9 tools to enhance business expense tracking 2025

Fresh insights from 2,650 finance decision-makers across Europe

Tracking business expenses has come a long way from chasing paper receipts and battling bloated spreadsheets. In a fast-paced business world, finance teams need tools that not only capture company spend, but also help manage it smarter, faster and with less hassle. That’s where business expense tracking tools come in.

From snapping receipts and categorising spend to enforcing policies and generating reports, today’s business expense tracking tools automate the manual parts of the process to give finance teams real-time oversight and employees a simpler way to manage expenses.

Whether you’re managing software subscriptions, travel costs or daily office spend, the right tools can help your business stay organised, avoid overspending and make better, data-driven financial decisions.

We’ve compiled a list of nine tools to help you enhance business expense tracking – from all-in-one expense management platforms to specialised solutions.

Key takeaways:

- Modern expense tracking tools simplify spend management by automating tasks like receipt capture, expense categorisation and approvals, helping businesses save time and reduce admin headaches.

- There’s a wide range of solutions available – from all-in-one platforms with integrated corporate cards to specialist tools for SaaS subscriptions, travel management and procurement analytics.

- Real-time visibility is essential for keeping business spend under control. The best tools give you instant oversight of expenses as they happen rather than waiting until month-end.

- When choosing an expense tracking tool, look for ease of use, seamless integrations, automated reporting and flexible approval controls to find a solution that works for both your employees and finance team.

What is business expense tracking?

Business expense tracking tools are all about using digital solutions to monitor, record and manage company spending without the manual admin that used to bog finance teams down.

Keeping track of expenses used to mean chasing paper receipts, sorting through inboxes for travel bookings and manually entering spend into spreadsheets. Thankfully, however, those days are behind us.

In 2025 expense tracking is faster, smarter and far more streamlined. Modern expense management tools automate the fiddly parts, capturing spend data in real time, letting employees snap receipts on the go, categorising expenses automatically and sending them through approval workflows – all without the endless back and forth.

These tools don’t just save time: they also give businesses greater control over company spending, reduce the risk of errors and overspending and provide clearer visibility into where budgets are actually going.

From all-in-one expense management platforms and corporate card solutions to travel expense tools, subscription spend trackers and ERP integrated modules, there are countless solutions on today’s market tackling different parts of the expense journey.

Still relying on spreadsheets and putting up with end-of-month expense headaches? It might be time to see what modern expense tracking tools can do for you!

Expense management platforms and corporate cards

Expense management platforms and corporate cards are designed to make it easy for businesses to track, manage and control employee spending in real time. Some providers focus on one or the other – and some combine the two to cover all bases.

These solutions let employees pay for what they need whilst capturing spend data instantly, enforcing company policies and automating approvals. They give finance teams real-time visibility over expenses, simplify reporting and help businesses stay on top of budgets without the usual end-of-month admin.

