Mastering Spend Management: What is a virtual card?

Fresh insights from 2,650 finance decision-makers across Europe

Buying stuff for work should be easy. That’s why we don’t just provide plastic cards, we also issue virtual cards.

These handy cards can do almost just as much as a physical card, but the difference is that they’re accessible electronically in your digital wallet.

When you need to use your virtual card, which can be accessed in Apple Pay and Google Pay, you just log in on your desktop or using the Pleo app. Tap ‘Cards’ and once you enter the passcode, you’ll see the details you need.

How do companies benefit from virtual cards?

Well, there are many reasons: flexibility, extra security when shopping online, and increased convenience when you don't have access to your cards. We found that in our 2020 Annual Report , virtual card usage grew 61% year-on-year as online purchasing soared.

In this blog post, we’ll go through all there is to know about virtual cards, who they’re ideal for and how they help companies handle their spending better.

Let’s start with the basics...

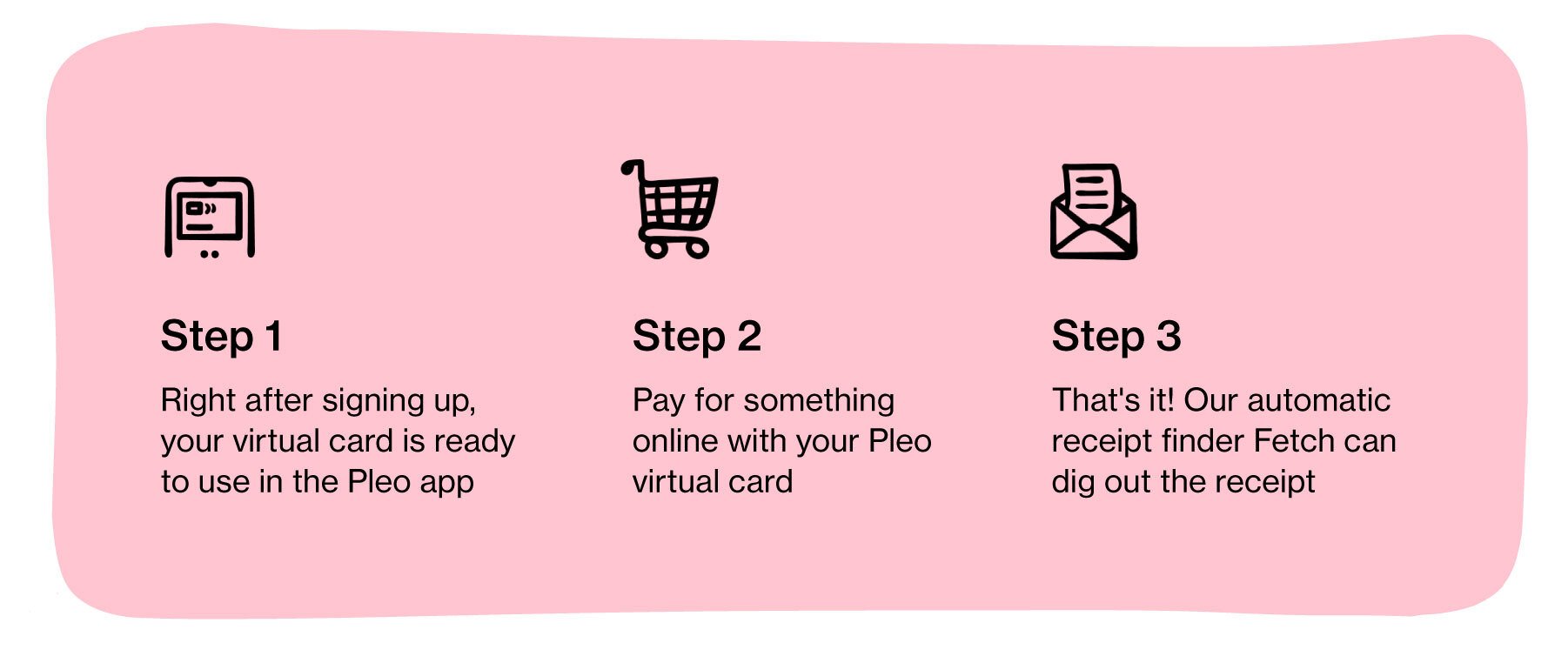

The Pleo virtual card is a Mastercard and is available to use right after signing up, so there’s no waiting around to start buying things. Admins simply give us the details of everyone in their company who needs a virtual card and we’ll send the sign-up details to their team members.

