How Pleo gives enterprise companies spending visibility

Don’t miss an article.

Whatever the business, big or small, there are expenses.

There’s no denying, workflows are harder to manage for growing teams. And for even larger companies, dealing with things like spending is on a whole other level.

Despite this, for most large companies employees are still paying out-of-pocket, finance teams are still chasing departments for crinkled receipts and their time is still being wasted on tedious admin work.

The answer to reducing admin work all while staying in control of company spend? That’s easy — Pleo.

How does Pleo work for bigger businesses?

We issue smart company cards to companies, with the CFO or finance team deciding who gets a card on the team, and what the individual spending limits should be.

Once a card has been used, be that virtual or physical, your team member who made the purchase is prompted to snap a picture of the receipt. Then, your team leads or finance department — whoever you decide — will receive a notification in real-time outlining the cost. Easy!

By digitising and centralising your business spending, you can wave goodbye to paperwork, tedious data-entry and out-of-pocket spending — all while staying in control and knowing exactly where company money is going.

Our insight and analytics means you can track data to give you a better idea of future spending forecasts for weeks, and even months ahead. And maybe most importantly, you can spot opportunities to save money.

You’re supported all the way

We get it. Introducing a new tool is daunting, especially if you have 20 new starters every month, countless other tools to manage and hundreds of tasks demanding your attention.

That’s why we’re here to help, every step of the way.

From thorough product demos with our sales team to onboarding calls with our customer success team to implementation guidance to getting your accountants up and running — it doesn’t take long to become a Pleo expert.

Once our team has helped you set up, it’s time to flesh out your expense policy — arguably one of the most important documents every business should have. To get you started, we’ve created a free Expense Policy Builder that’ll help you quickly draw up spending guidelines tailored to your business.

With both Pleo and a thorough expense policy for your team, you’ve got the foundations of a good spending culture.

Save time and money

Whether you’re a company experiencing rocket ship growth or managing a team of 50 people, every second counts. So why would you waste that precious time with exhausting expense procedures? Especially when it takes 20 minutes on average to complete just one manual expense report …

Pleo accelerates the whole process. Our software captures and categorises a purchase as soon as it’s made, saving you a whole bunch of time.

But how much time exactly? We found that Pleo admins save 11.5 hours on average doing expenses per month — that’s a whole day-and-a-half freed up to focus on the important things at work.

And it’s not just time you're saving, it’s money too. Did you know that a company of 100 people can spend £3,471 a month manually filing expense reports? That’s more than £40,000 a year .

The numbers don’t lie. Find out how much Pleo can save you using our ROI calculator .

Keeping your company’s money safe

Signing up to a new tool for a big company is serious business — so we've built a security infrastructure you can really trust with your money. It’s probably why 99% of our users feel safe paying with Pleo .

We partner with top-tier institutions like JP Morgan, Danske Bank and Mastercard who continually ensure we live up to the high standards we set ourselves with regular checks.

Not only does Pleo provide a layer of visibility like no other, but if a purchase doesn’t look right, we help you handle it. Maybe it was an out-of-hours purchase or something overly expensive? No worries — you can freeze a card at the tap of a button and our proactive customer service is always on hand to help.

And for an extra layer of protection, Pleo Assurance means managers are alerted if an expense exceeds a certain amount – letting them decide if it’s okay or not. This way, we’ve got you covered, all while keeping you in control.

Manage out-of-pocket spending and reimbursements

Business spending comes in all different shapes and sizes, and sometimes a company card doesn’t quite cut it. You know, things like mileage costs. Taking account of work cards used for personal purchases. Reimbursing employees who had to dip into their own pockets.

In fact, we found that 92% of company employees are still paying for business expenses with personal money, and in 69% of companies this happens frequently.

And that’s exactly why we built Pocket , a centralised place to keep track of the money owed between your team and the company.

Let’s say Lisa from your sales team paid out-of-pocket for a client lunch. Not only is she left waiting weeks just to get that £30 back, but your finance team also has to deal with the implications this has on payroll…

With Pocket, Lisa can add the lunch cost to her Pocket expenses along with her receipt and be reimbursed as soon as an admin approves the cost. Maybe Lisa frequently files expenses? If that's the case, you can allow Lisa to automatically reimburse herself, so there's no need for an approval workflow.

Want some extra reassurance? You can set up approvals on Pocket expenses, so you’re always in control.

Get in control of your subscription spend

Businesses today are relying on subscriptions more than ever. In fact, our recent study found that for 65% of the companies we spoke to, subscriptions account for at least a third of company spend.

As your teams rely on more and more subscriptions, the risk of duplicate signups is almost impossible to prevent, unless you use Pleo...

Sreya Chatterjee from Dublin-based software company TerminusDB is clear on the benefits Pleo offers her team — and it all starts with recurring subscriptions .

