracking, approvals and insights, so every expense – from supplier invoices to team purchases – flows through one clear, automated process.

8 invoice routing tools for seamless approvals in 2025

Still chasing approvals, digging through email threads or wondering where an invoice has disappeared to? It might be time to swap manual chaos for clarity with smarter invoice routing software.

We’ve put together a list of tools that simplify how invoices move through your organisation, making approvals faster, processes more accurate and visibility across teams crystal clear.

In the table below, you’ll find a quick overview of the solutions covered:

|

Software |

Category |

G2 rating |

Pricing |

|

Pleo Accounts Payable |

Accounts payable automation software |

4.7/5 |

Starting at £9.5 per month for up to 3 users |

|

Stampli |

Accounts payable automation software |

4.6/5 |

N/A – all pricing is quote-based |

|

onPhase |

Workflow management platforms |

4.4/5 |

N/A – all pricing is quote-based |

|

Jotform Workflows |

Workflow management platforms |

4.6/5 |

Offers a free version; priced tiers starting at $34 per month for 1 user |

|

NetSuite |

ERP systems with invoice modules |

4.1/5 |

N/A – all pricing is quote-based |

|

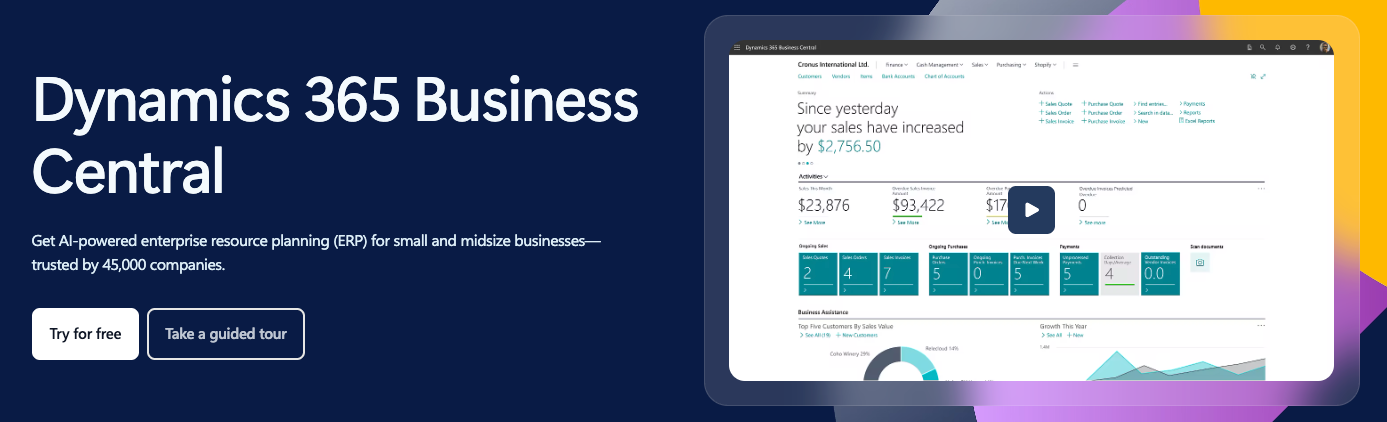

Microsoft Dynamics 365 Business Central |

ERP systems with invoice modules |

4/5 |

Starting at $70 per user per month |

|

Slack |

Collaboration and communication tools |

4.5/5 |

Offers a free version; priced tiers starting at €4.13 per user per month |

|

Microsoft Teams |

Collaboration and communication tools |

4.4/5 |

Starting at $4.00 per user per month |

|

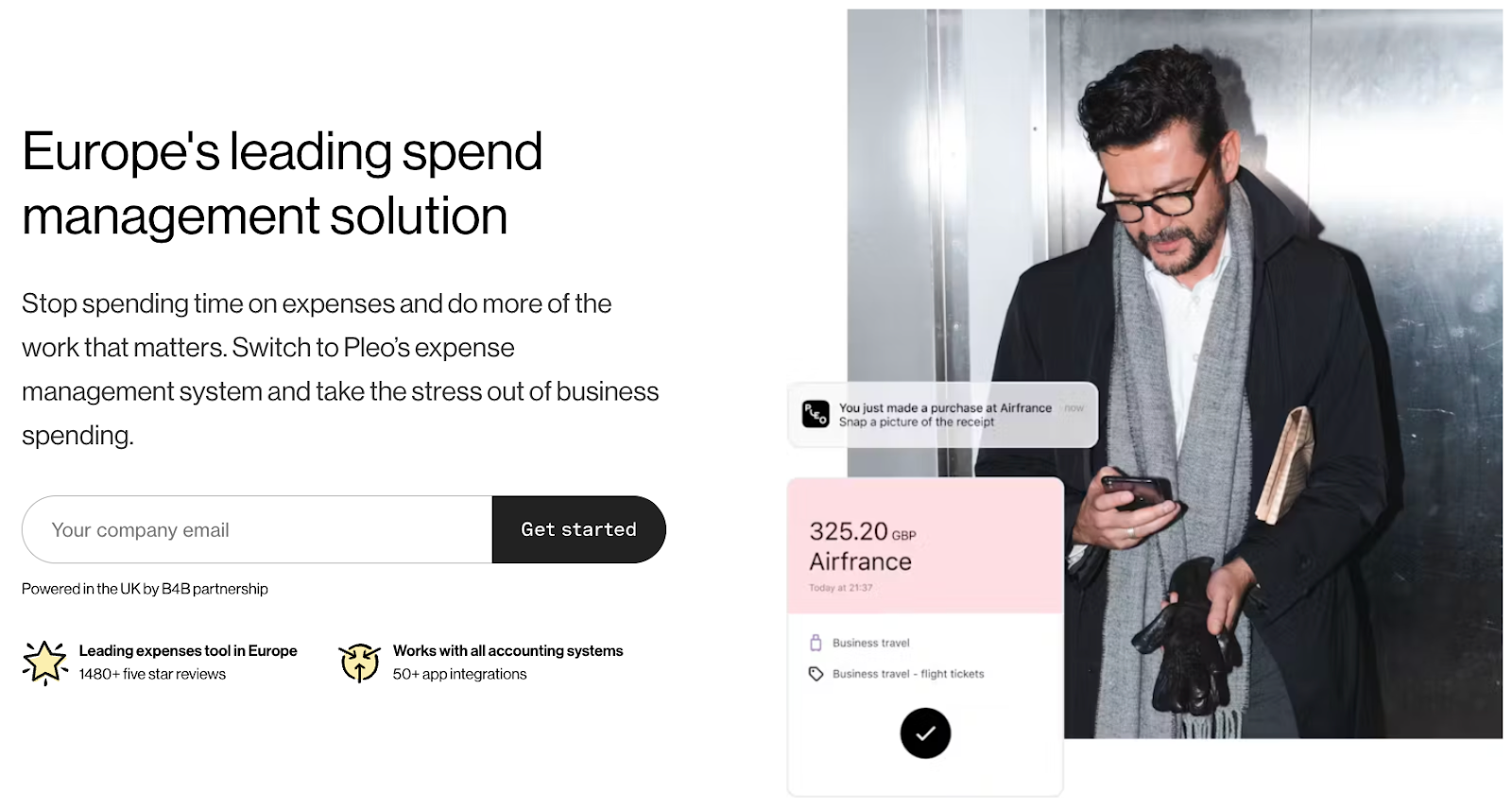

Pleo |

Spend management platforms |

4.7/5 |

Starting at £9.5 per month for up to 3 users |

Accounts payable (AP) automation software

If invoice routing had a best friend, it would be AP automation. These tools handle everything from capturing and reading invoice data to matching it with purchase orders and routing it for approval – automatically. They take the heavy lifting out of manual data entry and approvals, giving finance teams back their time (and sanity).

