7 tools for better FP&A in 2026

Fresh insights from 2,650 finance decision-makers across Europe

Financial planning and analysis (FP&A) is no longer just a back-office function: it’s a strategic driver that helps businesses make smarter decisions, optimise resources and stay agile in a fast-changing market.

The right FP&A software can transform how your finance team plans, forecasts and manages company spend, giving visibility into budgets, workforce costs, supplier payments and much more. From modelling scenarios to and tracking expenses in real time to connecting payroll, procurement and financial data, today’s FP&A tools put actionable insights at your fingertips.

We’ll explore what FP&A software is and introduce you to seven tools that enable your finance team to go from reactive reporting to proactive planning.

Key takeaways:

- FP&A software centralises financial data. From budgets and cash flow to workforce and supplier spend, these tools give teams a single source of truth.

- Real-time insights drive smarter decisions, allowing finance teams to track expenses, model scenarios and forecast with up-to-date data rather than outdated spreadsheets.

- Automation reduces errors and frees up time. Workflow approvals, policy enforcement and data integrations cut manual work and allow teams to focus on strategy.

- Flexibility and integration are critical. The best solutions connect with accounting, payroll, ERP and procurement systems, keeping forecasts accurate and planning agile.

What is financial planning & analysis (FP&A) software?

Financial planning and analysis (FP&A) software is all about helping businesses plan, monitor and optimise their financial performance – from day-to-day spending to long-term strategy.

Think of FP&A software as your organisation’s financial command centre. It gives finance teams clear visibility into budgets, cash flow, workforce costs and supplier spend and shows how every decision impacts overall business performance.

Gone are the days of juggling disconnected spreadsheets or waiting for outdated reports. With FP&A software, teams can forecast revenue, model different scenarios, track expenses in real time and align resources with strategic priorities.

From building accurate budgets and real-time insights into company spend to payroll and workforce planning, tracking supplier spend and streamlining approvals, these tools cover every corner of financial planning and analysis.

Together, these solutions form a toolkit that turns financial planning from a reactive reporting exercise into a proactive, strategic advantage. They help businesses make smarter decisions, optimise resources and stay agile in a fast-changing business world.

7 tools to take FP&A to the next level in 2026

Still juggling budgets, forecasts and financial reports with clunky spreadsheets and guesswork? It might be time to swap chaos for clarity with smarter FP&A tools. We’ve compiled a list of 7 solutions that help you plan, analyse and optimise your business finances with confidence.

In the table below, you’ll find a quick overview of the solutions covered:

|

Software |

Category |

G2 rating |

Pricing |

|

Anaplan |

Financial planning and forecasting software |

4.6/5 |

N/A – all pricing is quote-based |

|

Vena Solutions |

Financial planning and forecasting software |

4.5/5 |

N/A – all pricing is quote-based |

|

Pleo |

Spend management and expense control platforms |

4.7/5 |

Starting at £9.5 per month for up to 3 users |

|

HiBob |

Payroll and workforce planning platforms |

4.5/5 |

N/A – all pricing is quote-based |

|

Workday |

Payroll and workforce planning platforms |

4.1/5 |

N/A – all pricing is quote-based |

|

Coupa |

Procurement and vendor management systems |

4.2/5 |

N/A – all pricing is quote-based |

|

ProcureDesk |

Procurement and vendor management systems |

4.4/5 |

Starting at $498 per month (billed annually) |

Financial planning and forecasting software

In today’s fast-moving business landscape, static spreadsheets can’t keep up. Financial planning and forecasting tools bring agility to budgeting by allowing finance teams to model different scenarios, test assumptions and adjust forecasts in real time. These platforms connect financial and operational data, helping decision-makers anticipate change, allocate resources effectively and plan for long-term growth with confidence.

1. Anaplan

Financial planning isn’t just about setting targets: it’s about preparing for change. Anaplan empowers your finance team to build dynamic plans, accurate forecasts and scenario models that adapt as conditions shift. By connecting data across departments, it delivers real-time visibility into performance and the impact of every decision.

From creating agile budgets to running detailed what-if analyses, Anaplan transforms financial planning into a continuous, forward-looking process that helps your business stay resilient and ready for what’s next.

Pros and key functionalities:

- Dynamic scenario modelling: Run ‘what-if’ analyses to forecast how different spending decisions affect financial outcomes.

- Connected planning across teams: Align finance, operations and leadership on budgets and spending priorities.

- Real-time data updates: Adjust forecasts instantly as new data comes in, keeping plans relevant and accurate.

Reasons to choose Anaplan:

- User-friendly design

- Flexible and adaptable solution

- Powerful features for smarter planning

Source: G2

Pricing: N/A – all pricing is quote-based.

