Decision overload: How tool fatigue undermines financial clarity

Fresh insights from 2,650 finance decision-makers across Europe

Over the past decade, finance has undergone a digital revolution. Cloud software, automation and analytics have redefined how teams operate. These tools promised clarity – real-time insights, effortless reporting and faster decisions.

Yet somewhere along the way, that promise became buried under a mountain of platforms, dashboards and data streams.

What was meant to simplify finance has, in many cases, complicated it. Every process now has its own app; every challenge its own software. The result: tool fatigue – a state where technology overwhelms rather than empowers, and decision-making slows to a crawl.

It’s the paradox of modern finance: the more tools we add, the harder it becomes to see clearly. We’ll explore how the tool explosion in finance has created decision overload – and how forward-thinking finance teams can cut through the noise to reclaim focus, confidence and clarity.

Key takeaways:

- In the drive to modernise, finance teams have built sprawling tech stacks filled with tools for every challenge. But instead of streamlining operations, many are now drowning in disconnected data and duplicate insights.

- Finance leaders face conflicting metrics, fragmented data and cognitive overload, making confident decisions harder, not easier.

- Slower reaction times, growing scepticism in data and decision overload are now common symptoms of tool fatigue. Finance teams spend more time validating numbers than shaping strategy.

- Clarity comes from connection, not collection. The future of finance lies in unified, intelligent platforms that integrate spend, cashflow and analytics into one clear view, empowering teams to make faster, more confident decisions.

- Uniting every type of business spend in one connected platform replaces complexity with coherence. Automation, integrations and real-time insights empower finance teams to focus less on reconciling data and more on driving smarter, strategic decisions – and that’s exactly what Pleo is all about.

The tool explosion in finance

Finance has never been more digital – or more crowded. In the rush to modernise, finance teams have embraced an ever-growing stack of cloud platforms, automation tools and analytics dashboards.

Every niche challenge now comes with its own solution: expense tools, spend trackers, forecasting apps, reporting platforms, liquidity dashboards – and countless integrations to stitch them all together.

On paper, it’s progress. Each tool promises sharper insights and smarter decisions. But in reality, the modern finance stack is starting to resemble a patchwork – one where data lives in silos, processes overlap and visibility becomes fragmented rather than unified.

Instead of clarity, teams often face data chaos. Numbers don’t reconcile. Dashboards contradict. Decisions slow down because leaders spend more time reconciling sources than acting on insights. The technology built to create confidence is now creating confusion.

Digital transformation was supposed to make finance simpler. Yet for many organisations, it’s led to tool fatigue: a state where too many systems compete for attention, and the signal gets lost in the noise.

How tool fatigue leads to decision overload

Today’s finance leaders are drowning in insight. Every platform claims to offer the clarity finance so desperately needs, yet each one tells a slightly different story. When insight is everywhere, it starts to feel like it’s nowhere.

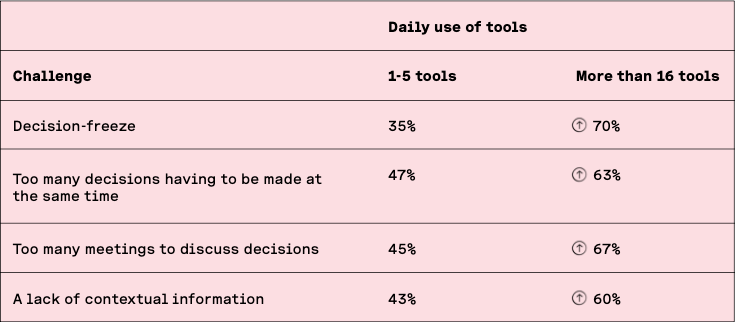

The result? Decision overload. The numbers speak for themselves:

Source: The power of better business decisions

What was meant to simplify has instead multiplied the noise. Each tool adds another layer of data to interpret, another dashboard to check, another version of ‘the truth’ to reconcile.

Over time, this doesn’t just slow decisions – it erodes confidence in them. In practice, here’s what that looks like:

- Fragmented data: When systems don’t talk to each other, finance teams spend hours manually stitching numbers together. Data reconciliation becomes a full-time job, and by the time the story is clear it’s often already out of date.

- Cognitive strain: Every new platform brings a new interface, a new workflow and another mental context to switch between. It’s a level of digital multitasking which the human brain simply wasn’t built for, and the constant toggling between tools drains focus and decision energy.

- Conflicting metrics: Different systems define KPIs in different ways. When dashboards disagree, even the most experienced CFO can hesitate. Should you trust the BI tool, the ERP or the cash flow model? When metrics conflict, clarity collapses.

- Reduced trust: Over time, this confusion breeds scepticism – not just in the data, but in the tools themselves. Finance teams begin to second-guess reports, rerun exports and revert to manual checks. The digital advantage fades, replaced by digital doubt.

What was once meant to empower decision-making has instead overwhelmed it. In a landscape of endless tools, clarity has become the ultimate scarcity.

The impact on financial decision-making

When every decision depends on aligning five dashboards and three approval workflows, speed becomes a luxury. What once took hours now takes days – not because finance teams lack capability, but because they lack coherence.