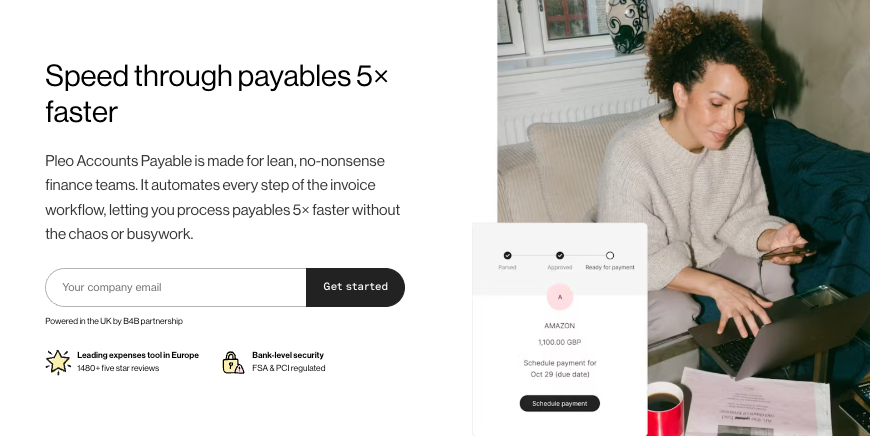

1. Pleo Accounts Payable

With more than 1,480 five-star reviews, Pleo is Europe’s most loved and trusted spend management platform – now with a powerful accounts payable solution that makes invoice routing effortless.

Capture, route, approve and pay invoices – all in one place. Pleo lets you automatically direct invoices to the right approvers, apply your company’s approval rules and keep every step visible in real time. No more chasing approvals, waiting weeks for sign-offs or losing track of where invoices stand.

With Pleo, what used to be a slow, manual process becomes a fast, transparent workflow that keeps cash flow healthy and everyone on the same page. Simplify invoice management for finance teams, bookkeepers and employees alike, with one smart platform built to handle every step – from capture to payment.

Pros and key functionalities:

- Streamlined invoice routing: Automatically capture, route and approve invoices with rules that fit your company structure. No more chasing approvals or losing track of supplier payments.

- Centralised visibility: Manage all invoices – across teams and entities – in one place. See exactly what’s pending, approved or paid, and stay on top of cash flow in real time.

- Seamless capture and categorisation: Upload invoices or forward them directly from email. Pleo extracts key data automatically, so every invoice is coded and ready for review.

- Smart approval workflows: Build custom routing rules to ensure the right people sign off before payment. Speed up approvals while maintaining full compliance.

Reasons to choose Pleo:

- Helpful customer support

- Efficient and time-saving solution

- Fast implementation and user-friendly interface

Source: G2

Pricing: Pleo offers monthly or yearly billing, with prices starting at £9.5 per month for up to 3 users.

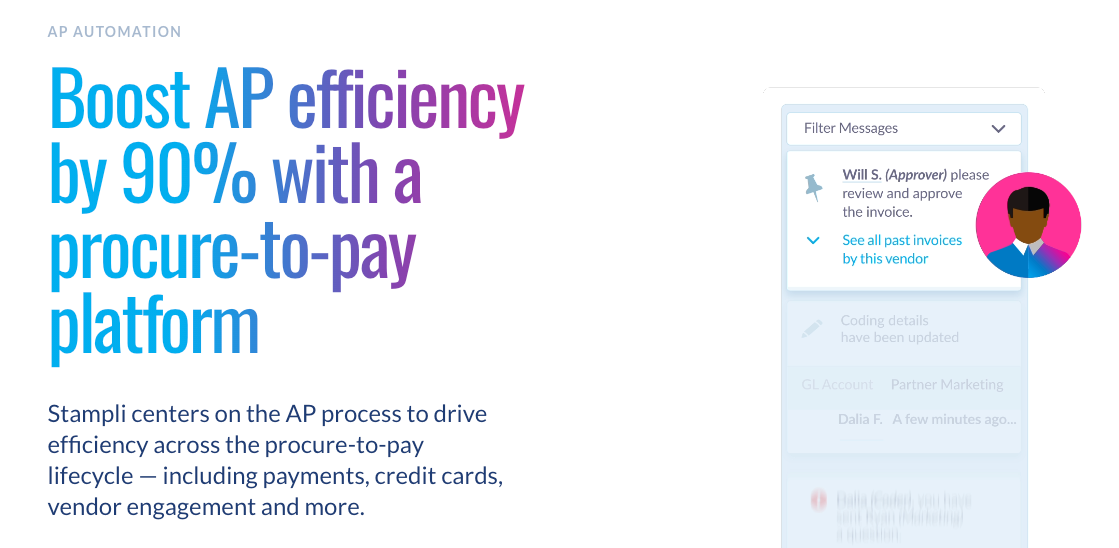

2. Stampli

Meet Stampli: the AP automation tool that gives invoices a voice – literally. It turns invoice approvals into quick, collaborative conversations right where the data lives.