2. Vena Solutions

Financial planning is more than creating budgets: it’s about connecting data, people and processes to make smarter decisions. Vena Solutions helps your finance team build accurate plans, forecasts and scenario models by integrating operational and financial data into one platform.

With real-time insights and flexible reporting, Vena transforms planning into a continuous, forward-looking process that drives strategic decision-making and organisational resilience.

Pros and key functionalities:

- Dynamic scenario modelling: Test multiple financial scenarios to see how changes in revenue, costs or investments impact overall performance.

- Connected planning across teams: Align finance, operations and leadership on budgets, forecasts and strategic priorities.

- Real-time data updates: Integrate operational and financial data to instantly adjust forecasts and maintain accuracy.

Reasons to choose Vena Solutions:

- Intuitive and user-friendly interface

- Seamless Excel integration

- Comprehensive financial management features

Source: G2

Pricing: N/A – all pricing is quote-based.

Spend management and expense control platforms

Controlling company spending is key to maintaining financial agility. Spend management platforms centralise expenses, automate approvals and give finance teams real-time visibility into where money is going. From employee cards to invoice tracking, these tools help organisations align spending with budgets and strategic priorities, turning everyday expense data into actionable insights for smarter planning and cash flow management.

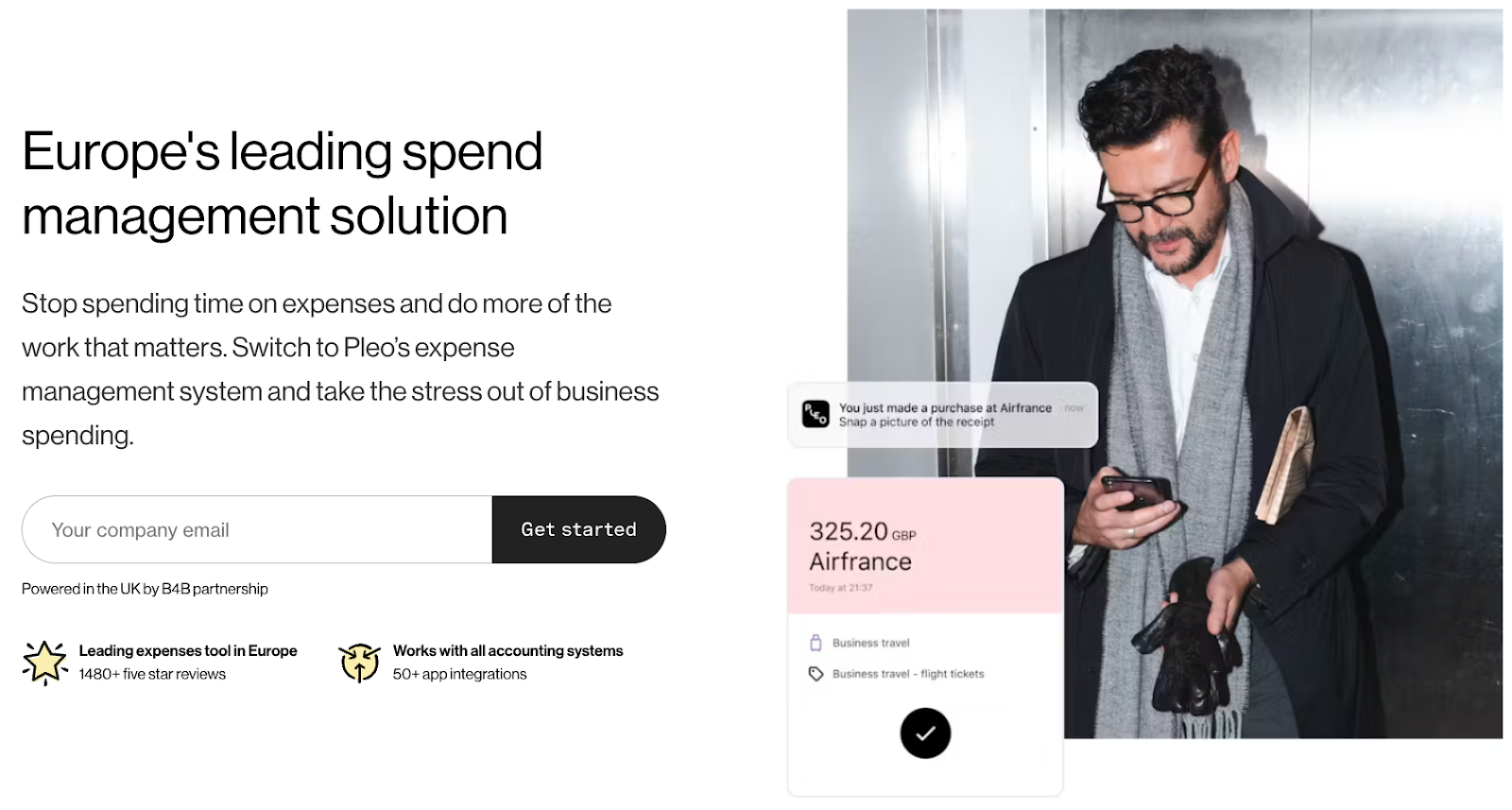

3. Pleo

With more than 1,480 five star reviews, Pleo is Europe’s most loved and trusted spend management platform.

