Business financial management: How to win the finance game

Fresh insights from 2,650 finance decision-makers across Europe

Navigating the world of business financial management is a demanding job that requires dedication and expertise. It’s a universal journey, no matter your industry.

At its core, it's about crafting a smart game plan, keeping a close eye on cash flow, and seizing opportunities when they appear. Find out how you can successfully win your game in business finance management!

- Key points at a glance

- What is business financial management?

- What are the objectives of business financial management?

- Levelling up on capital needs

- Optimising resources

- Tracking liquidity and cash flow management

- Ensuring compliance

- Developing financial scenarios

- Managing relationships with investors

- Elements of corporate finance management

- Financial Planning and Analysis (FP&A)

- Cash flow management

- Budgeting

- Investment strategies

- Financial risk management

- Tax planning

- Financial reporting

- Debt management

- 10 tips for a successful business financial management strategy

- 1. Have a comprehensive business plan

- 2. Monitor your finances

- 3. Make sure you get your payments

- 4. Keep track of your daily expenses

- 5. Ensure a good cash flow

- 6. Monitor your tax obligations and meet deadlines

- 7. Consider advice from an accountant

- 8. Choose a cloud accounting software

- 9. Have a rainy day fund for unexpected costs

- 10. Regularly review and adjust your financial management strategy

- Successfully manage your business finance strategy with Pleo

Key points at a glance

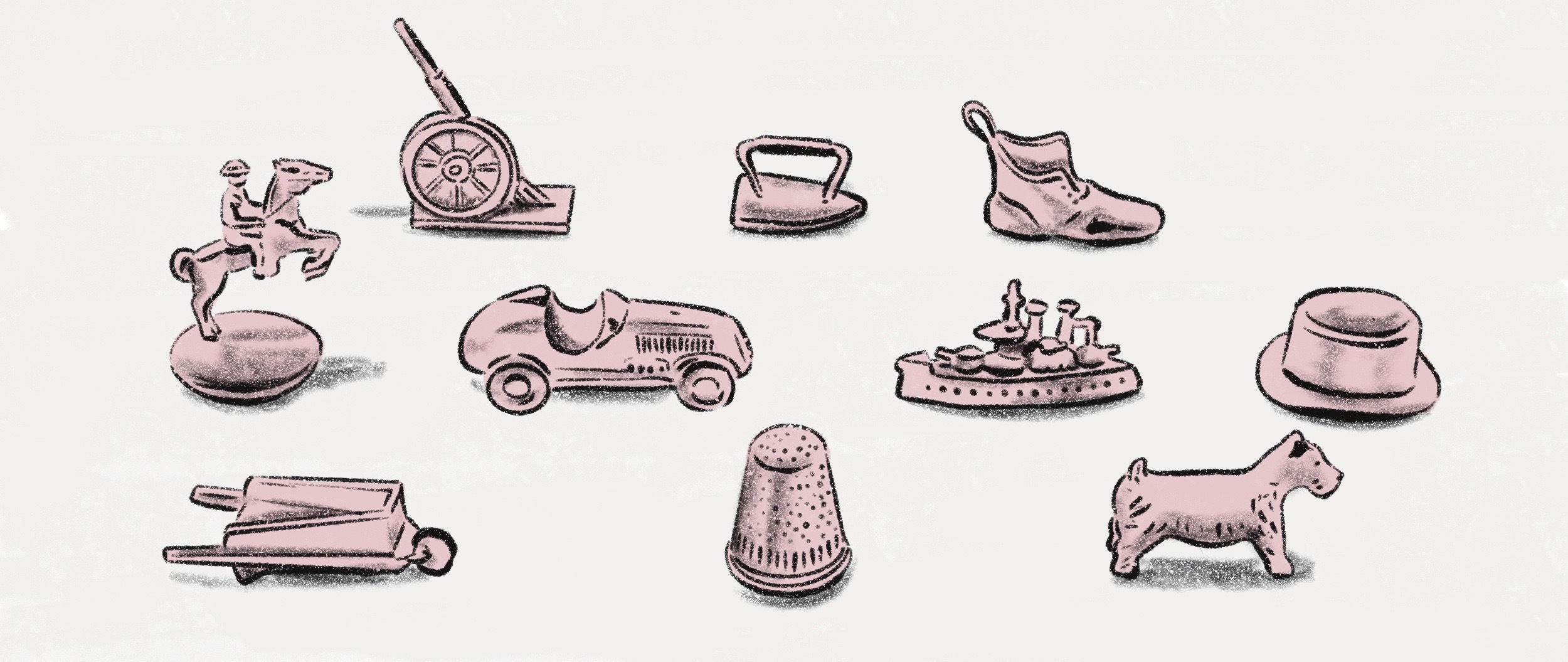

- Mastering business finances is like nailing the rules of your favourite board game – essential for victory.

