VAT reverse charge: Everything you need to know

Fresh insights from 2,650 finance decision-makers across Europe

Not sure what VAT reverse charge is? Don’t worry – it’s a labyrinth, and there’s no shame in being a little confused.

This mechanism shifts the responsibility for reporting VAT from the supplier to the customer, changing how businesses handle invoices, payments and reporting. It doesn’t alter the total VAT owed, but it can affect cash flow and accounting processes – particularly in high-risk sectors like construction, electronics and energy.

Whether you’re a supplier or a buyer, knowing how the reverse charge works is essential to staying compliant, avoiding mistakes and keeping your VAT reporting smooth and accurate. This guide breaks down everything you need to know, from practical examples to invoicing tips and post-Brexit rules.

Key takeaways:

- Reverse charge shifts VAT responsibility. Instead of the supplier charging VAT, the customer reports it on their VAT return. No VAT changes hands, but it’s still properly accounted for.

- VAT reverse charge applies mainly to B2B transactions. Only certain high-risk goods and services are covered, such as construction services, mobile phones, wholesale energy and renewable energy certificates. End users and non-VAT-registered businesses are not affected.

- Post-Brexit, UK businesses are no longer subject to the EU intra-community reverse charge. Import VAT is now handled using postponed accounting, allowing businesses to manage VAT directly on their VAT returns rather than paying at the border.

- Proper invoicing and reporting are crucial. Suppliers must clearly mark invoices with a reverse charge reference, whilst customers need to record output and input VAT correctly.

What is VAT reverse charge?

In the UK tax system, the VAT reverse charge is a way of shifting the responsibility for reporting VAT shifts from the supplier to the customer receiving the goods or services.

Instead of the supplier charging and collecting VAT, the customer records both the output tax (as if they sold the goods or services) and the input tax (as if they bought them) on their VAT return. This means no VAT is actually exchanged, but it’s still reported to HMRC.

The reverse charge was introduced to combat VAT fraud – particularly in industries where businesses might charge VAT but fail to pay it to HMRC. It typically applies to specific high-risk sectors and transactions, such as construction services under the Domestic Reverse Charge, certain electronic goods, mobile phones and wholesale energy trades.

Example: How the VAT reverse charge works

Let’s say a business hires a painter for a B2B service valued at £2,000. Under standard VAT rules, the painter (the supplier) would charge VAT at 20% – £400 – and invoice the customer a total of £2,400. The painter would then collect that VAT and pay it to HMRC in their VAT return.

Under the reverse charge, the process changes. The painter issues an invoice without adding VAT but includes a note stating that the reverse charge applies and that the customer is responsible for accounting for VAT.

The customer then records both:

- Output VAT (£400), as if they were the supplier, and

- Input VAT (£400), as if they were the buyer.

This is known as the Domestic Reverse Charge, which applies to certain UK-based transactions (for example, construction services under the Construction Industry Scheme).

It differs from the international reverse charge, which applies to cross-border B2B transactions. Since Brexit, the rules for supplies between the UK and the EU have changed. We recommend checking the latest government guidance to understand how VAT should be reported on such transactions.

Who’s the VAT reverse charge for?

The VAT reverse charge is designed for businesses or sole traders who are already registered to pay for VAT and provide goods or services to other businesses.

The specified goods that the reverse charge applies to are:

- Mobile phones

- Computer chips

- Wholesale gas

- Wholesale electricity

The specified services that the reverse charge applies to are:

- Construction services

- Emission allowances

- Wholesale telecommunications

- Renewable energy certificates

Not sure if the VAT reverse charge is relevant for you? It’s useful to think of the difference between a customer in the supply chain and the final consumer.

When one business sells something to another business, that’s their customer, but it’s still not the intended consumer or end user of the product. The VAT reverse charge is only for B2B transactions – not to sales made to the end user.

When does the VAT reverse charge apply?

HMRC provides detailed guidance on which goods and services the VAT reverse charge applies to. In general, it’s used in specific high-risk sectors, such as construction services under the Construction Industry Scheme (CIS).