Effective financial planning starts with knowing exactly where your money goes. With Pleo, you get full visibility of every company expense into one place – from subscriptions and supplier invoices to travel and day-to-day team spending – and your finance team get real-time visibility into outgoing cash and its impact on budgets and forecasts.

Get automated expense tracking, smart approvals and seamless policy controls. Turn spend management into a proactive part of the planning process; monitor budgets dynamically, spot trends early and align spending with strategic goals.

With Pleo, every decision is backed by accurate, up-to-date data.

Pros and key functionalities:

- Dynamic spend control: Empower teams to spend responsibly with physical and virtual employee cards with configurable limits and merchant restrictions.

- Real-time expense capture: Snap, attach and categorise receipts through the mobile app, ensuring up-to-date expense data flows directly into financial reports and forecasts. No delays, no manual errors.

- Automated workflows and approvals: Streamline expense reviews with smart automation that enforces policies and approvals instantly.

Reasons to choose Pleo:

- Fast implementation and onboarding

- Strong customer support and user-friendly interface

- Scalable solution that grows with your business

Pricing: Pleo offers monthly or yearly billing, with prices starting at £9.5 per month for up to 3 users.

What do our users say about Pleo?

Payroll and workforce planning platforms

People are often a company’s biggest investment – and one of the most complex to plan for. Payroll and workforce planning platforms connect HR and finance data to provide a clear view of labour costs, headcount trends and future hiring needs. By integrating payroll operations with forecasting models, these tools help finance teams accurately predict personnel costs and assess how workforce changes affect profitability and overall financial performance.

4. HiBob

Managing people costs effectively is a cornerstone of financial planning. HiBob combines HR and payroll in a single platform, giving your finance team a clear view of headcount, compensation and workforce trends.

By linking workforce planning to budgeting and forecasting, HiBob enables you to anticipate labour costs, assess hiring needs and make data-driven decisions that ensure your talent strategies are aligned with your financial goals.

Pros and key functionalities:

- Workforce cost visibility: Gain a clear view of headcount, salaries and benefits to inform budgeting and forecasting decisions.

- Scenario-based workforce planning: Model hiring, turnover and compensation changes to assess their impact on financial performance.

- Integrated HR And finance data: Connect payroll and workforce insights with broader financial planning for more accurate forecasts.

Reasons to choose :

- Intuitive and easy to use

- User-friendly interface

- Powerful and helpful features

Source: G2

Pricing: N/A – all pricing is quote-based.

5. Workday

Workday goes beyond payroll and HR administration and connects workforce data directly to financial planning. By providing a holistic view of personnel costs, performance and workforce trends, Workday enables your finance team to model scenarios, forecast staffing needs and optimise labour spend.

The result? A more accurate, forward-looking understanding of how your people strategies impact the overall financial performance of your business.

Pros and key functionalities:

- Comprehensive workforce analytics: Track personnel costs, productivity and trends to improve planning accuracy.

- Scenario modelling for workforce strategies: Run what-if analyses to understand the financial impact of hiring, restructuring or compensation changes.

- Real-time updates across departments: Keep financial and HR data aligned for continuous, forward-looking planning.

Reasons to choose :

- User-friendly and intuitive

- Comprehensive HR management features

- Seamless integrations and easy interface

Source: G2

Pricing: N/A – all pricing is quote-based.

Procurement and vendor management systems

Strategic procurement goes beyond purchasing: it’s about managing supplier relationships, costs and risks in line with financial goals. Procurement and vendor management systems streamline sourcing, approvals and payments whilst providing visibility into supplier spend and contract performance. For FP&A teams, this means better cost control, improved forecasting accuracy and a stronger link between procurement decisions and financial outcomes.

6. Coupa

Procurement doesn’t have to be a black box. Coupa gives your finance team visibility into supplier spend, contracts and purchase workflows, enabling better cost control and strategic sourcing decisions.

By integrating procurement data with planning and forecasting processes, Coupa helps your business align purchasing decisions with budgets and financial goals, turning supplier insights into actionable intelligence.

Pros and key functionalities:

- Spend visibility across suppliers: Monitor procurement data in real time to support budgeting and cost control.

- Scenario planning for procurement decisions: Assess how vendor choices or contract terms impact financial outcomes.