- Core gameplay revolves around financial planning, budgeting, and cash flow management.

- Navigating risk in business is akin to strategizing in a complex game – foresee, adapt, and overcome.

- Tax planning, debt management, and keeping a pulse on KPIs are the equivalent of game-winning moves.

- Pleo's pro-tips for financial success include solid planning, embracing tech-friendly tools, and always having a backup strategy.

What is business financial management?

In the grand game of business, financial management is your winning strategy. It's about optimising your financial resources, ensuring you're always a step ahead. With the right moves, you can achieve greater business prosperity and maximise your ROI. With rule pamphlet in hand, you're better equipped to navigate the challenges and score big, especially when you embrace technology to guide you.

What are the objectives of business financial management?

Financial management acts as your playbook. From sizing up your capital needs to playing by the ever-evolving rules of regulations, and building a team with investors and stakeholders – each move impacts your organisation.

Levelling up on capital needs

Think of it as a game strategy session: Dive deep into the costs of your on-hand and fixed assets, marketing campaigns, your safety net stash, and even those ongoing ops and HR expenses.

Just like having a plan for the next moves on a gameboard, having clear short-term and long-term financial roadmaps is crucial. After all, knowing your next move can be the difference between a winning streak and a learning curve.

Optimising resources

By cutting down on cash burn and boosting cash churn, you're not just aiming for the high score in ROI; you're also eyeing that top spot in profits. And just like those in-game hints that show up, understanding the upticks in raw material costs gives you that sneak peek into what's coming next.

Tracking liquidity and cash flow management

Staying on top of liquidity and cash flow is all about making sure your business has what it needs to level up. It's about making sure there's always enough in the tank to tackle challenges and seize new opportunities.

Ensuring compliance

Compliance might involve teaming up with legal experts, holding regular game-time reviews (aka internal audits), and providing regular training to level up your team’s knowledge. The aim is making sure everyone's on the same page, playing fair and square.

Developing financial scenarios

Ever played a game with multiple endings? Drawing up different financial scenarios is a lot like that. Based on where your company stands now and where it might be heading, think of all the possible turns the game might take and be prepared.

Managing relationships with investors

Building strong bonds with investors and board directors is akin to forging alliances in a strategy game. It's all about open channels, setting clear expectations, and rallying the troops when you're organising the next big move. Remember, when everyone's on board, you're more likely to succeed.

Elements of corporate finance management

Let’s take a look at the key game pieces that shape the whole corporate finance journey. Think of them as the strategies and power-ups that can set you on the path to business victory.

Financial Planning and Analysis (FP&A)

FP&A is like building your game's strategy, since it involves financial forecasting to predict how well your business will perform in various scenarios. Imagine turning your big moves and strategies into numbers.

That's what financial planning and analysis does. It translates real-world tactics into scoreboards and stats, helping you see the game’s outcome in the next levels – be it months, quarters, or years.

Choosing the right model is essential for your next move. These models guide decisions with:

- Revenue growth projection.

- Sensitivity analyses to gauge the influence of financial assumptions.

- Scenario planning to assess various situations.

- Cash flow analysis based on vendor-level expense projections.

Cash flow management

Did you know? A whopping 82% of business hiccups are due to fumbled cash flows. Your cash flow statement represents a real-time scoreboard of your business’s financial stats, and it breaks down into three main plays:

- Operations

- Investments

- Financing

In essence, your cash flow statement is like the instant replay of your financial game – giving you a crystal-clear picture of every move and possible directions to take.

Budgeting

When setting up a game plan for your business, think about where you want to go, the milestones you want to hit, and how you'll strategise to reach them. That's where budgeting steps in. It's not just about numbers or constraints; it's your business's playbook, nudging you closer to your goals.

Having a clear budget – whether monthly or yearly – lets you measure your profits and losses. It also helps in cost control, ensuring you don’t overspend in areas that don’t offer any ROI.

Come month-end, you can spot where you aced it or where tweaks might be needed. It's like getting a progress report, keeping you in the loop and prepping you for the next big move.

Each business has its own method of handling numbers. Some prefer rolling forecasts to navigate market fluctuations, while others choose zero-based budgeting to monitor expenditures. It's all about determining which approach aligns best with your business.

