5 essential Pleo features we announced at our Beyond event

Don’t miss an article.

And that’s a wrap on the first stop of our Europe-wide tour! Yesterday, we were joined by hundreds of industry leaders in London to learn about the new way of finance. From inspiring talks about the future of AI to learnings from our customers on how they’re modernising their finance functions, it’s safe to say Beyond event #1 was jam-packed.

But let’s not forget the Pleo feature announcements we shared with attendees. We’re always working hard behind the scenes to build genuinely useful features, and we see these five as key to helping our customers optimise their spend management processes. So without further ado, here’s what’s brand-new at Pleo…

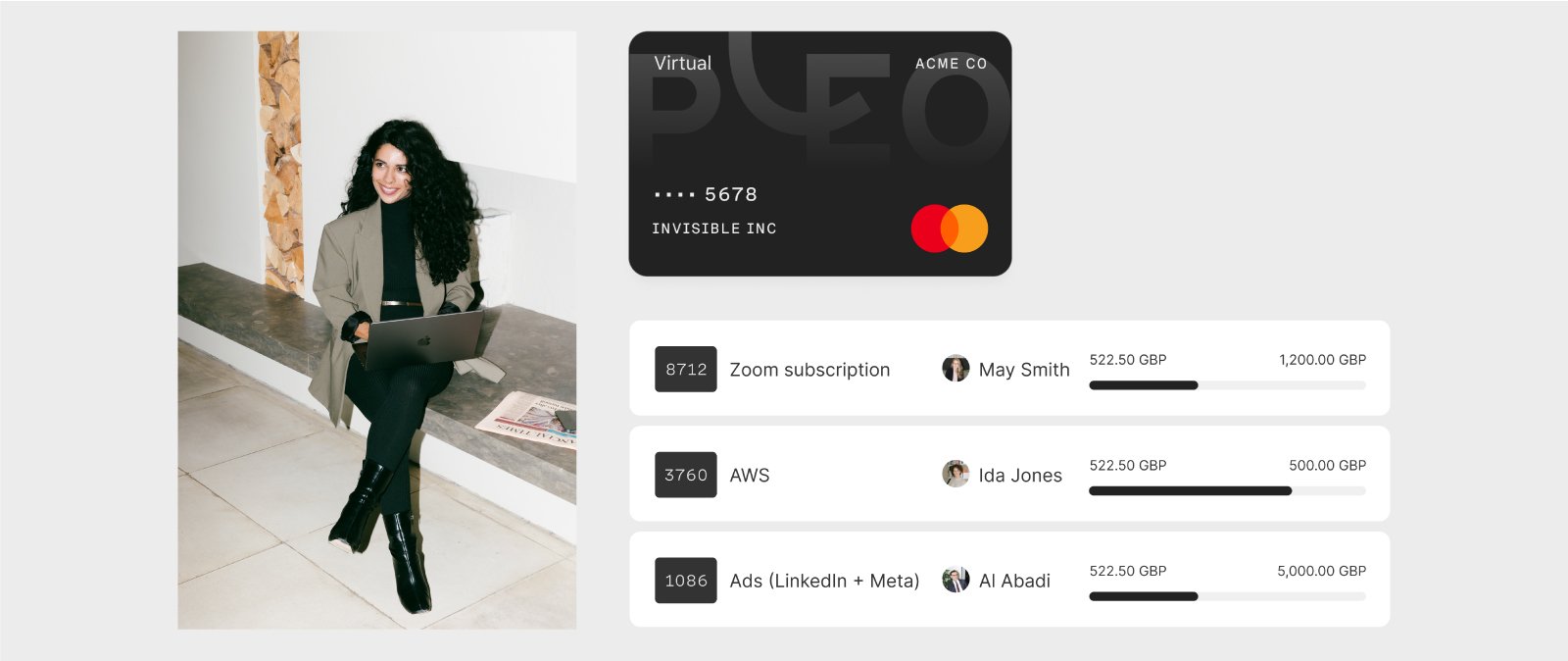

1. Vendor cards

Does your business have a Zoom licence or Slack subscription? Maybe you send emails through Hubspot or Salesforce? Our brand-new Vendor cards offer a simple way to manage your recurring payments and digital spending, clearly separating them from employee expenses. These are bound to be a dream for finance teams.

Let's say your colleague in marketing looks after LinkedIn paid ads. And someone in your IT department is responsible for paying for AWS. As an admin, you can now assign them each a virtual Vendor card exclusively for these payments. Automate the payment, set the right spending limit and make sure you never go over budget – just set and forget!