- Integrated procurement and finance workflows: Align purchasing, approvals and financial planning for more accurate forecasts.

Reasons to choose Coupa:

- Features and functionalities

- Intuitive user interface

- Efficiency and time-saving

Source: G2

Pricing: N/A – all pricing is quote-based.

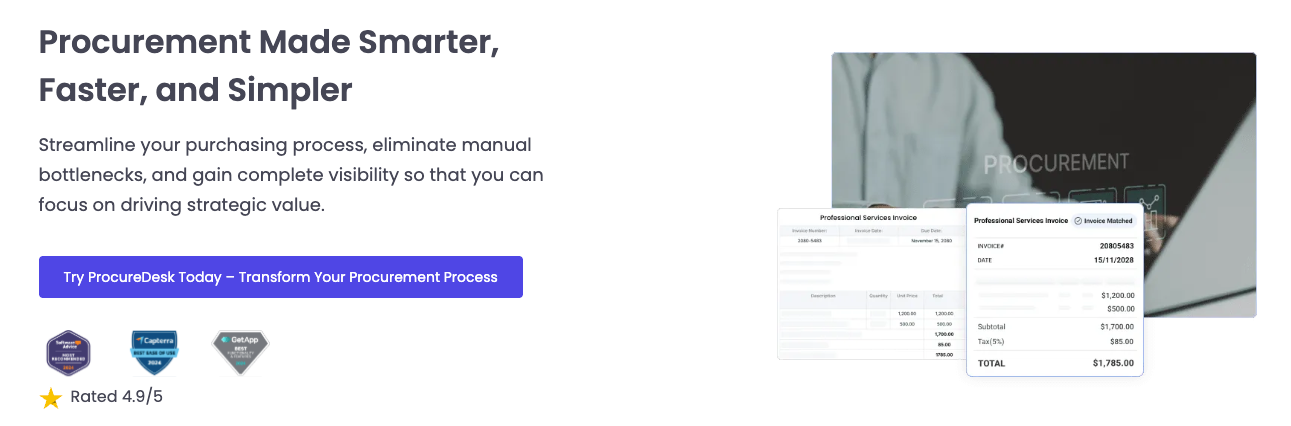

7. ProcureDesk

ProcureDesk streamlines procurement whilst keeping finance in control. From purchase requests to approvals and vendor management, the platform provides real-time visibility into spend and supplier performance.

For your FP&A team, this means more accurate forecasts, tighter budget compliance and a clearer link between operational purchases and overall financial strategy.

Pros and key functionalities:

- Centralised procurement insights: Track requests, approvals and supplier spend in one platform for complete transparency.

- Impact analysis on budgets: Model how procurement decisions affect cast flow and financial performance.

- Seamless financial integration: Feed real-time procurement data into forecasting and reporting processes.

Reasons to choose ProcureDesk:

- Seamless integrations and automation

- Intuitive and easy to use

- Reliable customer support and smooth approvals

Source: G2

Pricing: ProcureDesk offers monthly and annual billing, with prices starting at $498 per month for 10 users (billed annually).

What to look for in an FP&A solution

Choosing the right FP&A software can make a huge difference to how efficiently your finance team plans, forecasts and manages company resources.

Whilst every business has different needs, there are some key features that can take your FP&A process from reactive to strategic. Here’s what to prioritise:

- Real-time spend visibility: Look for tools that show you exactly where your money is going and track everything from subscriptions to team expenses – this’ll give your finance team the clarity they need.

- Automated approvals and workflows: Manual approvals slow down decision-making. Cut down delays and errors with smart, automated expense approvals that enforce policies on the spot.

- Seamless integrations: Look for solutions that connect your accounting, ERP and payroll systems to keep forecasts accurate and data flowing.

- Actionable insights: Choose a tool that goes beyond tracking and categorises, analyses and uses spend data to optimise budgets and make smarter decisions.

- Ease of use and accessibility: A user-friendly interface and mobile access mean teams can capture expenses, approve workflows and review reports anywhere, and that helps finance stay agile and responsive.

- Good value for money: Choose a tool that saves time, reduces waste – and scales with your business.

By prioritising these features, you can choose an FP&A solution that not only simplifies day-to-day processes but also turns financial data into a powerful tool for strategic decision-making.

Final thoughts

Choosing the right FP&A software can be a game-changer for your business. It doesn’t just simplify financial planning: it empowers teams to analyse trends, optimise spending and make data-driven decisions that support long-term growth.

Whether you need robust forecasting tools, spend management platforms, workforce planning solutions or procurement systems, the right toolkit can transform FP&A from a reactive reporting exercise into a strategic advantage.

With the right combination of visibility, automation and actionable insights, your finance team can move faster, plan smarter and stay ahead in an increasingly dynamic business landscape.