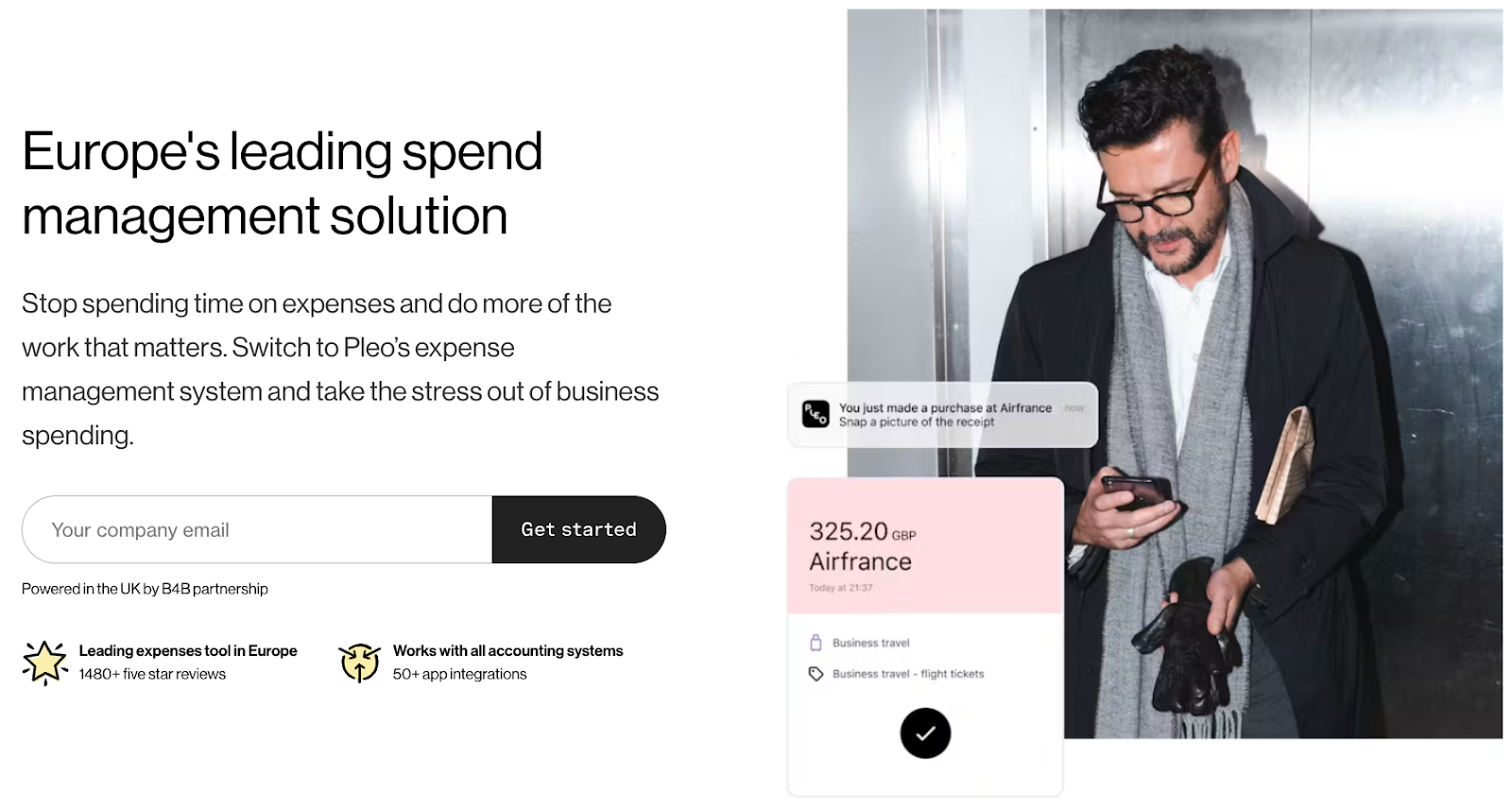

1. Pleo

With more than 1,480 five star reviews, Pleo is Europe’s most loved and trusted spend management platform, combining expense management with physical and virtual corporate cards for total control over company spending.

From daily business expenses and team lunches to software subscriptions and supplier payments, with Pleo you get instant visibility over every transaction. Employees can pay for what they need with their Pleo card whilst finance teams stay in control with real-time tracking, custom spending limits and automated approval flows.

Get detailed reports on spending patterns to help you spot trends, monitor budgets and make better financial decisions – all from Pleo’s intuitive analytics dashboard. And with easy expense categorisation, instant receipt capture and automated reporting, your finance team can keep on top of expenses as they happen, with no month-end surprises.

Pleo pros:

- Ease of use

- Seamless integrations

- Easy upload

- Expense management

- Simplicity

Source: G2

Want more proof? Check out this amazing review from Financial Controller William B.:

“As far as expense software goes, [Pleo] is easy to use both from a finance perspective but also for a non-financial individual. It is user-friendly and the steps to record and to upload your receipts are straightforward. It simplifies the whole process.”

SaaS spend management tools

Keeping track of recurring software subscriptions, cloud services and vendor contracts can be overwhelming. Fortunately, SaaS spend management tools are here to make it much easier.

