Netflix’s expense policy isn’t what you expect, but it works

Fresh insights from 2,650 finance decision-makers across Europe

Netflix’s expense policy is summed up in just five words:

‘Act in Netflix’s best interest’.

Fifteen years ago, the entertainment giant released a presentation on how they run their company: who they hire, who they fire and how they create their culture. ‘Netflix Culture: Freedom & Responsibility’ has been praised by many, although at the time it was seen by some as controversial.

CEO Reed Hastings and former Chief Talent Officer Patty McCord say the outcome of their approach has increased talent density and pushed productivity to new heights.

The numbers don’t lie. Since the 2009 presentation, the company has grown from 12m monthly subscribers to over 300 million customers worldwide. It’s one of the fastest-growing and most innovative companies in the world, employing 13,000 people…

… and it still doesn’t have an expense policy in place.

|

Key takeaways:

|

The Netflix way: ‘Treat people like adults’

In small or family businesses, trust comes naturally, but things change when companies start to scale. A growing number of policies and procedures are put in place, often in a very ad hoc way. While most organisations find this inevitable and welcome it, Netflix approached things a bit differently.

As Reed Hastings puts it, these processes emerge to stop the overwhelming chaos. ‘Time to grow up’ becomes a management mantra as they try to justify the new rules and regulations. As a result, policies pop up in different areas, including how much money employees are allowed to spend on business expenses.

But this is where another, often overlooked, problem actually occurs.

The side effects of over-policing employees

As companies get bigger, the growing number of procedures, rules and policies mean a reduction in employee freedom. Netflix realised a different type of chaos ensues as a result: the increased complexity significantly reduces the productivity of high-performing employees, who become unhappy and look elsewhere.

Research published in the Harvard Business Review shows that on average, a company loses more than 25% of its productive power to productivity drag.

Productivity drag is the bureaucratic processes that waste time and prevent people from getting things done, like expense reporting. And guess who really doesn’t like tedious, time-consuming processes? Millennials. They don’t want to be micromanaged and say that autonomy is the most valuable company perk – sometimes even more important than the size of their salary. No, really.

Netflix is not alone in realising the pain that drag can cause. Companies in the technology sector, whether smaller start-ups or huge corporations, often trust that the people they hire will end up doing the right thing, so policies are not just a drag, but quickly become obsolete. And according to research from consulting firm Bain & Company, employees in companies like Netflix and Google are on average 40% more productive as a result.

What does a ‘no limits’ expense policy actually mean?

In Netflix’s case, it’s quite simple.

Their five-word policy actually means employees are instructed to ‘expense only what you would otherwise not spend, and is worthwhile for work’. They don’t have any limits, rules, reporting or tracking set in place, as they have proven to be a waste of time.

‘We assume you are not here to rip off the company, and we’re not going to put in place processes that consume human capital, waste time, and zap energy.’

