Top 5 best softwares for CFOs

Fresh insights from 2,650 finance decision-makers across Europe

From managing payroll to IT and software expenses, the Chief Financial Officer (CFO) has more responsibilities than ever before. That means they need the right tools for the job – and that’s what CFO software is all about.

With so many different software tools for CFOs available, however, choosing the right solutions for your business can be challenging. We’re here to make it a little easier for you.

In this article, we’ll cover what CFO software is and give you a rundown of the pros, cons and pricing of the top 5 best software tools for CFOs on the market.

Key takeaways:

- CFO software provides functionalities to optimise and streamline your financial operations.

- When choosing a tool for your business, look for a solution with low implementation time and high ease of use – and make sure it fits within your budget.

What is CFO software?

CFO software refers to tools and platforms designed to assist Chief Financial Officers (CFOs) and finance teams in managing and optimising a company’s financial operations.

From improved decision making to cost optimisation, the benefits of CFO software are numerous – it’s just about choosing the right solutions for your business.

There are many different types of software that fall under the umbrella of CFO software. These include:

- Enterprise resource planning (ERP) systems

- Financial planning & analysis (FP&A) tools

- Spend management tools

- Accounting software

These different types of solutions provide functionalities to streamline budgeting, forecasting, financial reporting, risk management and strategic decision making. In short, they’re all here to make sure your company’s financial operations run smoothly.

The 5 best softwares for CFOs

1. Pleo

With more than 1,480 five star reviews, Pleo is Europe’s most loved and trusted spend management platform. From daily business expenses to software subscriptions, Pleo gives you instant visibility of all your company spend.

Review the details in real-time, and if something's missing, ask for more information in just a few clicks. Minimise human errors and avoid manual expense reports by exporting Pleo spending data right into the accounting tools your finance team uses every day – and much, much more.

2. CloudZero

2. CloudZero

CloudZero specialises in cloud cost intelligence. It dives deep into all the money your company spends on cloud services (like AWS or Azure) and helps you track, understand and optimise your cloud spending with advanced visibility and cost allocation tools.

3. Xero

3. Xero

Xero is an online accounting tool. It’s like having a super organised digital accountant who keeps track of everything from invoices and bills to payroll – all in one tidy, easy-to-use platform. It also integrates smoothly with a variety of other solutions, making your workflow seamless and your financial operations easier to manage.

Xero is an online accounting tool. It’s like having a super organised digital accountant who keeps track of everything from invoices and bills to payroll – all in one tidy, easy-to-use platform. It also integrates smoothly with a variety of other solutions, making your workflow seamless and your financial operations easier to manage.

4. NetSuite

4. NetSuite

NetSuite is the Swiss Army Knife for businesses looking to get their operations under control. It goes beyond basic accounting and offers tools for inventory, customer relationship management, supply chain and much more – basically, it collects everything in one place so you can focus on the big picture instead of drowning in spreadsheets.

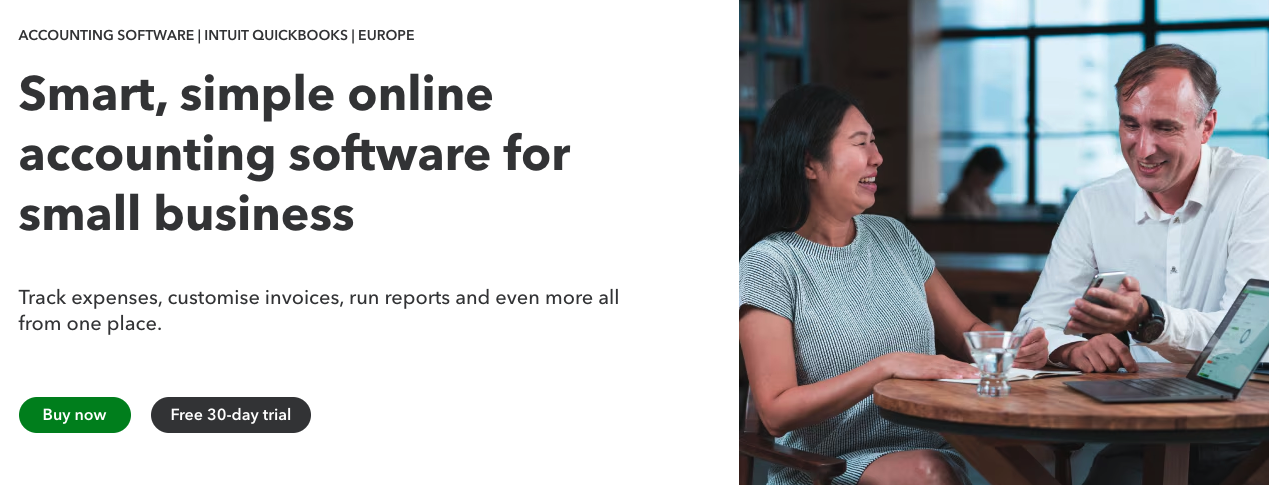

5. QuickBooks

5. QuickBooks

QuickBooks is the go-to for small businesses and freelancers who just want to get paid, pay their bills and stay on top of their taxes. It handles your bookkeeping basics, such as tracking expenses, creating invoices and running payroll. It’s also user friendly and grows with you – an important factor for businesses looking to grow.

How to choose the right CFO software for your business

How to choose the right CFO software for your business

No matter which type of CFO software you’re looking for, there’s no one-size-fits-all solution to all your needs. A tool that works well for one business isn’t necessarily the right one for yours. Even so, there are certain key functionalities that are always good to look for when choosing CFO software for your business.

When choosing CFO tools, here are some things to consider:

- Implementation time: The longer a tool takes to implement, the more expensive it is. Look for CFO software with a short implementation time and onboarding process.

- Ease of use: A CFO tool may have great features, but if it has a high learning curve it may be difficult to use. Read reviews and try product demos to make sure the tools you’re considering are easy to use and adopt.

- Advanced analytics and reporting: This one’s important. Advanced analytics and reporting give you deeper insights into your business performance and priorities, and that helps enhance your decision making. Look for solutions that offer these features.

- Data security: Protecting sensitive data and financial information is important. Make sure the software has passed industry-standard security and regulatory compliance checks.

- Compliance support: CFO software should comply with relevant reporting standards, financial regulations and data privacy requirements. You should also make sure the solutions you’re considering allow you to automate compliance reporting tasks and generate standard reports.

- Budget and value: Make sure you get the value you’re looking for. Compare the CFO tool’s pricing model with the value and features it offers, and weigh the potential benefits against the cost of the solution.

Wrapping up

CFO software tools help CFOs and finance optimise and manage everything from budgeting and forecasting to strategic decision making.

When choosing your CFO software, look for a solution that offers low implementation time and high ease of use while simultaneously being a good fit for the size of your business – as well as your budget.