Want to get your business set up with Vendor cards? Check out our Help article to get started.

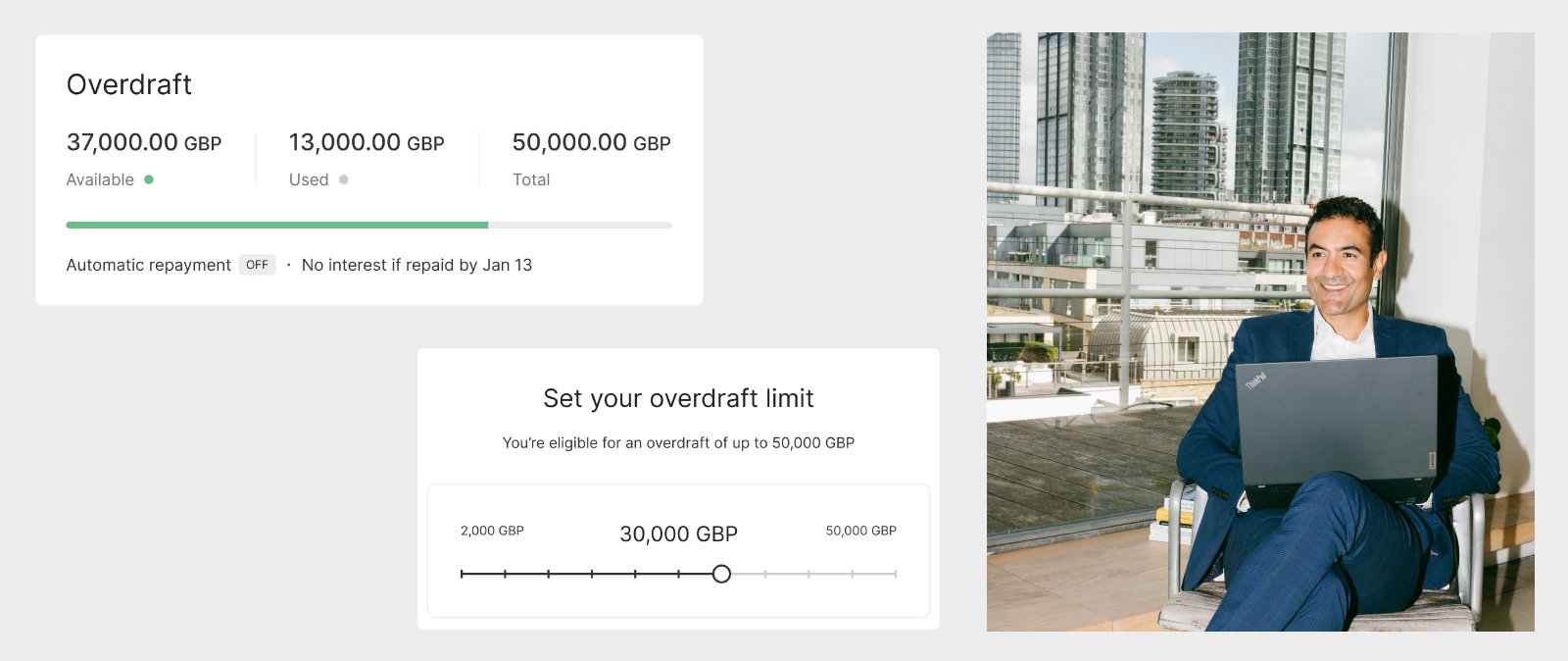

2. Pleo Overdraft

We’re very excited about this one. It’s no secret that managing cash flow for your business can be stressful. But there’s now an easier way. Keep essential outgoings running seamlessly and make sure your suppliers are paid on time with a Pleo Overdraft*. And the best bit? It’s completely interest-free when you repay on time.

Run all of your high-value transactions and recurring spend - from SaaS and marketing tools to office rent - through one platform, safe in the knowledge that we’ve got you covered if your balance runs low. With an Overdraft from Pleo, you can forget about a lack of funds leading to declined transactions which disrupt your day-to-day.

*Only available in certain markets. Eligibility approved on a per-customer basis.