With AI-powered capture, automatic routing and built-in communication, Stampli makes it easy for finance teams to manage invoices without endless email chains. Faster approvals, fewer errors and a happier AP team – all in one place.

Pros and key functionalities:

- Collaborative invoice management: Forget the endless email chains. Bring accounting, approvers and vendors together in one interface.

- AI-powered data capture: Stampli’s AI, Billy the Bot, learns how your team works and automatically codes, routes and categorises invoices for faster, smarter processing.

- Flexible approval routing: Customise workflows based on departments, amounts or invoice types to keep approvals quick, compliant and consistent.

Reasons to choose Stampli:

- Fast and intuitive

- Smooth onboarding process

- Efficient invoicing

Source: G2

Pricing: N/A – all pricing is quote-based.

Workflow management platforms

Workflow tools are the rule-makers behind smooth invoice routing. They define who needs to approve what, in what order and under which conditions. With clear routing rules in place, invoices flow effortlessly through the right channels. No bottlenecks, no confusion – just streamlined approvals that make sense.

3. onPhase

onPhase helps businesses design and automate approval workflows that actually make sense. With intuitive drag-and-drop tools and custom routing rules, you can build approval paths that match your organisation – not the other way around.

Whether it’s routing invoices, managing requests or keeping stakeholders aligned, onPhase keeps processes clear, compliant and on track.

Pros and key functionalities:

- Custom workflows, no coding: Build invoice approval routes that fit your business structure using simple, drag-and-drop tools.

- Rule-based automation: Automatically assign approvers, set conditions and trigger notifications based on amount, department or project.

- Cross-team collaboration: Keep stakeholders aligned and informed through built-in notifications and approval updates, reducing bottlenecks and delays.

Reasons to choose onPhase:

- Time-saving automation

- Easy navigation and intuitive interface

- Friendly and responsive customer support

Source: G2

Pricing: N/A – all pricing is quote-based.

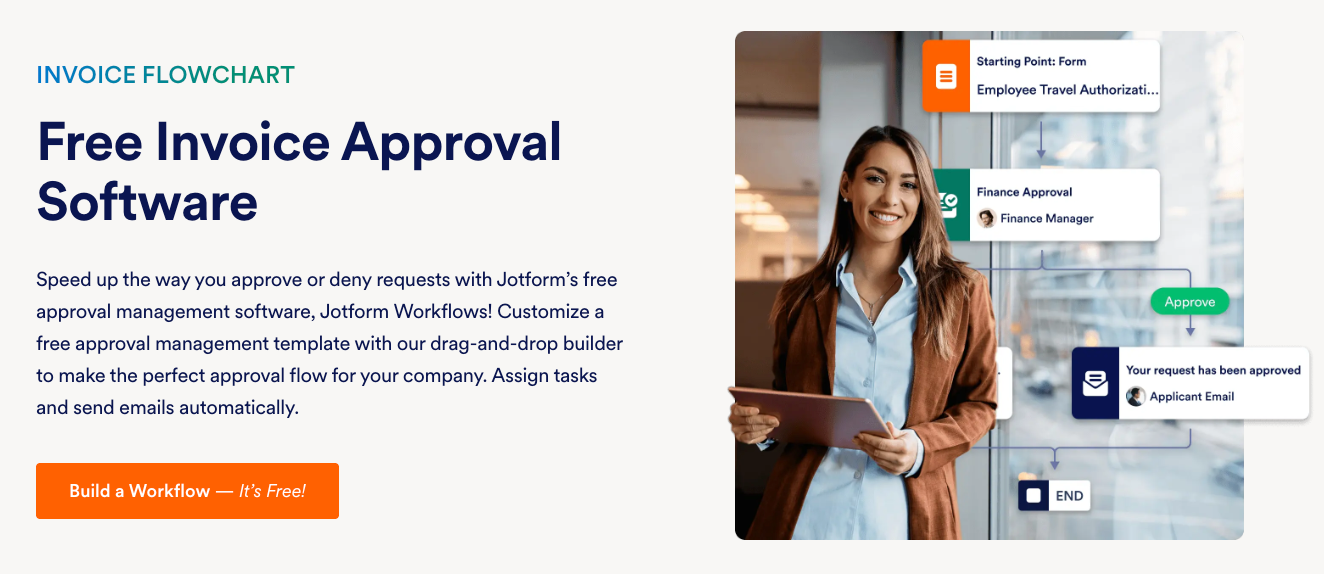

4. Jotform Workflows

Jotform Workflows brings simplicity to approvals. Build custom invoice routing flows with zero coding required – just set the logic, assign approvers and let automation do the rest.