By monitoring usage, renewal dates and costs, SaaS spend management tools help prevent duplicate costs, unnecessary renewals and wasted spend on underused services, helping businesses keep their budget in check.

2. Spendflo

Spendflo is a go-to platform for businesses looking to take control of their SaaS spend. It collects all your software subscriptions, contracts and renewals in one place, giving you instant visibility over what you’re paying for – and what you might be wasting money on.

With tools to track usage, manage vendor contracts and negotiate better deals, Spendflo helps you cut unnecessary costs, avoid surprise renewals and get more value from your SaaS stack.

Spendflo pros:

- Ease of use

- Customer support

- Cost savings

- Negotiation skills

- Efficiency

Source: G2

3. Cledara

Cledara is a SaaS management platform built to help businesses track, manage and optimise their growing software subscriptions. It gives finance and operations teams a clear, real-time view of every SaaS tool in use, from who’s using it to how much it costs.

With built-in approval workflows, renewal reminders and spend analytics, Cledara makes it easy to stay on top of subscriptions, eliminate duplicate tools and control SaaS budgets before costs get out of hand.

Cledara pros:

- Ease of use

- Centralisation

- SaaS management

- Features

- Card management

Source: G2

Business travel and expense management tools

Designed for businesses with regular travel spend, business travel and expense management tools help employees book travel, track trip-related expenses and submit claims in one place.

These solutions often include travel booking integrations, policy controls and real-time expense tracking to help ensure business travel spend stays within both budget and policy.

4. TravelPerk

TravelPerk is an all-in-one business travel management platform that makes it easy to book, manage and track business trips. It combines a wide travel inventory with built-in policy controls, approval workflows and real-time expense tracking. Finance teams stay in control, and employees get a smooth, hassle-free booking experience.

And here’s the best part: TravelPerk integrates with Pleo to make business trips plain sailing. Use your Pleo card to make your booking on TravelPerk, and automatically reconcile your expenses and invoices in one place – wherever you are.

TravelPerk pros:

- Ease of use

- Easy booking

- Convenience

- Customer support

- Booking management

Source: G2

5. Navan (formerly TripActions)

Navan (formerly TripActions) is a travel and expense management platform built for fast-moving businesses. It streamlines corporate travel booking, automates expense reporting and gives real-time visibility into travel spend – all in one easy-to-use platform.

With smart policy controls, integrated corporate cards and instant trip approvals, Navan helps you keep travel costs under control whilst making life easier for your employees on the move. Its powerful analytics tools also give finance teams insights to optimise travel budgets and spending limits.

Navan pros:

- Ease of use

- Easy booking

- Convenience

- Simple

- Experience

Source: G2

ERP systems with integrated expense management

Enterprise resource planning (ERP) systems often include built-in expense management features as part of their wider financial management offering.

These modules typically handle employee expense claims, per diem calculations and approvals – and they integrate directly with accounting, payroll and reporting systems for a centralised view of business finances.

6. Oracle NetSuite

Oracle NetSuite is a cloud-based ERP platform which brings together financial management, accounting, procurement and expense tracking in one system. Its integrated expense management tools let employees submit expenses, capture receipts and manage approvals on the go whilst finance teams benefit from real-time visibility and seamless reporting.

Built for growing and enterprise businesses, NetSuite helps streamline financial operations, enforce spend policies and connect expense data directly with core accounting and reporting processes.

Oracle NetSuite pros:

- Ease of use

- Customisability and customisation options

- Functionality

Source: G2

7. SAP S/4HANA

SAP S/4HANA is SAP’s flagship cloud-based ERP platform, offering end-to-end financial management, procurement and operational tools for enterprise businesses. Its integrated expense management functionality allows employees to submit expenses, capture receipts and manage approvals within the core ERP system.

S/4HANA helps finance teams get a clear picture of business expenses and keep them in check. It provides real-time reports, makes sure policies are followed and easily connects with accounting and payroll – all in one smooth financial system.

