What's more important to finance teams: growth or stability?

Fresh insights from 2,650 finance decision-makers across Europe

When we asked businesses what would most impact their business performance i n 2023 , the majority agreed that a hit to the wallet would hurt most. Cash flow, inflation and the high cost of goods, materials and services were the most frequently given answers.

And guess what – A lot of these issues haven’t gone away.

But businesses aren’t prepared to reign in their ambitions. In fact, this challenging environment seems to be the new normal. So how can businesses keep the balance between growth and financial stability?

The key is hitting that sweet spot by setting the right financial controls. And it’s the job of the CFO to make sure the control environment evolves as the business evolves, at the right pace.

Leakage is expensive…

In The CFO’s playbook for 2024 , when asked what they think will negatively impact their business performance in the year ahead, nearly all regions* apart from Spain (who stated high talent attrition), gave answers related to spending – high energy bills in the UK, high transportation costs in France and high cost of business travel in Germany.

* The CFO’s playbook for 2024 includes two sets of data – exploring the current state of play businesses across the UK, Germany, Spain, France, Denmark, Sweden and the Netherlands.

The common thread here is that businesses need comprehensive spending oversight in 2024.

And if businesses want to focus on filling pockets and growing revenue, they first need to check that there aren’t any holes in them to start. Because leakage is possibly the most expensive, and sneaky, thing for a company.

A good place to start is to assess your financial controls. Do you have any in place? If yes, which ones could be tightened up and/or altered to reflect the current market conditions or business strategy?

Do you provide guidance for your employees on how, when and how much is appropriate to be spending? And what about guidelines on how expenses and spend are captured and organised?

Almost half of businesses say that expenses and spend are different … but only 27% have clear guidelines on how they differ. - The CFO’s playbook for 2024

With the goal of achieving financial stability, businesses can no longer afford to silo their outgoings into expenses (think low-cost items like coffees, lunches) and spend (LinkedIn ads, business travel, office rent).

Without the right controls or clear definitions in place, finance teams are leaving what is and isn’t recorded up to chance.

…As is lost growth

But it’s not all about cutting costs and reducing spend and tightening controls. Because we all know the saying: you have to spend money to make money.

Something that Amir Afshar, Co-Founder at Shellworks echoes, “As a start-up, we want to build a sustainable business, so it’s all about balancing sales with growth. We need to generate income while growing incrementally.

But this doesn’t mean that there needs to be a trade-off between control and speed of execution.

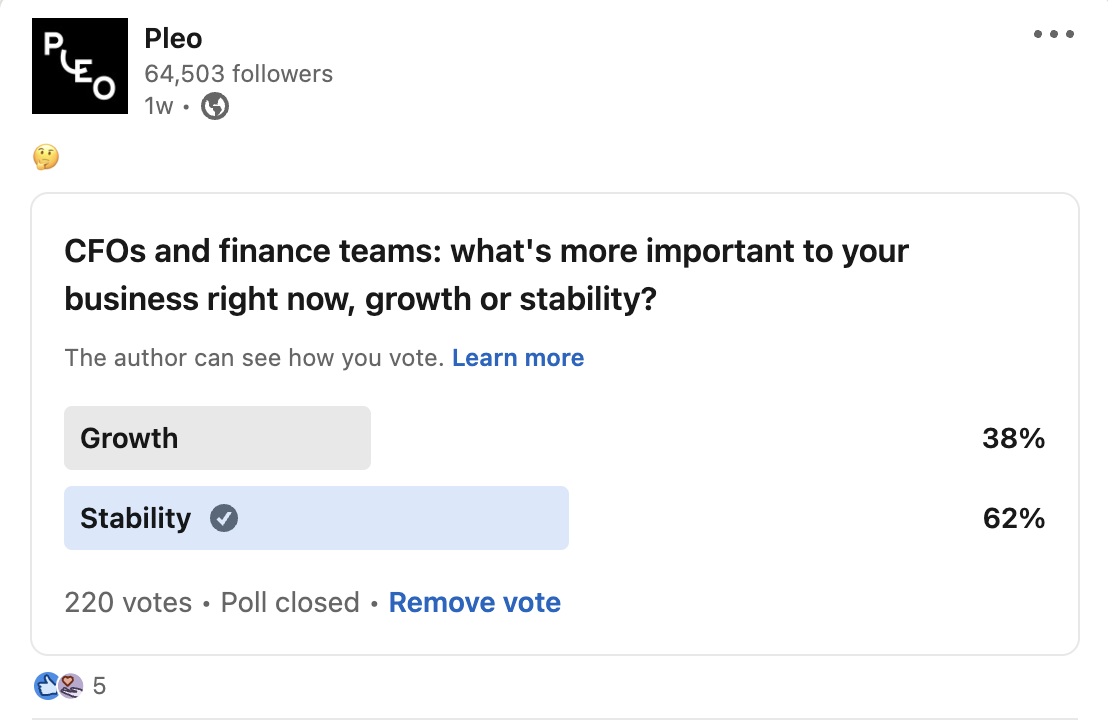

It’s clear that growth and stability are top of mind for many financial leaders and businesses, just take a look at this recent poll we shared from our LinkedIn profile .

And while the results show the there is a bit more focus placed on stability (at least with our LinkedIn followers), growth hasn’t been push aside by any means.

It’s more important than ever to make sure your finances don’t fall out of sync. And spend controls can help you achieve this balancing act.

The right controls means there’s no ambiguity when it comes to budgets or what money can be spent on for different projects. And this paves the way for creativity and quicker execution. Ultimately, fueling your business and growth – while keeping both expenses and spend balanced.

Curious what other areas CFOs and business leaders should be focusing on in the year ahead? Discover more in our second annual The CFO’s playbook for 2024.