Real-time notifications and status tracking mean no invoice ever slips through the cracks, giving finance teams a smooth, transparent approval process from start to finish.

Pros and key functionalities:

- Simple setup: Create invoice approval flows in minutes with pre-built templates – no tech skills required.

- Conditional logic: Route invoices automatically based on amount, vendor or department, ensuring the right people review and approve.

- Document automation: Automatically generate, share and store approved invoices securely within Jotform’s ecosystem.

Reasons to choose Jotform Workflows:

- Seamless form and workflow creation

- Feature-rich and customisable

- Flexibility and efficient automation

Source: G2

Pricing: Jotform Workflows offers a free version. Priced tiers start at $34 per month for 1 user (billed annually).

ERP systems with invoice modules

For larger businesses, invoice routing often happens inside an ERP system. These platforms bring everything – accounting, procurement, inventory and invoicing – into one place. It’s a structured approach that keeps data consistent and connected across departments, so finance always has the full picture when invoices come through.

4. NetSuite

NetSuite’s invoice management features take the complexity out of AP. From invoice capture to three-way matching and approval routing, everything lives within one connected ERP system.

For companies already using NetSuite to manage finance and procurement, it means invoices flow seamlessly from entry to payment – no extra tools required.

Pros and key functionalities:

- End-to-end invoice management: Capture, validate and route invoices within the same ERP system that handles your accounting and procurement.

- Custom approval workflows: Set rules for invoice routing and approval to fit your organisation’s hierarchy and spend limits.

- Centralised data: Keep all your financial information – from invoices to payments – connected for complete visibility and accurate reporting.

Reasons to choose NetSuite:

- All-in-one platform

- Extensive customisation options

- Strong integrations and localisation features

Source: G2

Pricing: N/A – all pricing is quote-based

5. Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central brings invoice routing into the heart of your finance operations. Its integrated AP workflows automatically capture, route and match invoices to purchase orders, keeping your data consistent across departments.

For growing businesses, it’s a scalable way to manage approvals and payments directly within the ERP environment.

Pros and key functionalities:

- Integrated AP workflows: Automate invoice capture, approval routing and payment processing within one central ERP platform.

- Seamless purchase order matching: Match invoices against POs and receipts automatically, reducing manual review and reconciliation.

- Connected financial data: Keep your AP, AR and GL functions aligned to maintain accuracy and streamline month-end closing.

Reasons to choose Dynamics 365 Business Central:

- Reliable and flexible platform

- Seamless integration with Microsoft ecosystem

- Effective financial management

Source: G2

Pricing: Dynamics 365 Business Central starts at $70 per user per month (billed annually).

Collaboration and communication tools

Sometimes the fastest way to get an invoice approved is a quick message, not another email thread. That’s where collaboration and communication tools come in. These platforms keep everyone aligned, make it easy to flag approvals or questions, and help invoices move from ‘waiting for approval’ to ‘paid’ in record time.

6. Slack

Slack keeps invoice approvals moving through quick, focused communication. With finance app integrations, you can receive invoice notifications, review details and approve or comment – all without leaving your workspace.

It’s the conversational layer that keeps finance teams connected and approvals on schedule.

Pros and key functionalities:

- App integrations: Connect AP and spend tools like Pleo or Stampli for automated updates, reminders and quick actions.

- Transparency and speed: Keep conversations, approvals and updates in one thread for better visibility and faster decision-making.

- Improved collaboration: Finance, procurement and budget owners can resolve invoice queries instantly, reducing delays and misunderstandings.

Reasons to choose Slack:

- Ease of use and simple setup

- Strong communication and collaboration

- Seamless integrations

Source: G2

Pricing: Slack offers a free version. Priced tiers starting at €4.13 per user per month.

7. Microsoft Teams

Microsoft Teams brings structure and clarity to invoice discussions. Finance teams can share invoice updates, assign approvals and integrate AP tools directly into their Teams channels.