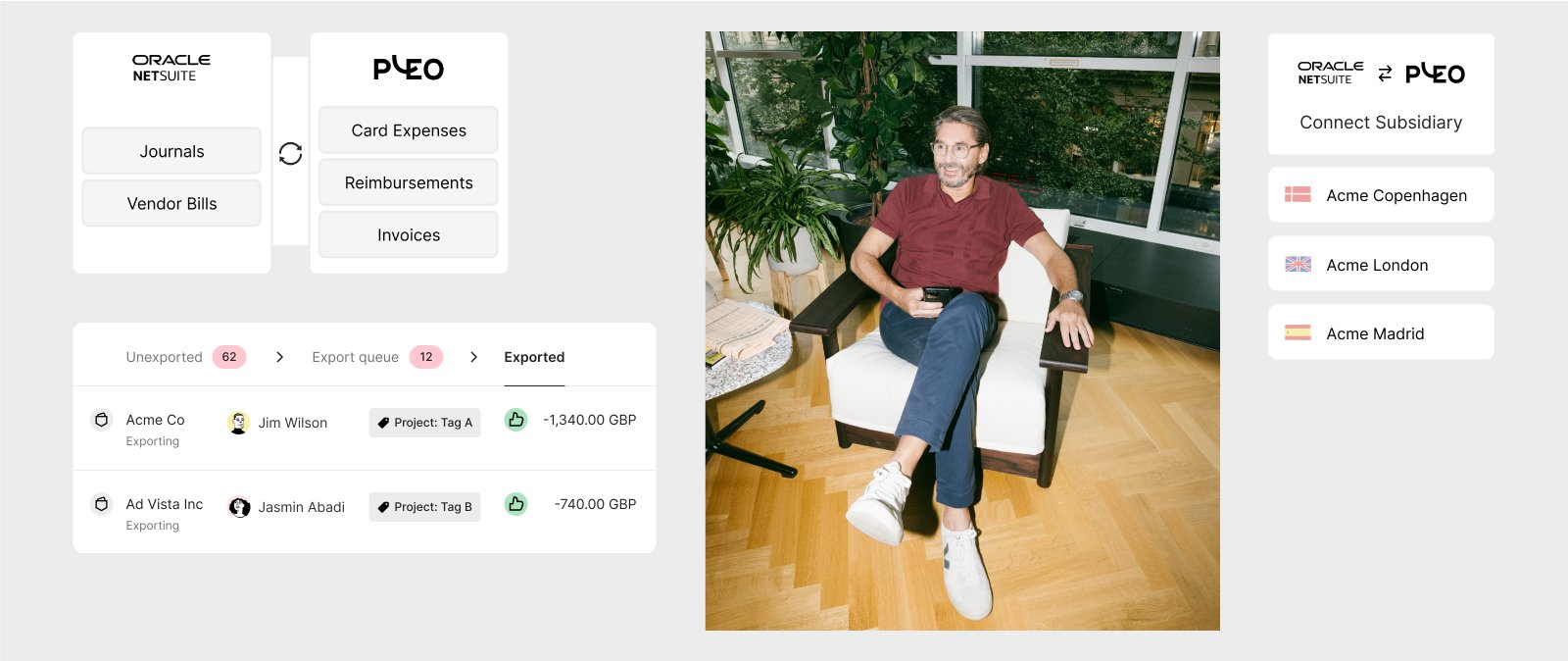

3. Pleo’s Built for NetSuite verified SuiteApp

It’s already easy to connect Pleo with most of your favourite accounting tools, like Quickbooks, Xero and Sage. But our latest integration is a big one.

You asked, we listened. Introducing… our Built for NetSuite verified SuiteApp and NetSuite SDN Partnership. Want greater control and visibility over your company spending? Just sync NetSuite with your Pleo cards, reimbursements, supplier invoices and transactions in one click.

Here’s why your finance team will love it:

- Automate and simplify your manual accounting processes with one seamless integration

- Get real-time transactional, financial and operational data for all your spending

- Improve accuracy by eliminating manual data work and duplicate data entries

- Double down on compliance and governance for all employee expenses and supplier payments

- Easily access multiple subsidiaries in one view and standardise accounting across them

If you’re using NetSuite to manage your financial data, Pleo is the perfect match for centralising your company spend and breaking data silos. To get set up, check that you’re an admin on both NetSuite and Pleo, then follow the steps on Pleo’s Integrations page .

