Stay ahead of the curve: Master e-Invoicing Across Europe with Pleo

Fresh insights from 2,650 finance decision-makers across Europe

E-invoicing is changing the game for how businesses handle accounts payable (AP) across Europe. With governments making it a must for B2B transactions, compliance isn’t just a choice anymore. No matter your business size, switching to e-invoicing is key to keeping things smooth, accurate, and ready to scale.

As Europe moves toward e-invoicing mandates, Pleo’s here to help your business not just stay compliant but actually get ahead. This guide breaks down the basics of e-invoicing, what the rules look like across Europe, and how Pleo’s tools can simplify your AP processes while keeping you on the right side of regulations.

What is e-Invoicing?

E-invoicing is all about sending invoices in a structured, machine-readable format like XML. Unlike old-school PDFs or paper invoices, e-invoices sync effortlessly with accounting systems, making automation easier, boosting accuracy, and keeping you compliant.

How e-Invoicing Helps Your AP Team

- Stay compliant: Keep up with country-specific rules and avoid fines

- Fewer errors: Automated, structured data means less room for mistakes

- Work faster: Speed up invoice processing and payments with smoother workflows

- Better visibility: Track invoices in real-time to improve cash flow and strengthen partnerships

B2B e-Invoicing mandates across Europe

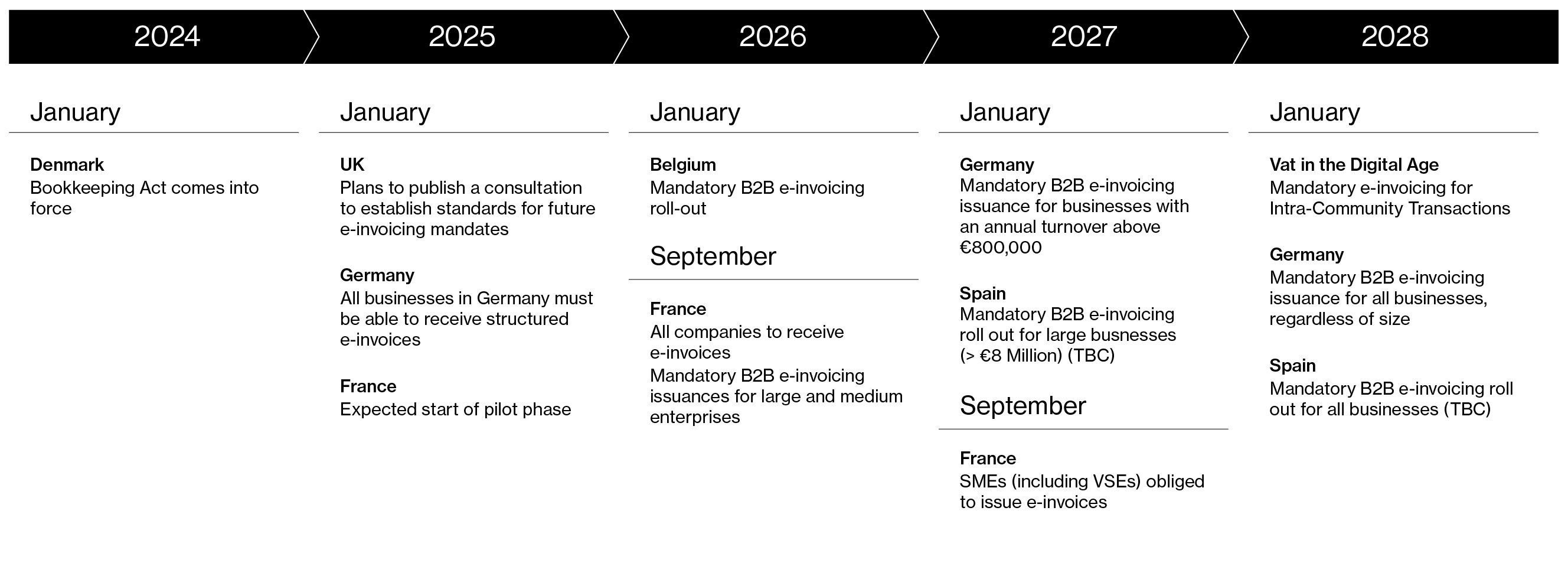

E-invoicing rules are spreading across Europe, with each country setting its own requirements. Here are the latest updates from major markets:

1. United Kingdom: Preparing for the Future

Mandates: While no B2B e-invoicing requirement exists yet, the UK government plans to publish a consultation in early 2025 to establish standards for future e-invoicing mandates.