Everything happens in one collaborative space, meaning fewer delays, fewer emails and faster approvals across the board.

Pros and key functionalities:

- Integrated approvals: Connect Teams with your AP or ERP system to approve invoices or review details without leaving the chat.

- Centralised communication: Discuss, share and track invoice progress within dedicated Teams channels for finance or projects.

- Automated notifications: Get real-time alerts when invoices need attention or have been approved, keeping processes moving.

Reasons to choose Teams:

- Streamlined collaboration and communication

- Seamless integration with Microsoft ecosystem

- User-friendly platform

Source: G2

Pricing: Microsoft Teams starts at $4.00 per user per month (billed annually).

Spend management platforms

Spend management platforms take invoice routing to the next level. They don’t just route invoices: they connect them to the bigger picture of company spending. From supplier payments to employee expenses, everything lives in one platform, giving finance teams full visibility and control over where money’s going and why.

8. Pleo

Not to toot our own horn again, but we can’t talk about spend management platforms without mentioning Pleo.

Managing invoices and company spend across multiple entities has never been simpler. With Pleo, every expense – from supplier invoices to team purchases – is tracked and approved in real time across all subsidiaries, giving finance teams full visibility and control over cash outflows.

Capture and route invoices instantly, apply entity-specific approval rules and keep budgets in check without the usual back-and-forth. Pleo’s automated workflows and smart categorisation ensure every invoice reaches the right approver, whilst analytics turn spend data into insights you can actually use.

Spend less time chasing approvals and reconciling costs – and more time focusing on strategic, data-driven decisions that keep your business running smoothly.

Pros and key functionalities:

- Real-time visibility: Get instant insight into every company expense, from subscriptions to supplier payments. Track spending across all entities to maintain full control of cash flow.

- Smart spend controls: Set custom budgets, approval flows and card limits by team or entity. Keep spending flexible – but always within policy.

- Automation that scales: Automate approvals, categorisation and reporting to save time and reduce human error. Give finance teams the bandwidth to focus on strategy, not admin.

- Integrated insights: Turn spend data into real-time analytics that reveal trends, flag anomalies and help finance leaders make smarter, faster decisions.

Pricing: Pleo offers monthly or yearly billing, with prices starting at £9.5 per month for up to 3 users.

What do our users say about Pleo?

“Pleo have been great from start to finish. The platform is incredibly easy to use, but if you ever get stuck with anything, (it’s so easy, I’ve only ever got stuck once,) their team offer great assistance in getting things resolved. The additional features they keep adding, (faster top ups as an example,) just make the whole platform a dream to work with.”

- Accountant Jon D., G2

What to look for in an invoice routing solution

When it comes to invoice routing, the right tool should simplify approvals, keep spend visible and eliminate bottlenecks. Here’s what to look for when choosing a solution:

- Automatic invoice capture: Forget manual entry. Look for software that scans incoming invoices, extracts key details and gets them ready for routing instantly.

- Customisable approval workflows: Choose a solution that lets you build routing rules by team, department, amount or vendor, so invoices always land with the right approver.

- Real-time visibility: You should be able to track every invoice from ‘received’ to ‘paid’ at a glance, with clear audit trails and live status updates.

- Accounting and payment integrations: The best tools sync seamlessly with your ERP and accounting systems, ensuring accurate records and smoother payments.

- Built-in spend controls: Opt for software that supports PO matching, spending limits and policy enforcement to prevent overspend before it happens.

- Ease of use and scalability: A good system should be intuitive enough for teams to adopt quickly and flexible enough to grow with your business as you add new entities or markets.

Invoice routing isn’t just about getting approvals signed on time: it’s about creating clarity, efficiency and control across your finance operations. With the right solution, teams can manage invoices confidently, speed up approvals and keep every payment aligned under one transparent, real-time workflow.

Final thoughts

Invoice routing is more than just a process: it’s a critical part of maintaining healthy cash flow, transparent finances and efficient teams. By choosing the right software, finance leaders can reduce delays, improve compliance and free up time for strategic, data-driven work.

Whether you’re a growing business managing multiple entities or a large enterprise streamlining AP, the right invoice routing solution makes approvals faster, smarter and far more reliable, transforming what used to be a headache into a seamless, automated workflow that keeps your organisation running smoothly.