Below are examples of construction-related services where the domestic reverse charge typically applies:

- Decorating or painting the inside or the exterior surfaces of any building or structure

- Site clearance, excavation, tunnelling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping and the provision of roadways and other access works, earth-moving

- Constructing, repairing, altering, demolishing, extending or dismantling buildings or structures, including offshore installation services

- Reservoirs, pipelines, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- Installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure

- Internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, restoration painting, extension or restoration

When does the VAT reverse charge NOT apply?

The VAT reverse charge does not apply to:

- Businesses or sole traders that are not VAT-registered

- Any employees and temporary workers your business is responsible for paying

- Zero-rated VAT supplies

- Work done outside of the UK

- End users (businesses using the construction services themselves)

- Intermediary suppliers (VAT-registered businesses connected to the end user, selling on goods or services without modification)

(Example: A property developer hiring a painter for their own building project would be an end user, so the reverse charge wouldn’t apply.)

Exemptions and excluded services

Some construction-related activities are specifically excluded from the reverse charge. These include:

- Drilling for, or extracting, oil or natural gas

- Installing seating, blinds and shutters

- Installing security systems, including burglar alarms, closed circuit television and public address systems

- Making, installing and repairing artworks such as murals, sculptures and other artistic items

- Signwriting and erecting, installing and repairing advertisements and signboards

- Architectural or surveying work, or of building, engineering, interior or exterior decoration and landscape consultants

- Manufacturing components for lighting, air conditioning, ventilation, heating, power supply, drainage, sanitation, water supply or fire protection systems, or delivery of any of these to the site

- Manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to the site

- Extracting minerals and tunnelling, boring or construction of underground works for this purpose

For the full and most up-to-date list, check HMRC’s VAT domestic reverse charge guidance.

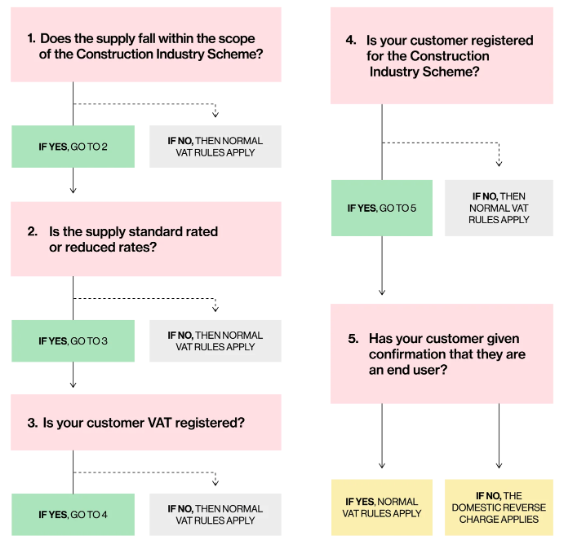

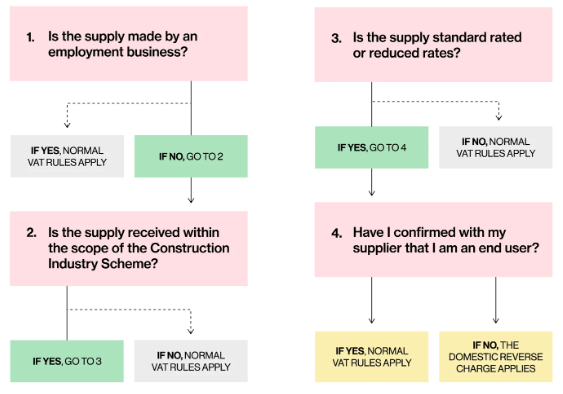

To make it a little easier to visualise – if you’re a supplier:

And if you’re a buyer:

How does the domestic reverse charge work for non-established suppliers?

A non-established supplier (or trader) is a business or individual that does not have a fixed place of business in a particular country.

Within the EU, each member state decides whether to apply the reverse charge mechanism to non-established suppliers under the EU VAT Directive.