Investment strategies

It is smart and reasonable to invest your money in things that offer a high growth potential. These investments deliver healthy returns and make sure you're on the safe side.

Digging deeper, investment strategies span both capital budgeting and day-to-day working capital decisions. Capital budgeting zeroes in on investments in significant assets, often requiring hefty financial commitments, but promising long-term growth.

This usually means directing funds towards infrastructure, technology, or machinery, which are pivotal for scaling operations and ramping up productivity.

In the business game, working capital management involves focusing on the company’s current assets, like managing inventory, overseeing accounts receivable, and ensuring accounts payable.

These actions, while daily and maybe tedious at times, lay the groundwork for smooth operations and strong financial health. It's about making those smart, consistent plays that set you up for long-term success.

Financial risk management

In the world of business, risk is part of the game. To better manage these risks, conducting a financial risk assessment and staying up to date regarding financial markets are crucial, as shifts can have a significant impact. And who better to lead the charge than financial managers? Here are the top four risks to pay attention to:

- Liquidity risk

- Credit risk

- Market risk

- Operational risk

Remember, identifying financial risks before it’s too late , is always the best way to go. If that’s the case, you can understand and navigate them with skill.

Tax planning

In the financial game, missing tax deadlines is like scoring an own goal. And nobody wants those penalties and interest piling up. Time for some defence.

By spotting potential tax pitfalls early on and tackling them with a well-thought-out game plan, you keep your business out of the penalty box.

Make sure to seek expert advice to ensure compliance and efficient tax strategies, and you'll keep your finances ready to win the championship in any season.

Financial reporting

Financial reporting and analysis are like your coaching sessions. Through financial analysis, you can gather all the statistics – revenues, expenses, profits, and more – and draft a solid game plan. And it's not just about tracking scores; it's ensuring you play fair, especially with tax regulations.

Debt management

Late payments can throw a wrench in your daily plays and block your cash flow goals. But with the right moves, like savvy debt management, you can navigate these challenges, ensuring a smooth cash stream and setting up your strategy for the long haul.

10 tips for a successful business financial management strategy

We've gathered ten best practices for financial management that guide you through this financial maze to ensure your success. These methods aim to offer clarity, bolster stability, and help you navigate the business terrain with greater confidence.

1. Have a comprehensive business plan

Crafting a strategic financial plan for your business is as necessary as plotting your moves in a strategic game.

It's more than just crunching numbers; it's about aligning everyone's efforts and clearly communicating with your team and investors to make informed business decisions. By integrating modern financial strategies, you're not just playing; you're playing to win.

2. Monitor your finances

Securing a healthy profit, solid sales, and consistent cash flow is the name of the game for any thriving business. It's like checking your progress markers: Where might there be hiccups in the journey? What's the next destination on the map? Which routes are boosting momentum, and which ones have roadblocks?

By keeping an eye on your overall financial performance, you're better equipped to ensure your business stays in top shape. After all, a healthy bottom line, dynamic sales, and dependable cash flow are what things turning smoothly.

- Dive into financial statement insights and management accounts: Balance sheets, profit and loss statements, and regular management reports give a clear picture of your financial standing and performance indicators.

- Understand working capital and financial ratios: They're your benchmarks, highlighting assets, liabilities, and liquidity – crucial information for investors.

- Examine cash and fund flow: This allows you to see the liquid cash coming in and the distinction between current and potential revenues.

- Assess overheads: Identify anomalies or inefficiencies in your financial reports and get a grip on where costs might be creeping up.

- Benchmark against the competition: Compare your numbers to competitors to discern your strengths and areas that need improvement.

3. Make sure you get your payments

According to a snapshot from the Federation of Small Businesses (FSB) , over half of small businesses (52%) grapple with payment delays. This bottleneck has nudged 37% of them to seek external financing to steer their cash flow back on track. To avoid these potential issues, consider these steps:

- Keep an eye on payment rhythms: Stay in the loop about how regular customers settle their bills – it can tip you off about any brewing issues.

- Set some ground rules: Firm up clear credit, collections policies, and the works, like credit caps, due dates, and follow-ups.

- Clue customers in: Make sure your payment conditions and any potential penalties are front-and-center on contracts and invoices.

- Lean on deposits: For sizable or bespoke orders, or with newbie customers with a lean credit past, ask for a deposit if applicable to your business model.