– Patty McCord, former Chief Talent Officer at Netflix

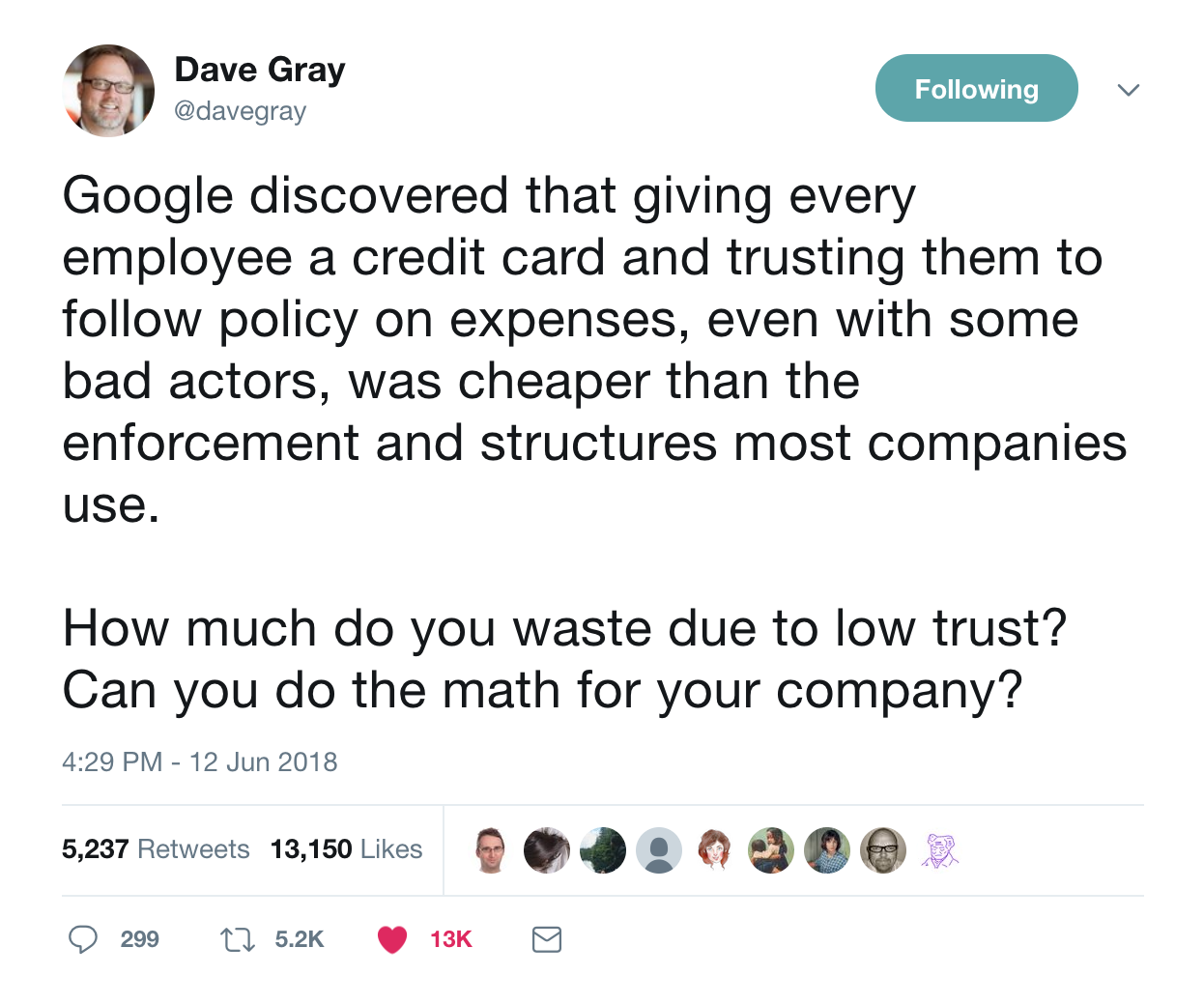

On the other hand, Google does things a bit differently:

Most companies today have corporate cards reserved only for senior management. At Pleo, we've seen many of our customers give cards to all their employees, rather than just a few, as it eliminates the need for those ad-hoc, out-of-pocket expenses.

This doesn’t just symbolise the amount of freedom and trust given to workers: it’s also a rational business decision to automate their expenses. In our case, employees are allowed to spend what they need in order to get their job done well, but also to use the company funds to do so.

In most companies, the majority of employees have to follow a strict expense policy and pay out of their own pocket for a simple business purchase. This is where the ‘expense report’ comes in, as a detailed record and description of each company’s purchases, left for review by the finance team so that workers can later receive their money back.

It’s a huge disruption to the status quo.

This goes against everything the Netflix approach stands for. Unfortunately, this cumbersome bureaucratic process has become a norm for the majority of businesses nowadays. People have learned to hate it and the fact that it often leaves them seriously out of pocket is no doubt tied to that.

Although, the era of expense reports is coming to an end, so the overlooked costs for organisations will hopefully start to decline.

Tip: Try our ROI Calculator to see how much time and money you spend on expense reports.

Won’t employees just spend more money?

Give your employees more freedom with expenses and they’ll overspend, won’t they?

The answer from Netflix’s example seems to be: not really, no.

They realised that ‘97 percent of their employees will always do the right thing… the other 3% were wrong hires in the first place’.

Similarly, Basecamp (which gave their employees the freedom of a no-red-tape expense policy), had just one case that was worth digging into from their 100+ employees. And guess what? The employee involved in the one case stayed working there afterwards, according to their co-founder Jason Fried.

At Google, which employs more than 180,000 people worldwide, things are harder to dig into on a case-by-case basis. This is why they had to find a way to give employees trust and freedom, but at the same time let them know what is deemed acceptable by the company.

‘On a very fundamental level, people like being told what they can and can’t do. They want flexibility, choice and to be able to do what they want to do, but they also want to know what’s reasonable and what’s acceptable in this company.’

- Michael Tangney, Director, International Treasury at Google

At last, the tools are here to do expenses better

For the past few decades, the trade-off between the requirements of the finance team and what employees want has resulted in a bad compromise for both: an expense report.

This has combined manual reconciliation times, no real-time overview, expense fraud attempts and unhappy employees waiting to get reimbursed. All of this is a source of stress and time loss for the entire organisation. The most innovative companies in the world have found ways of making it easier for their employees by building cutting-edge tools to fit their needs and even help them attract new talent.

Thankfully, the fast developments in business and finance technology are moving things in the right direction for forward-thinking companies everywhere.

Expense and travel tools are becoming smarter by automating the necessary regulatory requirements, whilst simultaneously giving employees a much easier and a smarter way to just get things done.

Take Rocketrip. Inspired by Google’s internal travel system, it’s an enterprise platform that rewards employees with gift cards if they go under budget on travel. Finance managers can follow all travel bookings and can set policies, while employees can book by themselves and earn rewards to save company money.

Another example is Pleo

With Pleo, employees are trusted with smart company cards, while at the same time finance teams can set individual limits.

Spenders are reminded to snap a photo of their receipt and add project or customer tags if needed. Finance teams see everything in real-time, categorised and automatically synced with their accounting software. This means everyone is compliant, everything is tracked, but no one has to do an expense report.

It's the best of both worlds: a way to keep your staff agile and fast, while at the same time giving companies more control over all their spending to help them save time and money.

And with all the saved time, there must be a boxset you’ve been meaning to catch up on… or some more work to do.

Try automating your expenses with Pleo today.