Pleo Hero: Christoph Martin, PensionBee

Fresh insights from 2,650 finance decision-makers across Europe

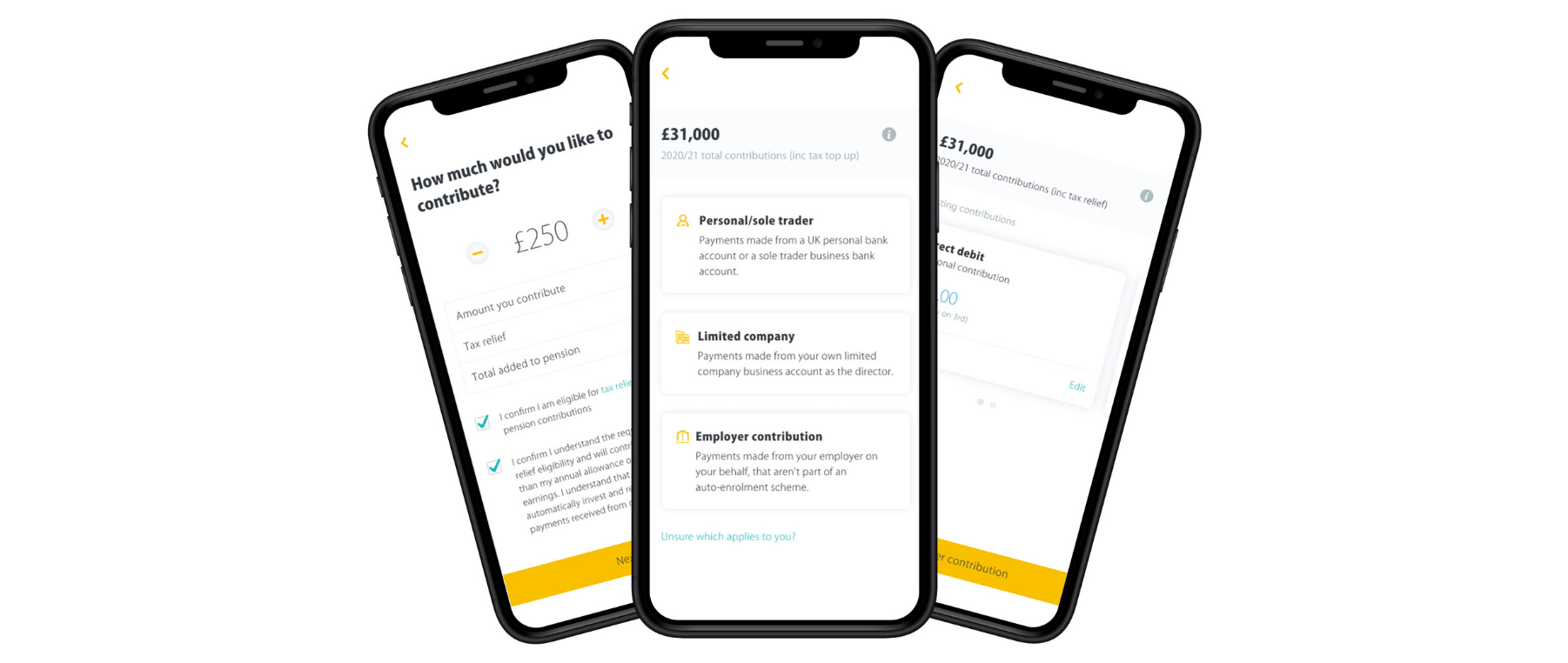

The traditional way of managing your pension is complicated — which often puts people off from even starting one. A recent study found that at least 17% of people aged 55 and over admit to having no pension savings. Also, one in five people simply don’t know how much they have in their retirement savings after switching jobs, or they forget about them entirely.

Tracking down these old pensions and consolidating them into one pot will save your future self a lot of hassle, and money. One company doing exactly that is PensionBee , an online pension management service that combines and transfers your old pensions into a brand new online plan.

We spoke to CFO, Christoph Martin, about how the PensionBee team uses Pleo – and how it’s changed the way he does his job.

What’s the journey that brought you to PensionBee?

I’ve worked in finance for many years, previously in corporate banking — that’s how I met PensionBee’s CEO, Romina Savova. She then built this company [PensionBee], and after a few years into its first investment round, we stayed in touch and she was looking for someone to take care of the finance department.

I found PensionBee really interesting from the beginning, I was really intrigued by what she was trying to accomplish and the problem she was solving. I’ve always appreciated entrepreneurs who are solving a very tricky problem. And the pension market problem in the UK is a real one, so it was very clear to me that I should join the team.

Can you tell us a little more about the work PensionBee does?

We’re an online, additional pension provider which allows people in the UK to manage their finances all in one place. This all starts with consolidating people's existing pensions that have been scattered around all over the place from previous jobs over the years.

Our users can set saving goals, such as the amount of money they’d like saved for when they retire. We’ll also help people plan ahead so they can achieve their goals at retirement — basically making it all as frictionless as possible so you don’t have to worry about life after work.

What kind of role has Pleo played at PensionBee?

Pleo has been extremely helpful when it comes to managing our expenses. Before Pleo, we had the nightmare of trying to manage manual expenses, deal with the mountains of receipts and track down the company card. It took a lot of time just to get on top of things since there’s so much admin around expenses — it was a total nightmare.

A lot of time was also spent chasing people if we hadn’t received receipts too. For everyone involved in the expenses process at PensionBee, Pleo has been a huge help.

And how does your team use Pleo?

We use Pleo for all kinds of things at PensionBee. Our team finds it especially helpful for smaller purchases such as office equipment, meetings, stationary and even birthday cakes and gifts for colleagues.

And how has Pleo made your job as CFO easier?

Well, for me it’s all of the admin side. What I’ve really liked about the product is having the full overview of people’s expenses. Previously, getting a hold of all this information was really time-consuming and involved a lot of back-and-forth.

Pleo has also made managing expenses so simple by just having everything like receipts centralised in one place — it completely solved our problem. It also helped me get a clearer overview of how much money people were spending in the company, and what they were purchasing.

Like PensionBee, Pleo’s customers have saved a whole heap of time when it comes to dealing with business expenses. In fact, our recent survey found that Pleo admins save a total of 11.5 hours per month — that’s pretty much a day-and-a-half, handed back to you.

So, why not join over 13,000 companies that chose automation over tedious paperwork when it comes to handling expenses?