2. Belgium: Moving toward e-Invoicing compliance

Mandates: Belgium will implement mandatory B2B e-invoicing starting January 1, 2026, as part of its commitment to ViDA. Also, invoices must comply with the PEPPOL-BIS standard or meet the EN16931 European format requirements, ensuring compatibility across platforms.

3. Germany: XML formats with ZUGFeRD

Mandates: Germany will roll out mandatory e-invoicing for B2B transactions starting January 1, 2025, as part of the EU’s VAT in the Digital Age (ViDA) initiative. Also, ZUGFeRD, a hybrid XML/PDF format, is widely adopted for B2B invoicing.

4. France: Factur-X for compliance

Mandates: B2B e-invoicing becomes mandatory in France starting September 1, 2026, for large enterprises, with SMEs and microenterprises required to comply by September 1, 2027. Also, the Factur-X format, combining XML and PDF, is the standard for compliance.

4. Spain: Facturae for digital invoicing

Mandates: Spain's mandatory B2B e-invoicing has been postponed to 2027, due to delays in finalising technical specifications. The Facturae XML format remains the standard for compliance.

5. Denmark: Emphasising digital standards

Mandates: Denmark’s Bookkeeping Act, enforced since January 2024, mandates digital bookkeeping systems registered with the Danish Business Authority. The OIOUBL format remains the standard for e-invoicing.

Since January 1st 2025, companies must now use digital bookkeeping systems capable of receiving and storing electronic invoices, as well as supporting the exchange of bookkeeping data via the SAF-T standard file. Medium and large companies using custom accounting software must also comply.

How Pleo supports e-invoicing

Seamless e-invoice uploads:

Pleo makes it easy to upload e-invoices, either through the web portal or by using the Invoices mailbox feature.

E-invoices usually come in a structured format like XRechnung in Germany. To make things even easier, Pleo automatically generates a PDF preview next to your XML files, so you can quickly review them.

Automated invoice processing:

One of the main perks of e-invoices is their machine-readable format, which lets Pleo pull invoice details with perfect accuracy. This cuts down on errors, gets rid of manual data entry, and speeds up processing, making sure invoices are captured and sorted correctly in your financial system.

Exports made simple:

Pleo exports the rendered PDF of the e-invoice, ensuring compatibility with your accounting workflows. This applies whether you’re exporting to an accounting system or using the standard export functionality.

You can also view the rendered PDF for each expense on the export page, just like any other invoice.

Unlocking the full potential of e-invoicing

Compliance is just the beginning, Pleo unlocks the full potential of e-invoicing by delivering end-to-end AP automation. Save time, reduce errors, and adapt effortlessly to changing regulations.

Support for structured and hybrid formats: Support for structured (XRechnung, UBL) and hybrid (ZUGFeRD) formats.

Boost AP efficiency: Minimise data errors with structured e-invoicing formats, reduce manual intervention through automation and streamline your AP workflows for greater productivity and accuracy.

Stay ahead of compliance standards: Stay up-to-date with evolving regulations across all key European markets, ensuring your business can adapt without operational disruptions.

Future-proof your invoicing process

As B2B e-invoicing becomes a must across Europe, businesses need a solid, scalable solution to stay compliant and efficient.

With Pleo’s support for XML formats, you can easily handle the complexities of e-invoicing rules while boosting your AP efficiency. Whether it’s XRechnung in Germany, Factur-X in France, or Facturae in Spain, Pleo helps keep your AP running smoothly.

Ready to make e-invoicing simpler? Get in touch today to see how Pleo can streamline your accounts payable workflows.