Pleo’s 2023 wrapped: More features, events and customers than ever before

Fresh insights from 2,650 finance decision-makers across Europe

2023 has been one hell of a year. The UK lost a Queen and gained a new King. Barbie became the highest grossing film of the year worldwide. Spain took home the trophy at the FIFA Women’s World Cup... hungry for more? Just ask our new friend, chatGPT .

We’ve had some pretty big milestones ourselves here at Pleo. So before we dive headfirst into Christmas and swap expenses for eggnog and cashback for carols, let’s take a look at some of our highlights of 2023.

1. We toured Europe with Beyond

October and November saw our biggest ever event brought to life. We took Beyond all over Europe, from London to Paris and Copenhagen to Amsterdam. And we had a blast.

Joined by industry-leading speakers from the likes of Deloitte and NetSuite, Beyond explored the trials and tribulations of modernising the finance function, how to implement digital transformation, leaning into artificial intelligence and loads more. Taking a deep dive into the trends finance teams should be aware of was a great way to wrap up such an eventful year.

Missed the event or just want to catch up on the best bits? Watch the talks from Beyond on-demand now (perfect if you’re already bored of Christmas films).

2. Say hello to NetSuite, our new partner!

As of 2023, we’re thrilled to share that Pleo is a SuiteCloud Developer Network Partner, now offering a Built for NetSuite verified SuiteApp integration to all of our customers.

But what does this mean for EU businesses? Well, it means that Pleo customers can save even more time, drive more efficiencies, reduce human errors and get even greater insight into their overall cash flow.

One of the biggest time (and money) wasters for finance teams is the manual reconciliation of accounts each month. Our integration with NetSuite allows you to sync and match all expenses, reimbursements, subscriptions and invoice transactions with one click. Plus, you can be sure your financial data is accurate and up to date. When exporting financial data from Pleo, NetSuite validates all that data before importing it into the system, removing the need to cross-check in the case of inaccurate transactional data.

Ready to get started? Learn more about Pleo’s NetSuite integration and start streamlining your spending.

3. Fine-tune your finances with spend controls

Earlier this year, we launched a personalised set of spend controls to help you hit your goals while keeping company spending in check. These included:

- Multi-step approvals

- Customisable spending limits

- Flexible reviewer thresholds

- Pre-blocked ATM withdrawals

- Budgets

- Easy approvals

Here’s what Charlie Maynard, Finance Manager at what3words, had to say: "With the controls we could implement, we have been able to spend our time on so many more business-critical projects."

Whether you’ve used one or all of our spend controls, we’d love to know what you think!

4. Browse our Partner Directory

Starting your search for the right accountant can be pretty intimidating. Not to mention confusing. How do you know where to look? Should you choose based on recommendations or price? Is it worth the cost?

Once you’ve decided your business could use some help, count on Pleo to help you find the right one. Our new Partner Directory showcases our best-performing Silver, Gold and Platinum level accountancy partners, so you can trust that they come with the highest level of recommendation.

Save time and money and find your perfect accounting partner in our Partner Directory .

5. Say no to running low with Auto Top-up

Ever had your card declined when you’re filling up the tank at the petrol station? Or been charged a late payment fee because you didn’t have enough money to pay a bill?

Then you’ll know how frustrating (not to mention embarrassing) it can be.

We want you and your team to be able to “Pleo it” with ease. That’s why we created Auto Top-up! Just set a low balance threshold for your Pleo account and choose how much you want to transfer once you hit that threshold. Once your balance falls below that threshold, we’ll automatically trigger a top-up to your Pleo account from your linked bank account.

Find out how to enable Auto Top-up and prevent any pesky disruptions to the running of our business.

6. We brought new insights to finance leaders

Dr Seuss once said “the more that you read, the more things you will know. The more that you learn, the more places you’ll go.” And we couldn’t agree more.

Which is why we’re always bringing you fresh insights, eBooks, data and reports to keep you at the forefront of finance, including…

The New Way of Finance - This video series provides over 50+ minutes of learnings from real finance professionals, sharing their knowledge and thoughts on the intersection of steering the business, control, processes and enabling your workforce. Watch the lessons for free .

Quarterly Spending Report Q3 ‘23 - We launched the first edition of Pleo's Quarterly spending report so businesses can benchmark themselves against real-time data to tap into savings potential and fuel more strategic financial business decisions.

