How the EU’s new PSD2 directive makes your Pleo payments even more secure

Fresh insights from 2,650 finance decision-makers across Europe

We got some good news in a recent survey of 300+ Pleo admins: 99% of our users feel that paying with Pleo is safe .

We’re on a mission to convince that 1% just how safe Pleo is. And today we’re bringing them (and you) some great news.

Thanks to new European regulations on payments – called Payment Services Directive 2 or PSD2 – Pleo is becoming even safer.

What PSD2 means

The purpose of the directive is to increase the protection of consumers when it comes to payments.

European lawmakers are keen to reduce the risk of fraud when it comes to electronic transactions, as well as bolstering protection for customers’ data. We’re right there with them on these points.

We’re bringing in these measures to benefit all Pleo customers – so even though it’s an EU directive, UK customers will see the same changes too.

What PSD2 changes for you

The main change for Pleo users from PSD2? Simple – how you log in and authenticate some transactions.

Strong Customer Authentication is going to become mandatory for all e-commerce throughout Europe. Card sharing is already something that carried a lot of risk for businesses.

Now, the new rules mean it's going to be all-but-impossible to share cards and buy things online.

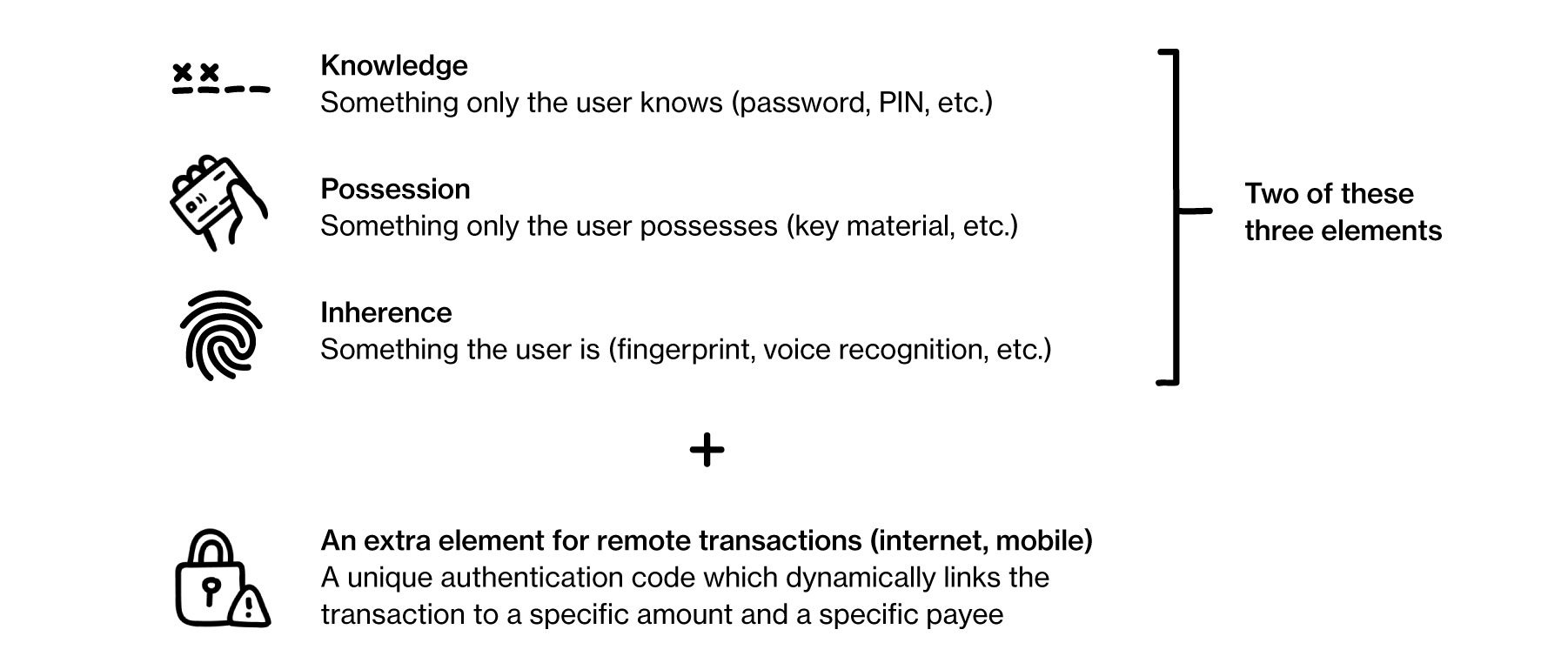

You will now have to authenticate using at least two of the three elements below and, for online card transactions, a dynamic linking process that uniquely binds the authentication to the specific amount and payee, as required by PSD2.

The process above might feel a little familiar. That makes sense – we actually implemented a solution back in July 2019 to establish a new standard in payment security.

But our top priority is always keeping your money safe. So we decided to slightly change our login flow to take account of PSD2.

Pleo: Less passwords, more security

Passwords are a way for you to prove that you have access to an account. They’re also, every so often, an absolute disaster.

We think we can design it better, so you don’t have to remember the name of your first dog, followed by the last four digits of your partner’s birthday. Instead we use magic. Or rather, we use a magic code.

How does it work?

When you sign in to Pleo for the first time on a device, you will be asked to fill a 6-digit code that we’ll send to the phone attached to your account with us.

Enter that code and... that’s it. You are now logged in on a trusted device.

After that, you will be asked to provide your passcode or biometric information in order to make high security actions in Pleo. This could be checking the details of your Pleo card or paying for something online.

What happens next?

At the next app update, you may be required to follow the revised log-in process reflecting current EU payment authentication standards.

With the ongoing update of EU payment regulations and the continued enforcement of PSD2 (now supplemented by new rules), this is the perfect chance to get a spending solution set up for your company.

Something that keeps your money safe – and make sure your team can buy what they need to do great work.