Decision overload quietly erodes agility. When they don’t fully trust the numbers or are unsure which dataset is the most accurate, teams hesitate to act. The result is missed opportunities, slower responses to market shifts and a growing sense of frustration across the finance function.

It’s the paradox of progress: the more tools we adopt, the harder it becomes to see clearly. Instead of enabling faster, sharper decisions, an expanding tech stack often slows them down. Data lives in too many places. Insights are duplicated, delayed or distorted. Confidence in the numbers – once the bedrock of good financial leadership – begins to crumble.

The finance team, meant to be the strategic nerve centre of the organisation, becomes bogged down in validation instead of vision. They spend more time questioning their systems than shaping the strategy. And when confidence goes, so does the courage to act.

In the pursuit of digital transformation, many organisations have unintentionally traded clarity for complexity – a cost that compounds with every new tool added to the stack.

The good news? Complexity can be tamed. With the right approach, finance teams can cut through the noise, rebuild trust in their data and rediscover the clarity that technology once promised.

How to overcome tool fatigue and regain financial clarity

Clarity doesn’t come from having more tools: it comes from making the right ones work together. Regaining control over a tangled tech stack starts with intention. It’s about choosing connection over collection; simplicity over sprawl.

Audit your stack

Start by taking inventory. What’s actually driving value, and what’s simply adding noise? Map out your current tools, their use cases and where overlaps or redundancies exist. Often, the first step toward clarity isn’t adding another platform – it’s removing one.

Integrate where possible

Disconnected tools breed disconnected insights. Look for integrations that unify data flows and automate reconciliation. A connected ecosystem doesn’t just reduce manual work: it creates a single financial narrative that everyone can trust.

Consolidate systems

Where multiple tools serve similar purposes, consolidation can dramatically improve efficiency and visibility. Fewer logins, fewer dashboards, fewer contradictions. A streamlined stack enables teams to focus on analysis instead of admin.

Simplify data outputs

More data isn’t always better. Prioritise quality, not quantity. Build dashboards that highlight the metrics that truly matter to decision-making, and eliminate the rest. Simplicity is the foundation of speed.

Create one version of the truth

Ultimately, financial confidence depends on having a single, trusted source of information. Whether it’s a unified data platform or a clearly defined reporting framework, ‘one version of the truth’ should be more than a catchphrase: it should be a principle guiding every system decision.

When technology serves strategy (not the other way around), clarity returns. The goal isn’t necessarily to have fewer tools: it’s to have the right ones working in harmony – because in a world overflowing with data, focus has become finance’s most valuable asset.

The future: Smarter tech, fewer tools

After a decade of rapid expansion, the market is shifting from fragmented tools to unified platforms that integrate data, workflows and intelligence into a single, cohesive ecosystem.

We’re entering the age of platform unification and embedded analytics – where automation replaces manual reconciliation, and insights live within the tools teams already use. Instead of chasing information across a dozen dashboards, finance leaders will access a consolidated view that’s accurate, real-time and actionable.

Next-generation finance platforms are built around these principles: clarity, automation and integration. Clarity ensures that everyone is working from the same data. Automation removes the friction of repetitive tasks. Integration ensures that insights flow seamlessly across the organisation, eliminating silos once and for all.

When technology is designed strategically – to connect, not complicate – it becomes the foundation of confident, agile decision-making. Finance teams can move from reactive reporting to proactive insight. From validating data to driving strategy. From tool fatigue to financial clarity.

In other words, the future is smarter technology, thoughtfully applied.

The clarity to move forwards

The challenge facing modern finance is that when every tool promises value in isolation, the true potential of finance gets buried under complexity. The next era of financial leadership will belong to teams who can unify, simplify and see clearly.

Sadie Restorick MSC MABP, an expert in workplace wellbeing and psychosocial risk, shares her perspective in Pleo’s recent report:

“Effective decision-making thrives in environments where learning happens quickly and deliberately. Teams excel at this when they can act on actionable data, test assumptions in real time and adapt swiftly to emerging information rather than being stalled by uncertainty.

Clear structures reinforce decisiveness: defined criteria, accessible information and systematic evaluation reduce hesitation and help maintain momentum under ongoing pressure.”

This is exactly where Pleo makes all the difference. By bringing every type of business spend into one place – from cards to cashflow and everything in between – Pleo lets you replace tool sprawl with a single, connected source of truth. With seamless integrations, data flows freely across the finance stack, giving teams real-time visibility and control.

Pleo Cash Management unites all accounts – bank, Pleo and investment – under one roof in a live dashboard. Finance teams can create sub-accounts, automate transfers, manage currencies and budget with confidence. Automation features like transfer rules remove repetitive manual work, whilst AI-powered policy flagging and smart spend recommendations help teams spend responsibly and optimise continuously.

Finance leaders finally get the clarity they've been chasing: one platform that empowers faster, more confident decisions. In fact, 88% of financial decision-makers using spend management tools feel confident about their decisions in an economic downturn, compared with just 71% who don’t.

When spend and cash management finally come together, finance teams gain more than just efficiency: they gain focus. Focus to advise the business. Focus to drive growth. Focus to lead with confidence again.

With Pleo, technology returns to what it was always meant to be: an enabler of clear, connected and confident financial decision-making.