- Don't dawdle with invoices: Whisk them out ASAP and check in with clients to nail down that they've received them and are prepping for payment.

- Consider receivable factoring: If outstanding invoices are giving you a headache, factoring can turn them into on-the-spot cash.

- Flex your payment muscles: Broaden the horizon and offer a palette of payment methods for clients to choose from.

4. Keep track of your daily expenses

Cash flow issues can sideline even the most profitable businesses. Knowing your business's key financial benchmarks ensures you're prepared for all challenges to come.

Keeping a close eye on your daily expenses and financial metrics helps you stay on track and navigate any unexpected turns, ensuring your business remains resilient throughout the year.

- Set up a dedicated business bank account and card: To maintain clarity between personal and business transactions, opt for distinct bank accounts. This distinction not only simplifies the tax process but also provides a clear overview of your business expenses.

- Maintain an organised receipt system: Whether they're traditional paper receipts or digital ones, ensure they're systematically stored. Several tools allow you to scan and archive receipts, enhancing your administrative efficiency.

- Select an expense tracking approach: You can start with basic spreadsheets, but as your business expands, consider transitioning to accounting software. The latter is designed to reduce time spent and minimise potential errors.

5. Ensure a good cash flow

Navigating your business's cash flow requires an understanding of its unique rhythm. Stay equipped, especially during those unpredictable times, and consider seeking expert advice when needed.

Noticing a cash pinch? Address it promptly. This could involve exploring options like expanding your credit, converting outstanding invoices into tangible cash, or leveraging assets with sell-and-lease-back strategies.

A cash flow forecast serves as your business's game plan. It offers insights into potential financial trends, guaranteeing informed financial decision-making. By staying vigilant, you can steer clear of unforeseen financial challenges.

6. Monitor your tax obligations and meet deadlines

Missing tax deadlines can lead to fines and growing interest – a cost no one wants to bear. Dodge those pitfalls with a little foresight.

- Go digital with receipts: Make life simpler by scanning and storing receipts with tech tools. Not only does it minimise desk chaos, but it also streamlines your expenses.

- Stick to your calendar: Circle those tax dates in red and set up reminders. Better early than scrambling at the eleventh hour.

7. Consider advice from an accountant

Talking to tax professionals like accountants or finance specialists can be a game-changer for your business's financial direction. They're the wizards with the know-how to give you the insights you need.

Keeping your accounting records and tax situation up-to-date is one thing. But with these pros on board, you get the added benefit of diving deep into your business’s financial health, spotting where the ship might need a little course correction.

Whether it's pinpointing areas ripe for a tweak, crafting cost-cutting tactics, or guiding you through financial mazes, these experts have your back.

8. Choose a cloud accounting software

Traditional accounting laid the groundwork, but the introduction of desktop computers revolutionised the process with advanced software.

Today, small businesses are adopting cloud accounting to enhance their operational efficiency and financial reporting. This approach not only offers the benefits of real-time financial management but also provides cost-effective alternatives to traditional ERP systems.

Cloud-based solutions, with their affordable plans, are becoming the preferred choice for small business finances.

9. Have a rainy day fund for unexpected costs

In the dynamic landscape of business, unexpected twists are inevitable. For savvy small businesses, having a cash reserve is akin to a power-up, providing that essential liquidity boost during trickier levels.

A smart move? Direct some of your earnings into a dedicated business savings account. By consistently depositing into this reserve, you're essentially collecting bonus points, building a robust financial buffer. With this in your arsenal, you ensure your business remains resilient, always ready for the next challenge.

10. Regularly review and adjust your financial management strategy

Recognize your standout moments, pinpoint areas that need a power-up, and strategise for upcoming levels. With each review, you're better prepared to tackle challenges and amplify your strong points.

Think of KPIs as your in-game achievements, tailored to your business's unique missions. From boosting operational efficiency to attracting more customers and collecting revenue, these metrics offer the detailed intel you need to strategise and win big.

Successfully manage your business finance strategy with Pleo

Business financial management is essential to master your company’s finances. With Pleo, you're equipped with the right tools to make calculated moves, ensuring you're always on the path to success.

Invoicing, a consistent challenge, becomes more manageable with automation, like a quick power-up. This efficiency not only speeds up your progress, but also strengthens relationships with suppliers and vendors, ensuring everyone is on the same team. With the right strategy, success is just around the corner.

Find out how you can implement automated invoice processing with Pleo’s automated invoicing software. From capturing to recording, handle all your invoices effortlessly in one unified hub and elevate your financial strategy to success.