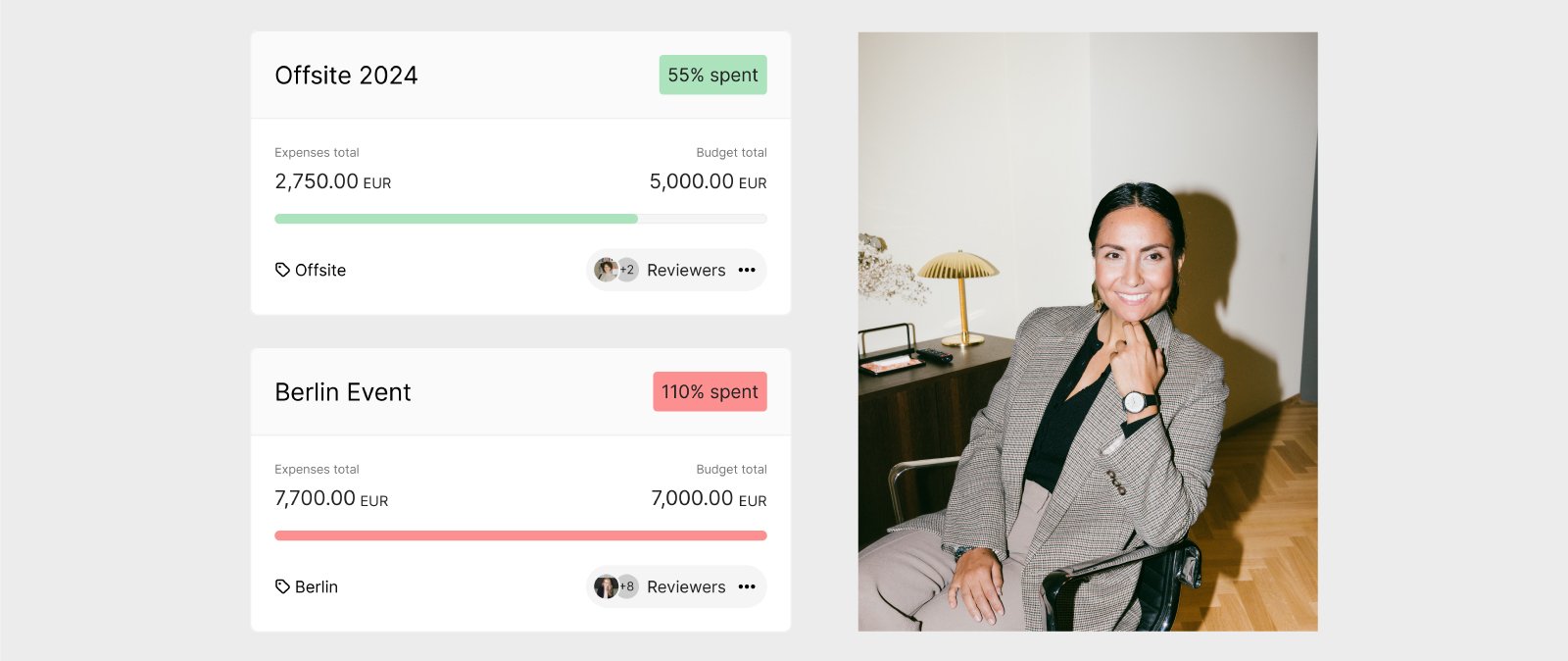

4. Budgets

We recently launched a handy range of spend controls to help finance teams take greater control of employee expenses, and the Budgets feature is one of our customers’ favourites.

Thanks to Tag Budgets, admins can create a budget using a personalised Tag, helping you to better visualise and keep track of spending in real-time. Imagine you’re a construction company dealing with lots of different clients. Just set up a Tag for each client name to automatically assign spend associated with that Tag to your budget. You’ll even be notified when you’ve spent over 75% and 100% of that budget to help you stay on top of things.

Head to Pleo’s Budgets page to set one up for your business and feel confident that you’re not overspending.

5. VAT Split

Looking through all your expenses one by one to identify cases with multiple VAT rates can be really time-consuming. In some markets, it’s possible to have receipts with multiple VAT rates in one place, for example. And we know you have better things to do with your time.

Now, Pleo saves you time on manual work by splitting the expense into different VAT lines, so the only thing you have to focus on is reviewing the details! Finally, a way to effortlessly manage your expenses at scale.

This feature is currently available to anyone on our Advanced plan, so if you don't have access but want to save a tonne of time, just reach out to your Pleo Customer Success Manager.

There you have it – the five biggest features we announced at Beyond in London. We’re so excited to continue our European tour for more fireside chats, panel discussions and happy hour networking. Yet to sign up for our events in Madrid, Berlin, Paris, Amsterdam and Copenhagen? Don’t miss out, secure your spot for free now. We’ll see you there!