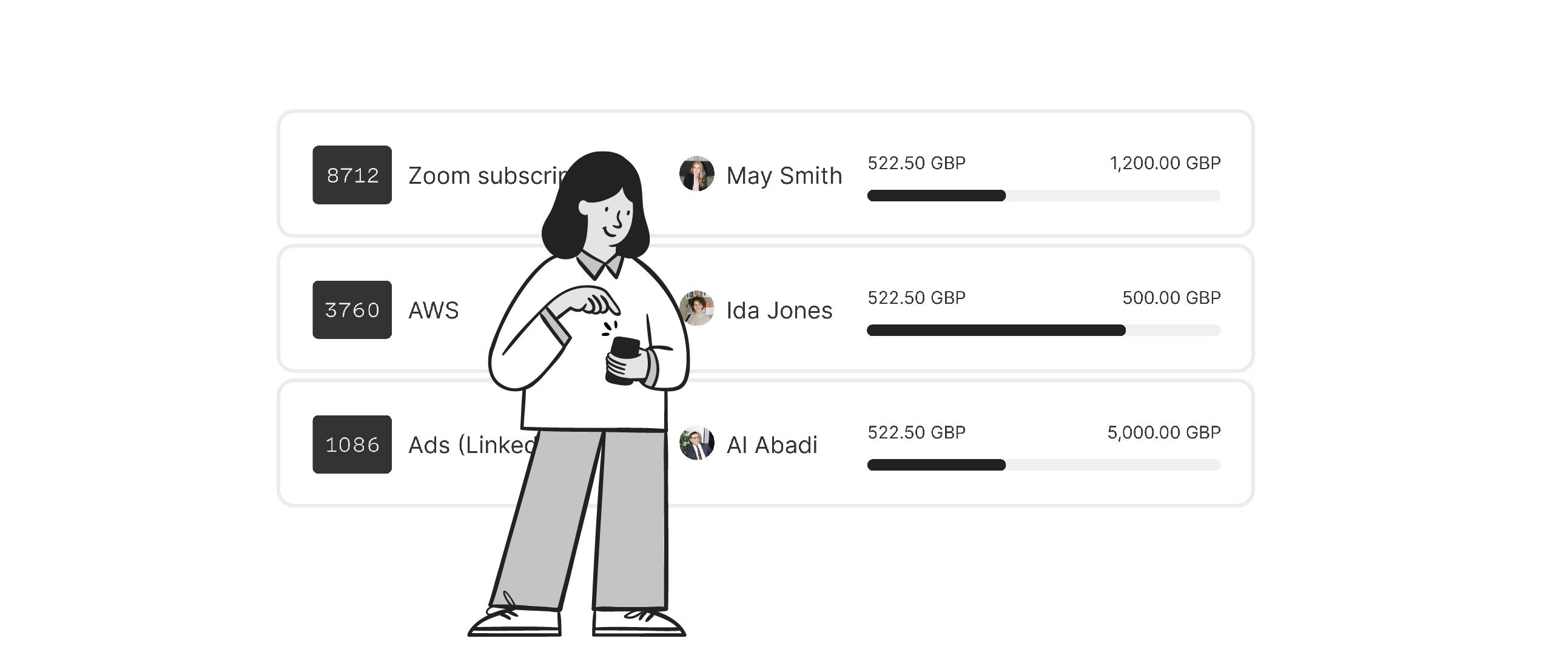

7. Manage recurring payments with Vendor cards

If your business has a Zoom licence or Slack subscription – or maybe you send emails through Hubspot or Salesforce? – then this one’s for you.

Our brand-new Vendor cards offer a simple way to manage your recurring payments and digital spending, clearly separating them from employee expenses. Vendor cards give finance and procurement much-needed control over cash flow, as well as visibility over subscriptions and digital services. How? By centralising and limiting payments to one or a group of vendors.

For more information on how Vendor cards work, and to get your company set up with some, check out our Help article .

8. Keep your cash flow… well, flowing

With a Pleo Overdraft *!

That’s right. Keep essential outgoings running seamlessly and pay your suppliers on time with Pleo. And the best bit? Our Overdrafts are completely interest-free when you repay on time.

Run all of your high-value transactions and recurring spend - from SaaS and marketing tools to office rent - through one platform, safe in the knowledge that we’ve got you covered if your balance runs low. With an Overdraft, you can forget about a lack of funds leading to declined transactions which disrupt your day-to-day.

Flow money, no problems.

*Only available in the UK, Germany and Sweden. Eligibility approved on a per-customer basis.

9. Pleo Invoices landed in Europe

Helping companies manage their expenses is our bread and butter. But we do way more than that. Heard of Pleo Invoices ?

We did some digging and found out that for 66% of admins, half of their spending is processed through invoices. So we created a feature to equip admins to better handle this type of spending. With Pleo Invoices, you can capture, process, approve, pay, and bookkeep your invoices, all in one place. No more missed invoices and manual data entry. Perfect.

And in 2023, we brought Pleo Invoices to Europe!*

*For the beady eyed amongst you, yes – our Invoices feature was live in the UK and Germany last year. But in 2023, we brought it to the rest of Europe (apart from Denmark, Sweden and Norway – keep your eyes peeled if you’re in those locations!).

10. We reached 30,000 customers

We couldn’t not celebrate this milestone. What a way to end the year.

Thank you to each and every one of our customers (all 30,000 of you!) who choose and trust Pleo to take care of your business finances every single day. We’ve loved working with you and look forward to bringing you even more handy features to supercharge your spending in 2024.

For now, enjoy a well deserved break and we’ll see you in January!