Since the UK left the European Union at the end of December 2020, it’s no longer covered by the EU VAT Directive. Instead, UK VAT-registered businesses now use postponed VAT accounting to handle import VAT on goods brought into the UK from abroad.

This allows businesses to account for import VAT on their VAT return rather than paying it upfront at the border, improving cash flow and simplifying VAT reporting.

How do you calculate reverse charge VAT?

Standard reverse charge VAT is still 20% of the cost of the service or item you’re buying – unless you’re eligible for zero-rated VAT.

Your supplier should only invoice you for the service or item they provided, and then advise you this payment needs the reverse charge VAT applied.

All you need to do to calculate reverse charge VAT is divide the amount of the service or item by 100, and times it by 20. Easy as pie.

How does the reverse charge work on VAT returns?

For suppliers:

If you’re the supplier, you only need to report the net value of the sale (excluding VAT) in Box 6 of your VAT return. Do not include any output tax for that transaction – the customer is responsible for accounting for VAT under the reverse charge.

For customers:

If you’re a customer, you must:

- Record the output tax (as if you were the supplier) in Box 1 of your VAT return

- Record the input tax (as if you were the buyer) in Box 4, provided the purchase is eligible for VAT recovery

If you can reclaim the VAT in full, these entries will offset one another – meaning no net effect on the amount of VAT you owe or reclaim.

How to invoice under the reverse charge

If you’re a supplier issuing an invoice where the domestic reverse charge applies:

- Do not add VAT to the invoice total.

- Show the net amount for your goods or services.

- Include a clear note stating that the domestic reverse charge applies and the customer must account for the VAT.

- State the applicable VAT rate (e.g. 20%) or the amount of VAT due, even though you’re not charging it.

- Do not collect VAT from the customer.

Example note you can include on your invoice:

‘Reverse charge: Customer to account for VAT to HMRC under the VAT Act 1994 Section 55A.’

Other acceptable phrases include:

- ‘VAT Act 1994 Section 55A applies.’

- ‘S55A VATA 94 applies.’

- ‘Customer to pay the VAT to HMRC.’

You can find a full invoice example on HMRC’s VAT domestic reverse charge guidance page.

Does the intra-community VAT reverse charge apply?

The intra-community VAT reverse charge applies to B2B goods or services traded between EU member states. Under this system, VAT is generally accounted for in the country of arrival, using the reverse charge mechanism to simplify cross-border transactions.

Since the UK left the EU at the end of December 2020, it is no longer part of the intra-community system and is not subject to the EU VAT Directive.

UK VAT-registered businesses now account for import VAT using postponed accounting, which allows them to include import VAT on their VAT return rather than paying it upfront at the border.

What actions should my business take?

Your business needs to figure out whether it’s subject to the VAT reverse charge as a customer or a supplier, and what paying VAT in this way would do to your cash flow and procedures.

It's important to remember that the reverse charge does not change the amount of VAT owed – it simply alters how it’s accounted for. Depending on your situation, this may improve cash flow for some businesses and reduce it for others.

If you think you might be eligible for the reverse charge, we recommend consulting an accountant to make sure you get your accounts in order.

Keep track of your VAT with Pleo Accounts Payable

Managing VAT doesn’t have to be a headache. Pleo Accounts Payable lets your finance team streamline every step of the invoice workflow, making it easier to track, report and reconcile VAT accurately:

- From inbox to approval: OCR automatically extracts invoice details, including VAT, and routes them to the right project, team or cost centre for approval.

- Flexible approval workflows: Set rules by amount, team, vendor or project to ensure every payment gets proper oversight.

- Effortless vendor payments: Pay locally or globally, schedule individually or in bulk and manage cash flow with ease.

- Sync with your accounting system: Automatically export invoices, approvals and payments for accurate, real-time data – no manual uploads required.

With Pleo, your VAT reporting is simpler, faster and far less error-prone, freeing your team to focus on what matters most.

Pretty cool, right? We think so, too. Automate your AP process with Pleo today.