“It’s great for our team to have the freedom to sign up to the tools they need – but you do need to keep track of what you subscribe to,” Chatterjee says. “Things like whether you’re signing up for two similar tools that solve the same problem, and you need to choose one over the other.”

With real-time monitoring, you’re not only saving money on used subscriptions, but your finance team can confidently forecast spend and make strategic decisions on where money is best being spent .

Smarter ways to pay, wherever you are

Chances are, your team is scattered all around the country — maybe you’ve got a few offices, regular freelancers or remote workers. Whether they’re working in sales or customer service, they’ve probably all got expenses.

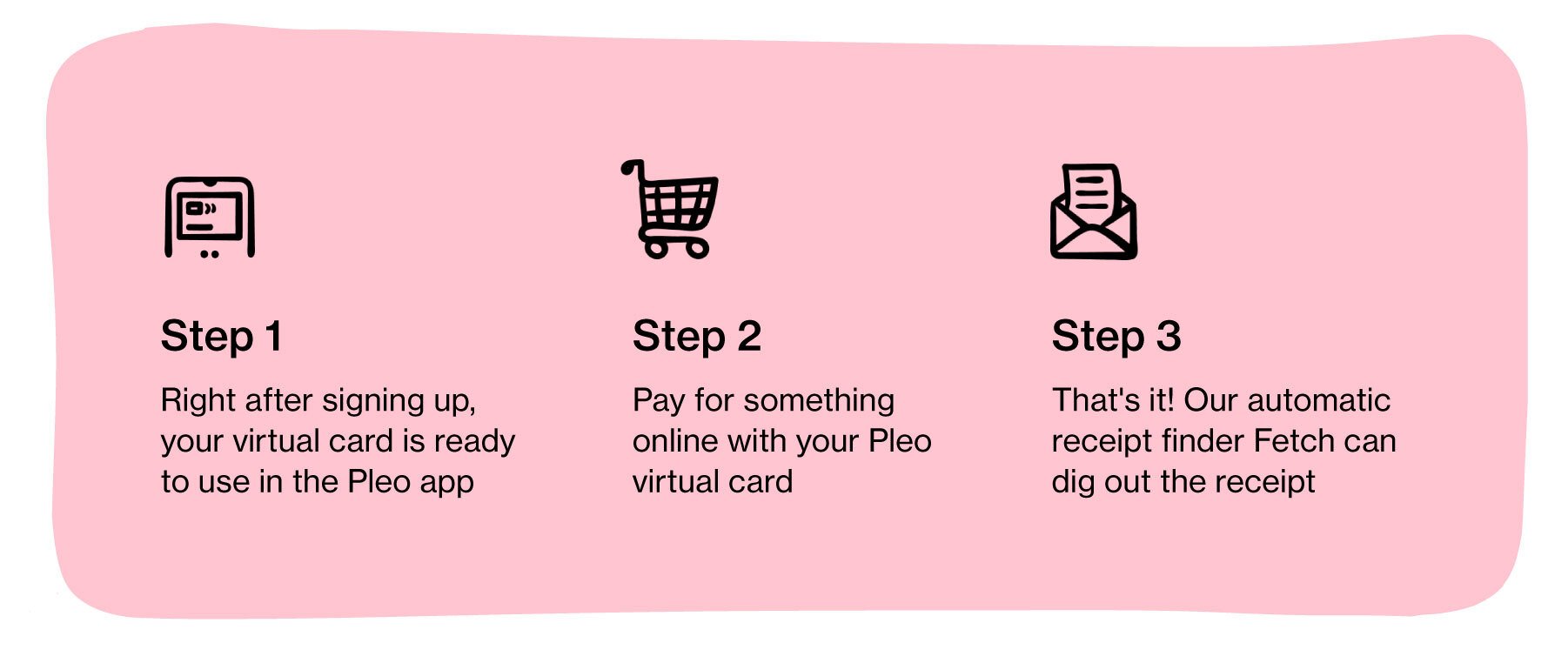

We think buying stuff for work should be easy. That’s why we don’t just provide plastic cards — we’re fully compatible with Apple and Google Pay, and we even issue virtual cards .

These handy cards are available to use right after signing up. Meaning your team can get a better handle on spending from day one, whether that’s for online purchases or recurring online subscriptions.

And virtual cards aren’t just efficient either, they provide an extra layer of security when buying things online and can be frozen at any time, meaning you’re reducing the risk of fraud.

Regardless of the company size, getting a good handle on spending is one of the most important aspects of running a business. Our spending solution has the power to revolutionize a lot of your spending processes — from invoices to online purchases — all while keeping you in control.

Smarter spending for your business

Save time on tedious admin and make smarter business decisions for the future. Join Pleo today.

Powered in the UK by B4B partnership