They’re a great spending solution to finally getting on top of all your — and your team’s — online and in-app purchases and recurring online subscriptions.

While these virtual cards only exist online, they carry the same standard information and card details as any other card: 16-digit card number, expiration date and CVV code.

Every time a virtual, or physical, card is used for an online purchase, our tool, Fetch — once you’ve activated it — will automatically dig out the email receipt so you’re always on top of your finances.

Who’s a virtual card good for?

Unlike plastic cards, it’s pretty hard to lose your virtual card. Even if you lose your phone, you just need to know your credentials to log into another device. Better still, no one else will be able to access your card without the password, biometrics, or two factor authentication.

Unlike plastic cards, it’s pretty hard to lose your virtual card. Even if you lose your phone, you just need to know your credentials to log into another device. Better still, no one else will be able to access your card without the password, biometrics, or two factor authentication.

Freelancers and contractors

And they’re not just a back-up card, they’re a great spending solution for your freelancers and contractors who don’t necessarily need a plastic card, and aren’t part of your full-time team.

The trust of issuing a virtual card goes both ways — your freelancers won’t be paying out-of-pocket, while you stay in control with spending limits and a real-time overview.

Once your freelancer's contract is up, you can easily freeze or delete the card, knowing all the expenses have been filed away and synced with your accounting software .

Larger teams

For companies that want their whole team to manage spending with Pleo, but don’t want to order a Pleo card for everyone, virtual cards are a quick solution. Right after signing up, these cards can be used, so there’s no waiting around for your plastic cards to arrive.

For larger teams, it’s unlikely that everyone will be traveling and meeting clients, which is when a plastic card is needed. For the majority, most of their work expenses will likely occur online — from software to subscriptions to office equipment.

One-off purchases

Maybe your team doesn't have regular expenses, they might need just a one time use. But every now and then, they might find themselves having to expense something for work online — maybe that’s a new laptop or a ticket for an event.

Your employees shouldn’t be paying out-of-pocket. As an admin, you can invite new users to your Pleo account and get them set up with a virtual card in seconds. Then when the purchase is made, you can freeze the card again.

Project purchases

Most projects differ in cost. Maybe you need a larger team or maybe you’re relying on more software — it’s hard to forecast spend.

With Pleo’s virtual cards, all expenses are tracked in real-time, so you can see exactly where your money is going. Having a centralised overview means every purchase is accounted for, giving you a better idea of what a similar project in the future could cost and making it easier to create a cash flow forecast .

Staying even more secure online

Virtual cards aren’t just convenient, they provide an extra layer of reassurance when buying things online.

According to UK Finance , in 2019 fraud losses on UK-issued cards totalled £620.6 million, with £470.2 million of this being down to “card not present” transactions — these payments are typically made online or over the phone.

When you bear that in mind, sharing bank details via email, text message or paper airplane probably doesn’t feel quite such a good idea. And with new Europe-wide guidelines on card payments on the way , the days of one card being passed around are numbered anyway.

Our 2020 Annual Report found that virtual cards are becoming an even bigger part of the Pleo experience — software was purchased using a virtual card 72% of the time.

Isobel Edmonds from music events startup company, Sofar Sounds is clear on the benefits that Pleo's virtual cards have to offer.

“When we get back to putting on shows in-person, it's actually the virtual cards that tend to be one of the handiest things for us,” Edmonds said. “If somebody needs to buy something, I can just issue them a virtual card on-the-spot so there's no delay.”

The CFO's playbook for 2024

Discover the state of spending in an increasingly automated and digitised financial world

Powered in the UK by B4B partnership