SAP S/4HANA pros:

- Ease of use

- Functionality

- Cloud-based

- Efficiency

- Intuitive

Source: G2

Bonus categories

Alongside core expense tracking and management platforms there’s a growing market of specialised tools designed to handle specific areas of business spend.

These tools might not cover every type of expense, but they’re useful add-ons for businesses looking to fine-tune their processes and gain even more control over company costs. We’ve included a couple of examples below.

Mileage tracking tools

Mileage tracking apps help employees log business travel by car, calculate reimbursements and submit claims quickly and accurately. They automatically track journeys via GPS, record distances travelled and generate mileage reports, making them handy for businesses with remote workers, sales teams or field-based employees,

8. Everlance

Everlance is a mileage and expense tracking app built for businesses with teams on the move. It automatically logs trips using GPS, tracks mileage and calculates reimbursements, making it easy for employees to submit claims and for finance teams to manage approvals and reporting.

With features like receipt capture, business expense categorisation and IRS-compliant reporting, Everlance helps you cut down on manual admin and stay on top of travel-related expenses.

Everlance pros:

- Ease of use

- Easy mileage tracking

- Mobile app

- Expense tracking

Source: G2

Procurement and spend analytics

These tools go beyond day-to-day expense management to give finance and procurement teams deeper insight into company-wide spending patterns. They analyse supplier costs, track procurement trends and identify saving opportunities, helping businesses make smarter, data-driven decisions about where and how they spend their money.

9. Procurify

Procurify is a cloud-based spend management and procurement platform designed to give businesses real-time visibility and control over company purchases. It streamlines the entire purchasing process – from requests and approvals to order management and invoice matching – whilst tracking spend against budgets.

With built-in expense tracking, approval workflows and powerful spend analytics, Procurify helps finance and procurement teams control costs, prevent overspending and make smarter purchasing decisions.

Procurify pros:

- Ease of use

- Time-saving

- Efficiency

- Tracking ease

- Simple

Source: G2

What to look for in a business expense tracking tool

The tools we’ve covered above tackle different parts of the business expense journey – from managing SaaS subscriptions to capturing receipts and tracking mileage. But when it comes to choosing an expense tracking tool for your business, there are a few essentials worth keeping in mind:

- Ease of use: An expense tracker should make life easier, not more complicated. Look for solutions with a simple, intuitive interface that works well for both employees and finance teams.

- Real-time tracking: To stay on top of company spend, you need visibility as it happens. Prioritise tools that offer real-time expense tracking so finance teams always know where money’s going – not just at month-end.

- Built-in corporate cards: Some tools, like Pleo, combine expense management with smart corporate cards, making it easier for employees to pay for business expenses whilst keeping company budgets under control.

- Seamless integrations: To avoid manual data transfers and keep things connected, choose tools that work well with your existing systems – whether that’s your accounting software, payroll solution or ERP system.

- Automated expense reporting: Look for tools that can capture receipts, categorise expenses and automate reporting workflows; they can save time, reduce errors and speed up month-end processes.

- Customisable controls and approvals: Every business is different. The best expense tracking tools let you set spending limits, approval rules and category tags to suit your unique business needs.

- Good value for money: Make sure you get what you’re looking for. Compare the different tools’ pricing models with the value and features they offer and weigh the potential benefits against the cost.

Ultimately, the right expense tracking tool should help your business save time, reduce admin and keep spending in check – whilst giving your finance team the visibility they need to stay one step ahead.

Final thoughts

In 2025 the days of clunky spreadsheets, missing receipts and month-end expense stress are behind us. Today’s business expense tracking tools offer smarter, simpler ways to manage company spend, saving time, reducing admin and giving finance teams the visibility they need to stay in control.

Whether you need an all-in-one solution like Pleo, a specialist tool for SaaS subscriptions or an integrated travel management platform, there’s a tool out there to suit your business. The key is finding one that’s easy to use, works seamlessly with your existing systems and gives you real-time oversight of company expenses.

With the right setup in place, you’ll spend less time worrying about expenses and more time focusing on what really matters: running your business.